Insurance Content Navigation

- What Is Fire Insurance?

- What Does Fire Insurance Cover in Illinois?

- What Doesn’t Fire Insurance Cover in Illinois?

- Fire Damage Stats

- Does Car Insurance Include Fire Coverage in Illinois?

- Does Illinois Homeowners Insurance Cover Forest Fires?

- Here’s How an Illinois Independent Insurance Agent Can Help

Fire is both a natural and man-made foe to property owners of all kinds. They can be so destructive, in fact, that insurance companies often consider this peril first when designing their policies. It’s crucial for all residents in Illinois to know which of their policies covers fire damage, and how coverage applies.

Fortunately an Illinois independent insurance agent can help you find the right homeowners insurance and other policies to protect your property from fire damage. They’ll also be able to get you set up with additional fire insurance if necessary. But before we jump too far ahead, here’s a deep dive into fire insurance in Illinois.

What Is Fire Insurance?

According to insurance expert Paul Martin, fire insurance is available as a separate product, but fire coverage is already included in standard Illinois homeowners insurance, business insurance, and car insurance. Fire coverage is included in so many policies because it’s one of the most common and costly threats to insurance customers of all kinds. An Illinois independent insurance agent can help you review your existing coverage to ensure that you have enough fire protection.

What Does Fire Insurance Cover in Illinois?

Martin says that separate policies that cover fire and lightning damage are available. But fire coverage is included as part of your standard homeowners insurance, business insurance, and car insurance already. The fire portion of a homeowners policy offers this kind of protection:

- Coverage for up to 50% of your home’s value against fire damage.

- Coverage includes the dwelling as well as personal property.

- Coverage kicks in after you’ve met your policy’s deductible.

- Some policies cover the original replacement value of fire-damaged items, while others factor in depreciation.

- Additional replacement value riders can be purchased to protect the original value of any fire-damaged items.

An Illinois independent insurance agent can review your homeowners insurance policy with you to make sure you’re satisfied with the level of fire damage coverage it provides.

What Doesn’t Fire Insurance Cover in Illinois?

Martin says that many insurance companies don't cover fires that remain within their intended space, such as your fireplace or grill. Insurance companies often refer to these types of fires as “friendly fires,” and they’re usually excluded in your coverage.

Other perils not covered by fire insurance include:

- Mysterious disappearance

- Owner negligence

- Spoilage

- Hail or wind damage

- Theft and vandalism

- Flood damage

Since Illinois tends to be prone to flooding incidents, it’s important to consider looking into getting a separate flood insurance policy with your independent insurance agent. They’ll help you get equipped with all the coverage you need against all disasters, not just fires.

Fire Damage Stats

Fires occur in every type of structure more often than you might suspect. It’s important to understand the real threat of fire damage to every type of property owner when looking into getting the proper insurance policy. Here are just a couple of eye-opening fire stats for the US.

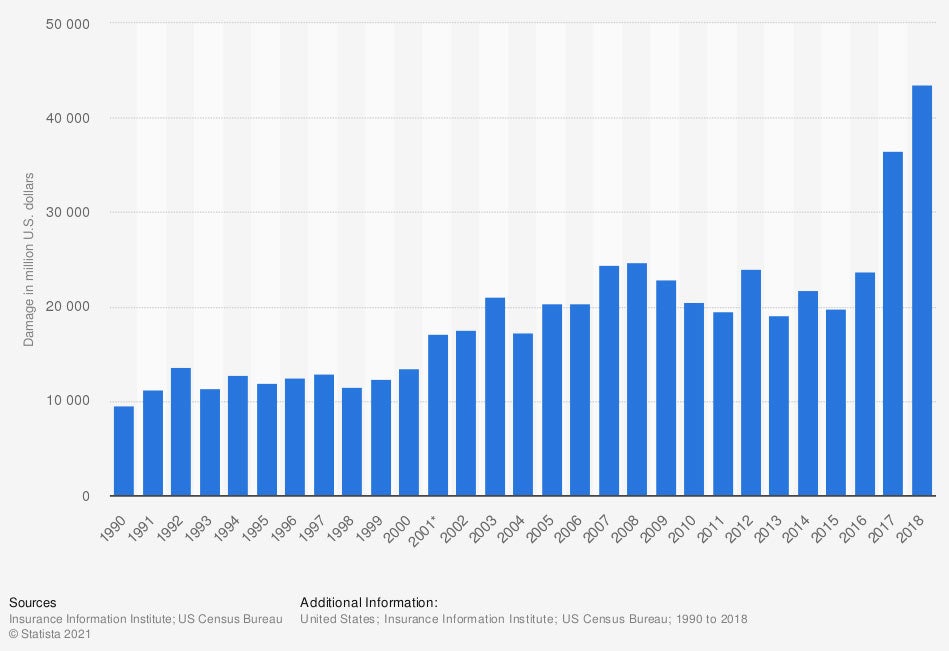

Total incurred losses due to fire in the US from 1990 to 2018

(in million US dollars)

