Insurance Content Navigation

- Average Cost of Car Insurance in Illinois

- How to Calculate Car Insurance Costs in Illinois

- How to Calculate Additional Car Insurance Policies in Illinois

- Reasons for Higher Car Insurance Costs in Illinois

- How Do I Reduce the Cost of Car Insurance?

- How to Calculate Car Insurance Costs for a New Car in Illinois

- Here’s How an Illinois Independent Insurance Agent Can Help

When shopping for the right car insurance for your vehicle, it can be helpful to have some figures in mind. But without knowing the behind-the-scenes details of how car insurance costs are calculated, estimating premiums on your own can be complicated. Fortunately there are a few hacks to figuring out how policy costs are determined.

Better yet, an Illinois independent insurance agent can not only help you find the right car insurance for your needs, but can also provide you with all the details that factor into your policy’s cost. But before we jump too far ahead, here’s a deep dive into car insurance and how premiums are calculated.

Average Cost of Car Insurance in Illinois

Whenever you buy a new type of insurance, it can be helpful to consider how it’ll fit into your budget beforehand. Reviewing the average cost of car insurance in Illinois is a good starting place. Here are some figures for car insurance in Illinois vs. the US overall:

- The average cost of car insurance in Illinois is $1,079 annually.

- The average cost of car insurance in the US is $1,311 annually.

- Drivers in Illinois pay about $232 less per year than the US average.

An Illinois independent insurance agent can help you find more exact figures for your specific city and vehicle.

How to Calculate Car Insurance Costs in Illinois

Just like everywhere else in the country, Illinois has a certain set of factors that help determine car insurance premium costs. According to insurance expert Paul Martin, not only is information about the vehicle taken into account, but also details about the driver.

Some of the key factors that determine insurance costs are:

- The type and value of the vehicle: The more valuable your vehicle is, the more costly it is to insure, and the higher the car insurance premiums will be. So, in general, a car insurance policy for a Lamborghini will be much more expensive than for a Prius.

- How often the vehicle is driven: When you drive more, you put your vehicle at a greater risk of accidents and other disasters. While car insurance companies may provide a discount for drivers who stay below a certain amount of mileage per year, those who go over may pay more for their coverage.

- Driving history and traffic records: If a driver has prior traffic violations or accident history, their car insurance premiums will almost always be more expensive.

An Illinois independent insurance agent can further explain these pricing factors and others that go into determining the cost of car insurance premiums.

How to Calculate Additional Car Insurance Policies in Illinois

To start off, it’s crucial to know which coverages in Illinois are mandatory for drivers to have by law. In Illinois, these coverages are:

- Uninsured motorist: Coverage protects drivers against getting into accidents with other drivers who do not carry any or adequate insurance to cover the damage.

- Property damage liability: Coverage protects against damage to property, like a house, if the driver hits it with their vehicle.

- Bodily injury liability: Coverage protects against injuries to a third party and their passengers if the policyholder gets into an accident with another driver.

Basic coverages out of the way, it’s time to consider additional policies to add onto your basic car insurance. Some important coverage options you might consider include:

- Personal injury protection (PIP): Coverage reimburses drivers for their own injuries, and for any injuries to their passengers. PIP coverage costs can range from about $50 to $200 annually.

- Comprehensive coverage: Coverage protects your vehicle from threats other than collision, such as flood damage. Comprehensive insurance averages $192 annually.

- Collision coverage: Protects against damage to your vehicle if you get into an accident. Collision insurance premiums average $526 annually.

An Illinois independent insurance agent can help you decide which coverages, if any, make the most sense to add onto your car insurance policy, and also tell you how much they’ll cost.

Reasons for Higher Car Insurance Costs in Illinois

Martin says there are several factors that can hike up the cost of car insurance premiums, one being the age of the driver.

