Quick Content Navigation

- What Is Car Insurance?

- What Does Car Insurance Cover in Illinois?

- What Does Car Insurance Not Cover in Illinois?

- How Many Tornadoes a Year are in Illinois?

- Disasters Your Car Insurance Will Cover in Illinois

- Additional Car Insurance Options in Illinois

- How an Illinois Independent Insurance Agent Can Help You

What Is Car Insurance?

In Illinois, car insurance is regulated by the state. This means you are required to carry the minimum limits of liability in order to use the roadways. Take a look at what is needed and what is included in your policy below.

Minimum limits of auto liability in Illinois

- $25,000 per person/ $50,000 per accident/ $20,000 property damage

Your auto policy will provide coverage for the following

- Property: Coverage for damage to vehicles and outside property

- Liability: Coverage for bodily injury or property damage

- Medical: Coverage for your medical expenses due to an at-fault loss

What Does Car Insurance Cover in Illinois?

Your Illinois auto policy will come with standard minimum limits of liability. If you're looking for additional coverage for vehicle damage and roadside assistance, you'll have to add it. In the meantime, check out some options.

- Gap coverage: Pays for the difference in your remaining loan balance and the market value when a total loss occurs.

- Tow coverage: Will pay for a tow truck to tow a covered auto due to a loss.

- Rental car coverage: Will provide reimbursement for a rental car when your covered auto is damaged.

- Comprehensive coverage: Will pay for property damage to your vehicle that is hit by an unavoidable object.

- Collision coverage: Pays for property damage to your car in the event of a crash.

What Does Car Insurance Not Cover in Illinois?

In Illinois, you will also be required to have the uninsured/underinsured motorists coverage or UM/UIM. These are at the minimum limits and can only be increased if you ask your agent to do so. Your UM/UIM limits will be set at the below amount.

- Uninsured/underinsured motorists or UM/UIM: A minimum liability of $25,000 per person/$50,000 per accident/ $20,000 property damage.

- UM/UIM: This coverage will pay for your expenses arising from an accident with an uninsured at-fault driver.

- National average of uninsured drivers: 13.0%

- Illinois average of uninsured drivers: 13.7%

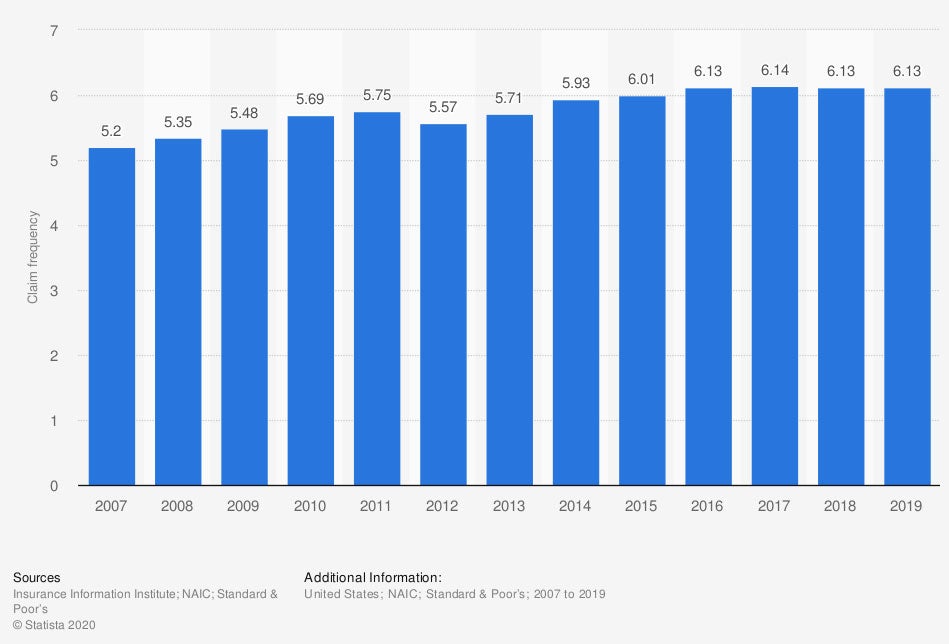

You won't have coverage for the damage of your own vehicles unless you add comprehensive or collision insurance. The number of claims that have occurred are listed below.

US Auto Collision Claims

If you're needed more than liability only, consider increasing and adding some of the other limits to your auto policy. This will ensure that you have adequate limits of protection.

How Many Tornadoes a Year Are in Illinois?