Fire damage losses have greatly increased in recent decades. In 1990, a reported $9.49 million was lost due to fire. By 2018, this number had jumped four and a half times, to $43.58 million.

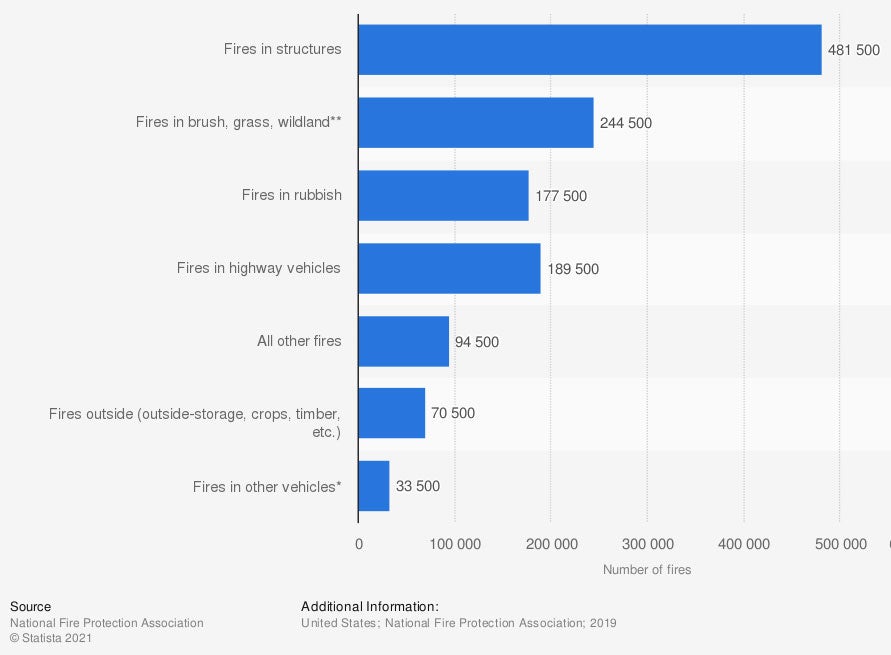

Total number of reported fires in the United States in 2019, by type

In 2019, 481,500 fires were reported in structures, including homes, businesses, etc. Also in 2019, 189,500 fires were reported in highway vehicles, and another 33,500 fires occurred in other vehicles.

Since fires happen so often, not only in homes, but also in businesses and vehicles, it’s important to review the fire coverage portion of your business insurance and car insurance policies with your Illinois independent insurance agent.

Does Car Insurance Include Fire Coverage in Illinois?

In order for your car insurance to cover fire damage, you’ll need to purchase comprehensive car insurance, otherwise known as “other than collision” coverage. Comprehensive car insurance protects your vehicle against numerous perils, including:

- Fire damage

- Flood damage

- Theft

- Wind and hail damage

- Windshield damage

To ensure that your vehicle is properly guarded against fire damage and much more, work together with an Illinois independent insurance agent to find the right comprehensive car insurance for you.

Does Illinois Homeowners Insurance Cover Forest Fires?

Yes, typically home insurance covers forest fires, since these are considered to be fires of a “hostile” nature, rather than “friendly.” Of course, you’ll want to double-check your specific policy to be sure. Homeowners insurance often provides coverage for several types of fires, like:

- Forest fires

- Wildfires

- Grease fires

- Electrical fires

If your area is prone to wildfires, however, your homeowners insurance company may require you to purchase a separate wildfire insurance policy. This exception applies more to residents in California and other hotspots than Illinois, though.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting home and car owners against devastating perils like fires, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in fire insurance, home insurance, and car insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/203771/number-of-fires-in-the-us-by-type/

chart - https://www.statista.com/statistics/198884/total-fire-losses-in-the-us-since-1990/

iii.org

© 2024, Consumer Agent Portal, LLC. All rights reserved.