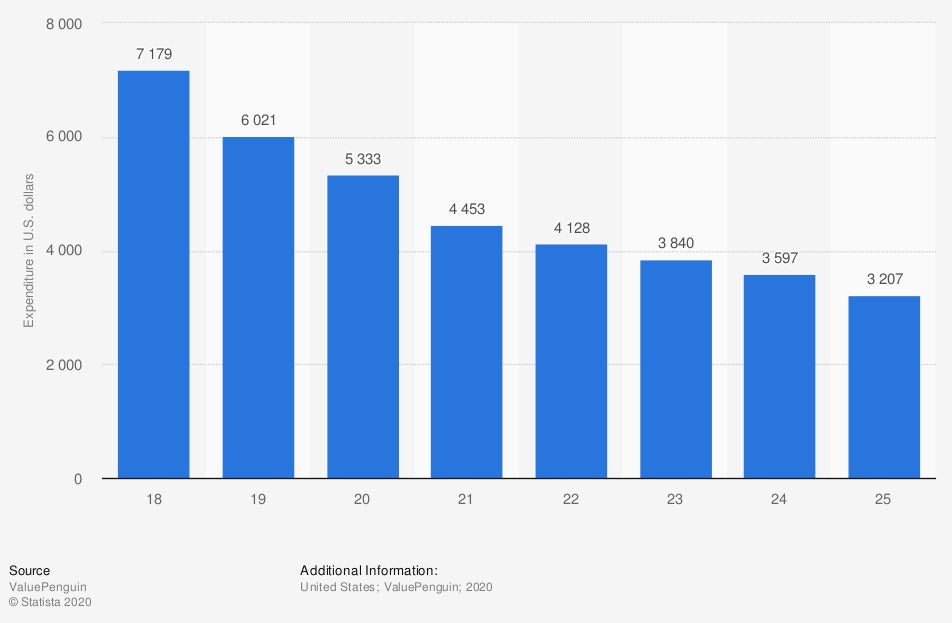

Average auto insurance expenditure in the United States in 2020, by age (in US dollars)

Once a driver reaches age 25 they often pay much less for car insurance, since statistically this is the age from which drivers get into fewer accidents. In 2020, 18-year-old drivers paid a whopping average of $7,179 annually for car insurance, while 25-year-olds paid less than half of that, at $3,207 per year.

A couple of other factors that could increase car insurance costs include:

- Specific location: Car owners who live in areas prone to natural disasters might pay more for their coverage. Likewise, car owners who live in major cities that are more prone to crimes like theft might also pay more for coverage.

- Credit score: Relationships between poor credit management and poor driving behaviors, as well as the opposite, have been discovered over time by car insurance companies. As a result, drivers with lower credit scores will likely pay more for their coverage.

An Illinois independent insurance agent can further explain factors that go into determining the cost of your car insurance.

How Do I Reduce the Cost of Car Insurance?

Fortunately several discounts are offered by most car insurance companies on their coverage. An independent agent can help you find more money-saving hacks, but here are just a few of the most common to get started:

- Bundle your policies: Insurance companies generally offer discounts for policyholders who buy more than one type of coverage with them, such as auto and homeowners insurance.

- Take a defensive driving course: Often, car insurance companies will award discounts for customers who complete state-approved defensive driving courses to better their driving skills.

- Maintain a good grade average: For students, many car insurance companies offer generous discounts on coverage if you maintain a good grade average.

If you’d like more information about discounts you might qualify for on car insurance, enlist the help of an Illinois independent insurance agent.

How to Calculate Car Insurance Costs for a New Car in Illinois

Newer vehicles are often more expensive to insure, since their value is higher. Since new cars are more costly to replace, the cost of coverage must be higher to make up for this. Car insurance premiums are estimated to decline an average of 3.5% every year you own the vehicle. So, once you’ve had the car for 5 years, the cost of coverage will be about 17.5% less than when you originally bought it.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to helping Illinois drivers calculate the cost of their car insurance premiums, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in auto insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Paul Martin

Author | Chris Lacagnina

chart - https://www.statista.com/statistics/555827/auto-insurance-costs-usa-by-age/

iii.org

irmi.com

© 2024, Consumer Agent Portal, LLC. All rights reserved.