You know your business has many moving parts that can break down and cause various disasters. But you may not be certain if having business insurance is actually legally required in your area.

It’s important to know if and why coverage is mandatory in your state before opening your doors to the public. An Illinois independent insurance agent can not only clarify this answer for you, but also help you find the right business insurance. But first, here’s a closer look at business insurance, and if it’s required.

Is Business Insurance Required in Illinois?

While Illinois business insurance as a whole may not be required by the state, at least a couple of components of this coverage can be. Businesses are often required to carry the property coverage associated with a business insurance policy by their mortgage lenders. It’s always better to be safe than sorry, and just be equipped with coverage from the very start.

What Does the Law Require for Illinois Business Owners?

Illinois specifically requires businesses to carry unemployment and disability insurance for qualifying employees. The state also has strict workers’ comp requirements. An Illinois independent insurance agent can help you get set up with all the important coverage your business needs to pass state requirements and more.

What Are the Workers’ Comp Requirements in Illinois?

In Illinois, any business with employees is required to carry workers’ comp to protect against injury or illness on the job. This is true even if the employees are part-time.

Illinois law requires employers to purchase a policy through an insurance company or obtain permission to self-insure. Be sure to work with an Illinois independent insurance agent to get your business covered.

Workers’ Comp Stats

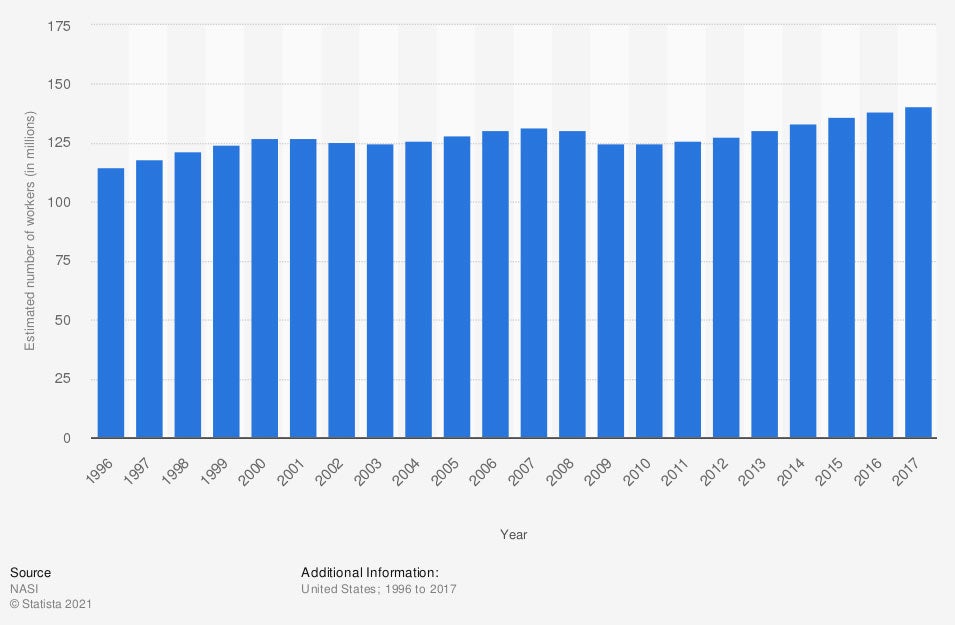

Just how many employees in the US workforce are covered by workers’ compensation, anyway? Check out the chart below and see for yourself.

Estimated number of workers covered by worker's compensation in the US

More and more workers are being covered by workers’ compensation insurance over time. At the beginning of the observed period, 114.7 million workers were covered by this insurance. At the end of the period, this number had grown significantly, to 140.4 million employees.

Workers’ comp is becoming a more commonly purchased and used product as time goes on. That's all the more reason it’s critical to get your business covered by Illinois workers’ comp ASAP.

Can an Employee Sue If You Don’t Have Workers’ Comp Insurance?

Yes, having workers’ comp is critical for employers to protect themselves against employee lawsuits if they get injured or become ill on the job, or as a result of workplace activities. Without this coverage, the employee has the right to sue the business after an incident.

Workers’ comp offers compensation to injured or ill workers, and in turn, these workers forfeit the right to press charges against their employer. Without workers’ comp, a business is vulnerable to lawsuits from employees and even their families.

What If an Illinois Employer Doesn't Have Business Insurance?

If an Illinois business doesn't carry any business insurance, they can be denied a mortgage for their rented commercial property. This can lead to numerous complications, including not being able to open to the public at all.

Also, if the business doesn't have various other business coverages, like commercial auto insurance, it’s vulnerable to lawsuits and associated costs from common disasters like accidents involving a company vehicle. Basically, there are many reasons it’s critical for Illinois businesses to be covered by adequate business insurance.

What If an Illinois Employer Doesn't Carry Workers’ Comp?

Illinois businesses that don’t carry the required workers' comp insurance can be subject to a fine by the state, or worse. Fines are typically $500 per day that the business lacked coverage, with a minimum fine of $10,000. In more serious incidents, business owners can be subject to jail sentences, and a cease and desist order can even be placed against the business.

Here’s How an Illinois Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect business owners against commonly faced liabilities. Illinois independent insurance agents shop multiple carriers to find providers who specialize in business insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/194835/number-of-us-workers-covered-by-workers-compensation-per-month/

https://www.iii.org/article/can-i-own-home-without-homeowners-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.