Strange things happen every day, and a rock kicking up from your neighbor's lawnmower and damaging your windshield could happen at any time. But if this random event did occur, who would be responsible for your windshield? Is it your responsibility or your neighbor's?

Incidents like this are why it's important to understand the coverages you have in your auto and home insurance policies. An Illinois independent insurance agent can answer your questions about insurance and set you up with the coverage you need.

Who’s Responsible If My Neighbor Accidentally Shatters My Windshield?

Technically, if your neighbor is the one mowing their lawn and the rock shoots from their lawnmower into your car windshield, they're to blame, right? Yes, but it would likely be your insurance that responded to the damage. We'll explain.

Damage to a vehicle typically needs to be filed through car insurance, not home insurance. Therefore, you'd be likely to start with filing the claim with your auto insurance rather than your neighbor filing with their homeowners insurance.

An agent can help you understand why incidents like this fall under car insurance and not home insurance, even though the vehicle is parked at your house. They can also make sure you have the right coverage in place.

Am I Responsible for Covering Any Damage Caused by My Neighbor?

Your insurance would be responsible for covering any damage caused by a rock from your neighbor's lawnmower hitting your window. However, if you did not have the right auto insurance coverage, you could attempt to get reimbursed through your neighbor's homeowners insurance. We don't recommend relying on this as a solution, since home insurance typically doesn't cover auto claims.

If the damage was significant, you could also choose to file a lawsuit for the damage against your neighbor. You'd file the claim through your neighbor's home insurance against their liability coverage.

Situations like these are why it's worth having the proper car and home insurance in Illinois. Without the right coverage, you're left having to pay out of pocket for incidents like these that may not even be your fault.

What Does Illinois Car Insurance Cover?

Illinois requires all drivers to have a minimum amount of liability coverage that covers property damage and injuries that you may cause to other drivers. It also requires drivers to have uninsured/underinsured motorist coverage. The following minimum amount of coverage is required:

- Bodily injury liability: $25,000 for injury or death of one person in an accident, $50,000 for injury or death of more than one person in an accident. If you're sued, this coverage pays for third-party medical expenses and legal fees.

- Property damage liability: $20,000 for damage to property of another person. This coverage pays for damage you cause to someone else's vehicle or property.

- Uninsured motorist coverage: $25,000 per person and $50,000 per accident. This coverage pays for damage to your vehicle and personal injuries if you're in an accident with an uninsured or underinsured motorist.

Some essential but optional add-on car insurance coverages in Illinois include:

- Collision coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled in a collision, regardless of fault.

- Comprehensive coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled by a non-collision event such as a hailstorm or theft.

- Medical payments coverage: Pays for personal injuries in an at-fault accident or after a hit-and-run.

What If I Don’t Have Comprehensive Coverage on My Vehicle?

Comprehensive coverage is an essential part of auto insurance because it's the only policy that will reimburse for damage that results from incidents outside of a collision. If you don't have it, you'll have to pay to repair or replace your vehicle out of pocket.

If you did not have comprehensive coverage when the neighbor's rock hit your windshield, you'd be out of luck. Any costs associated with repairing or replacing the windshield would come out of pocket.

Since comprehensive coverage is optional in Illinois, an agent can make sure you're set up with this policy, so you're not left exposed.

Comprehensive Car Insurance Stats

If you're still questioning whether comprehensive car insurance is worth having, just check out these statistics of how frequently comprehensive insurance claims happen.

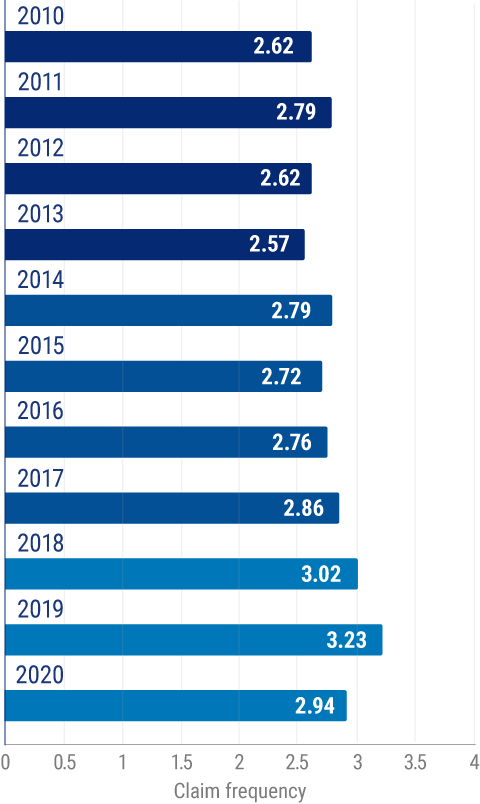

Frequency of Auto Claims

- Even though the frequency of comprehensive insurance claims fell in the last year, it continually increased in frequency year over year in previous years.

- In one recent year, there were 3.23 comprehensive insurance claims filed per 100 cars.

- In the following year, this number dropped to 2.94 per 100 cars.

- In that same year, the average value of private passenger auto comprehensive insurance claims for physical damage was $1,995.

An Illinois independent insurance agent can help you decide if comprehensive insurance is right for you.

Why Work With an Illinois Independent Insurance Agent?

Disaster can strike at odd times, and sometimes it strikes through the lawnmower of the neighbor next door. When someone else causes damage to your property, there's always the question of who's to blame and the best way to get reimbursed for the damage.

An Illinois independent insurance agent helps you get set up with the right auto and home insurance, so you don't have to worry about unexpected accidents. They know the coverages you need and where to find them. Agents are available to answer your questions and ensure that you're always equipped with the best insurance to protect your home, vehicle, and possessions.

Article reviewed by | Jeff Green

https://www.ilsos.gov/publications/pdf_publications/vsd361.pdf

https://www.iii.org/article/what-is-covered-by-collision-and-comprehensive-auto-insurance