Illinois drivers are required to have a minimum amount of car insurance coverage in order to operate a vehicle in the state.

The good news is that there are a variety of ways to lower your car insurance premiums, and working with an Illinois independent insurance agent can help.

Annual car crash fatalities in Illinois

- 1,010 total fatalities

- 938 fatal crashes

- 315 restraint used

- 263 restraint not used or used improperly

- 186 un-licensed drivers

How Much Is Car Insurance in Illinois?

Illinois ranks 39th in the US for car insurance rates. Drivers pay an average premium of $1,079 a year. This is several hundred dollars less than the national average of $1,311.

The state requires that all drivers carry bodily injury liability, property damage liability, and uninsured motorist coverage. Drivers are not required to carry personal injury protection, but it's worth speaking with your Illinois independent insurance agent about.

Illinois car insurance minimum liability limits

- $25,000 for injury or death of one person in an accident

- $50,000 for injury or death of more than one person in an accident

- $20,000 for damage to property of another person.

How Much Is Full Coverage Car Insurance in Illinois?

Full coverage auto insurance is a combination of coverages that provides additional protection beyond the required state minimums.

Full coverage will typically include collision and comprehensive insurance in addition to liability and uninsured motorist.

- Collision insurance: Pays for repairs to your vehicle if you are in a collision with another vehicle, tree, or pole.

- Comprehensive insurance: Pays for repairs to your vehicle from damage outside of your control like weather or theft.

Adding additional coverages in your policy are likely to increase your insurance premiums. In Illinois, full coverage costs will be based on multiple factors and will vary depending on the insurance company you choose.

According to Car and Driver, Illinois drivers can expect to pay the following for full coverage.

- State Farm: $1,092 a year/$91 a month

- Progressive: $1,577 a year/$131 a month

- American Family: $1,854 a year/$155 a month

Those numbers increase for drivers who have a history of speeding tickets or accidents.

What Are Some Factors That Can Influence My Rate?

Illinois car insurance rates are highly influenced by multiple factors that may or may not be in your control.

- Driver age and gender

- Vehicle type and model

- Accident history

- Driving record

- Miles driven each year

- Credit history

Your Illinois independent insurance agent can help you understand what personal factors may impact your premiums.

How Can I Lower My Car Insurance Rates in Illinois?

Fortunately, there are several opportunities for Illinois drivers to lower their car insurance premiums.

"When you can combine multiple policies with the same company, you will get discounts," explained insurance expert Paul Martin.

Most companies will offer similar discounts that you can speak with your independent insurance agent about.

- Bundling discounts: Combining auto, home, and life insurance can lower your premiums.

- Safety discounts: Most companies will provide discounts for good driving and increased safety features on a vehicle.

- Group discounts: Members of the military, veterans, teachers and other groups may receive discounts on premiums.

- Loyalty discounts: Staying with the same company can reduce premiums.

The easiest way to save is to shop multiple carriers, which your agent can help you do. Martin added that you never want to skimp on your liability coverage, as it's not worth the risk.

Will My Safe Driving Record Improve My Rates?

Yes, most insurance companies will reward drivers for having a clean driving record with minimal to no accidents.

The longer you can keep a clean record, the less of a risk your insurance sees you as. The good driver discount also extends to students. Some companies will reward teens who get good grades with better rates.

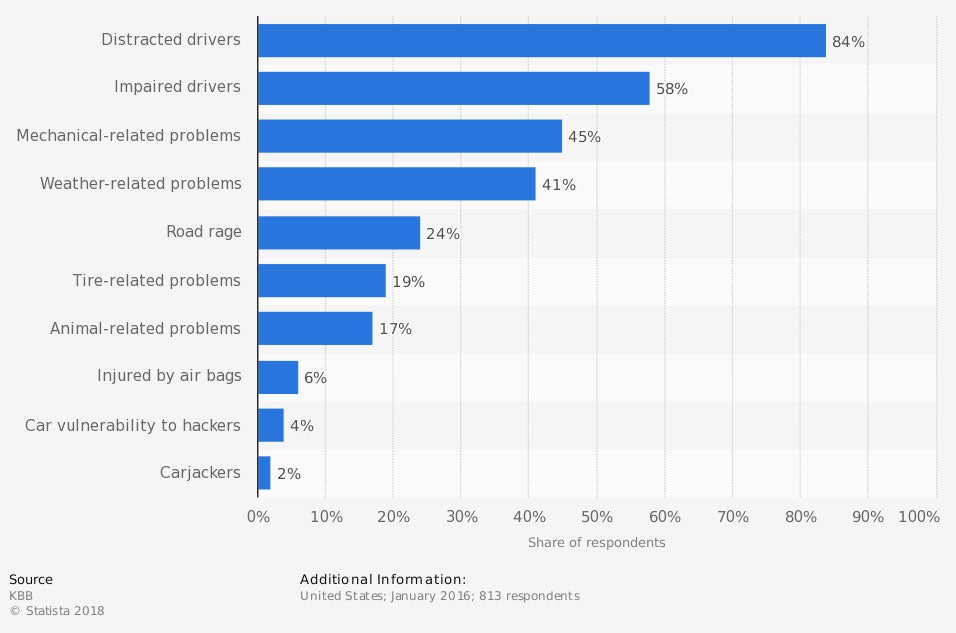

Largest safety concerns while driving a vehicle

Distracted driving is the leading concern among US drivers.

Are There Any Safety Tips That Can Help Me Save?

The safer your vehicle, the better it looks for an insurance company that is insuring you. For this reason, there are a few safety steps you can take to save even more money on your Illinois car insurance.

- Install GPS devices: Driving the speed limit and not driving at night can be tracked by a GPS device and save you money.

- Shop new cars: Newer cars are stocked with safety features like cameras and automatic braking systems that enhance safety.

- Take a driving class: Some carriers will offer safety classes for drivers to reduce premiums.

- Minimalize distracted driving: Distracted driving is one of the leading causes of accidents.

- Install antitheft devices: Prevent the potential for break-ins.

How Can an Illinois Independent Insurance Agent Help?

Illinois independent insurance agents are experts in car insurance. They'll talk with you, free of charge, to learn about your driving history and shop car insurance quotes.

"You want your insurance to pay off in money, quality of service, and speed of resolution in the event of a claim," explained Martin. When comparing multiple companies with affordable rates, your agent will know which company has the best reputation for rates and dealing with claims.

Author | Sara East

Article Reviewed by | Paul Martin

Graphic 1: https://apps.dot.illinois.gov/FatalCrash/historicsnapshot.html

https://www.cyberdriveillinois.com/publications/pdf_publications/vsd361.pdf

https://www.caranddriver.com/car-insurance/a36479892/average-car-insurance-cost-illinois/

Geo Data: Car Insurance Rates

https://www.iii.org/article/nine-ways-to-lower-your-auto-insurance-costs

© 2024, Consumer Agent Portal, LLC. All rights reserved.