You expect things to go smoothly when you hire a professional tree cutter to trim up your trees. But what happens if the tree cutter drops a branch right onto your neighbor's shed, causing damage? Are they responsible for the damage, or are you?

The answer isn't always black and white, which is why an Illinois independent insurance agent can help. Agents can help you understand your homeowners insurance coverage and clarify when you're financially responsible for accidents on your property.

My Tree Cutter Caused Damage to My Neighbor's Property, Am I Responsible?

Individuals that offer professional services, like tree trimmers, are responsible for having business insurance for incidents like this. Since the professional is cutting the trees, paying for the damage is on them.

However, it is your responsibility to ensure that anyone you hire to do work on your property has insurance. Before hiring any professional service, it's best to ask if they have insurance for accidents like this and others.

Assuming the tree cutter is adequately insured, the neighbor would file a claim with their insurance company, which would then handle the process.

Would I Be at Fault for Any of the Damage?

The blame for damage could only be turned on to you if there was reason to believe that something you did caused the branch to fall onto the neighbor's shed. If you failed to properly maintain the trees on your property, which then broke and caused damage to the neighbor, you might be held responsible.

If your neighbor's home insurance denied the claim or did not fully reimburse them for the damage, the neighbor could choose to come after you for the remaining expenses. If the neighbor were to take legal action for the damage, you could use the liability coverage in your Illinois home insurance to help cover the claim.

What If Someone Is Seriously Injured by the Damage?

Anytime you cause damage to someone else or their property, it falls under the liability coverage of insurance. If the falling branch caused serious injury to the neighbor, liability insurance would step in.

There's also a chance that the neighbor would sue you or the company for their injuries. In either situation, liability insurance would pay for the costs associated with the injury, which can be broken into two primary coverages.

- Medical payments: Pays for injuries to a third party, such as your neighbors or guests, if a branch from one of your trees falls onto their property.

- Personal liability: Pays for property damage, defense, judgment, and settlement fees you may be ordered to pay if your neighbor sues you.

Liability insurance is part of your home insurance policy, so you would be protected if the tree cutting company did not have adequate coverage.

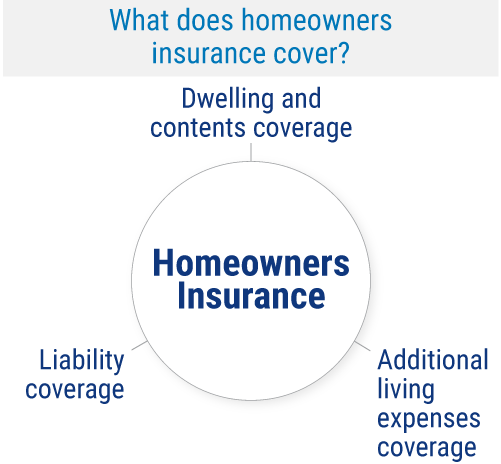

What Does Homeowners Insurance Cover in Illinois?

Homeowners insurance is a great tool to have in your insurance arsenal because it protects you from various potential risks you may face. Whether it's a tree branch falling on your neighbor's property or a freak accident unrelated to your landscaping, you're covered through several policies.

- Liability coverage: Liability insurance protects you against claims of bodily injury or property damage filed by third parties. Legal costs, including attorney and court fees, are covered if you get sued.

- Dwelling and contents coverage: These separate sections of property insurance protect the structure of your home against various perils like fire and lightning, as well as your stuff inside the house (and in many cases, also stored elsewhere) against threats like theft.

- Additional living expenses coverage: This coverage provides extra costs if you need to live elsewhere after a covered disaster severely damages your home. Covered expenses include hotel stays, additional gas mileage, and more.

Home insurance is highly customizable, and your Illinois independent insurance agent can help you build a policy that fits all of your needs.

Will My Illinois Homeowners Insurance Offer Full Coverage for My Neighbor’s Property?

Your home insurance policy will not pay for any and all damages that occur on your neighbor's property, but it may pay for some.

The only time you would bring your home insurance into the claim is if the neighbor decided to sue you for the damage. In this case, you would file the claim through your home insurance, which your liability insurance would cover. However, there is a limit to how much liability coverage will pay for property damage such as a tree falling into the neighbor's yard. This amount is clearly stated in your policy.

How Can an Illinois Independent Insurance Agent Help?

As a homeowner, understanding different aspects of your Illinois home insurance and its coverage can help when accidents occur on your property. Whether you're looking to reassess your coverage or get new protection, an Illinois independent insurance agent can help.

Agents are familiar with local insurance carriers and will shop multiple home insurance quotes for you. They can review coverages, answer your questions, and help you select a policy and the proper limits to keep you and your family protected against any potential risks.

Article Reviewed by | Paul Martin

https://jacksontreestl.com/what-kind-of-insurance-should-a-tree-service-have/

© 2024, Consumer Agent Portal, LLC. All rights reserved.