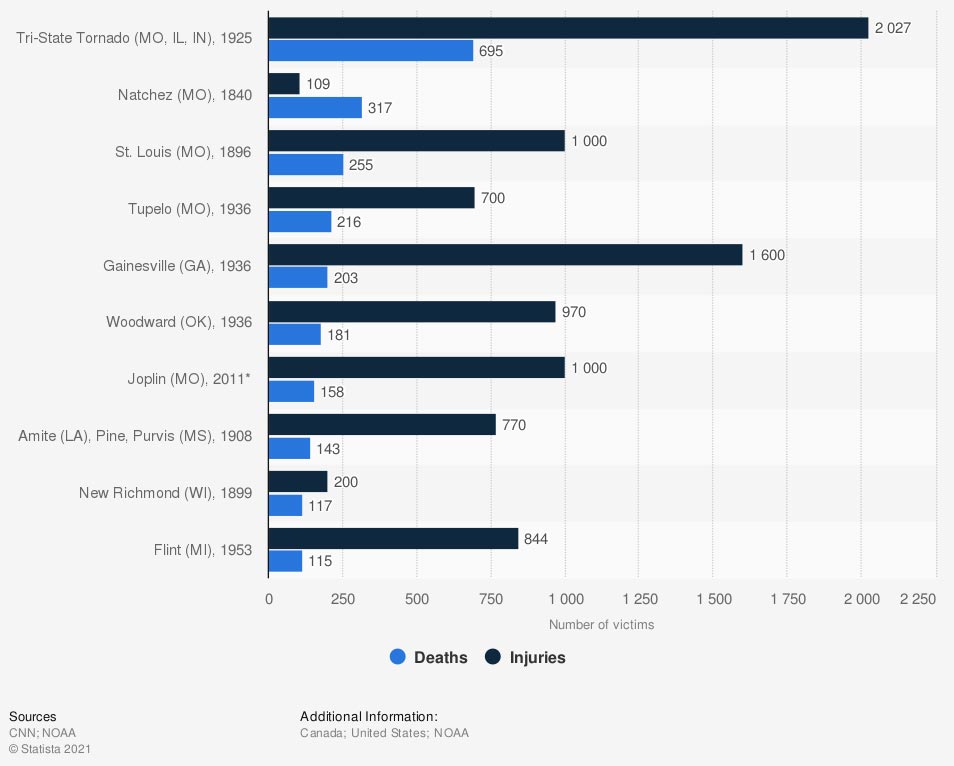

Tornadoes occur all over the nation and should have coverage under your policies. Fortunately, your car and homeowners insurance will have an option for protection against tornado damage. Let's look at the numbers.

Number of tornadoes in the US annually: 1,000

Number of tornadoes in Illinois annually: 54

Deadliest Tornadoes in the US

No matter where you reside in Illinois, there is a chance you'll encounter severe weather. If you have to file an auto claim due to tornado damage, then your auto policy will respond as long as you have comprehensive coverage. Review your policy with a licensed professional for accuracy.

Disasters That Your Car Insurance Will Cover in Illinois

When it comes to your Illinois car insurance, you'll automatically have coverage for bodily injury to another and property damage to a third party. However, if you want protection for tornadoes, severe weather, flooding, and more, you'll need to put an endorsement on your policy. Comprehensive and collision coverage will supply insurance up to the policy limit for physical damage to your vehicle. A deductible of $500 to $1,000 is typically applied first and your portion of the loss.

Additional Car Insurance Options in Illinois

In Illinois, you'll have some options when insuring your vehicles. First, you'll start with the standard liability coverage. Then you can add on other limits of protection as you see fit. Some additional ones you may not think of are rental car coverage, gap insurance, and roadside assistance.

If you are involved in a covered loss, rental car coverage will pay for a temporary vehicle while yours is replaced or fixed. Gap insurance is for your newer vehicles and will fill in the gap between the market value and the remaining loan balance. If you need some roadside assistance when your car breaks down, then you can add it to most auto policies. Some other carriers may offer equipment coverage and more, and should be reviewed with your agent.

How an Illinois Independent Insurance Agent Can Help You

When you're shopping for the best Illinois auto insurance policy, it's important to know what you're getting. Coverage can be confusing if you're not a trained professional. If you're finding insurance on your own, you could be missing key limits of protection.

Fortunately, an Illinois independent insurance agent can help you access several carriers at once so that you save time and money. They do the comparing at no additional cost and find a policy that fits your needs and budget. Connect with a local expert on TrustedChoice.com to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/830102/car-collision-claim-frequency-for-physical-damage-usa/

Graphic #2: https://www.statista.com/statistics/221192/the-10-deadliest-tornadoes-in-the-united-states/

http://www.city-data.com/city/Illinois.html

https://stateclimatologist.web.illinois.edu/climate-of-illinois/tornadoes-in-illinois/

© 2025, Consumer Agent Portal, LLC. All rights reserved.