Quick Content Navigation

- What Is Car Insurance?

- What Does Car Insurance Cover in Illinois?

- What Doesn't Car Insurance Cover in Illinois?

- Does Car Insurance Cover Hail Damage in Illinois?

- How Much Hail Damage Does Illinois Car Insurance Cover?

- Car Insurance Statistics in Illinois

- How an Illinois Independent Insurance Agent Can Help You

What is Car Insurance?

Illinois, like most states, has adopted laws making car insurance mandatory if you use the roadways. The minimum limits of liability are necessary to avoid serious fines or worse. Take a look at what is needed and what is included in your policy below:

Minimum limits of auto liability in Illinois:

- $25,000 per person/ $50,000 per accident/ $20,000 property damage

Your auto policy will provide coverage for the following:

- Property: Coverage for damage to vehicles and outside property

- Liability: Coverage for bodily injury or property damage

- Medical: Coverage for your medical expenses due to an at-fault loss

What Does Car Insurance Cover in Illinois?

Your Illinois car insurance will come standard with the minimum limits of liability. Coverage for your cars themselves and any additional protection is optional. In the meantime, check out some options:

- Gap coverage: Pays for the difference between your remaining loan balance and the market value when a total loss occurs.

- Tow coverage: Will pay for a tow truck to tow a covered auto due to a loss.

- Rental car coverage: Will provide reimbursement for a rental car when your covered auto is damaged.

- Comprehensive coverage: Will pay for property damage to your vehicle that is caused by a non-collision incident such as fire, theft, or vandalism, or colliding with an animal.

- Collision coverage: Pays for property damage to your car in the event of a crash.

What Doesn't Car Insurance Cover in Illinois?

Car insurance in Illinois will come with the minimum limits of liability, and that includes uninsured/underinsured motorist coverage. It will not include adequate protection, and most of the time more coverage is necessary to have a policy that pays for an entire loss. Take a look at how uninsured/underinsured motorist insurance works:

- Uninsured/underinsured motorist or UM/UIM: Minimum liability of $25,000 per person/$50,000 per accident/ $20,000 property damage. This coverage will pay for your expenses arising from an accident with an uninsured at-fault driver.

- National average of uninsured drivers: 13.0%

- Illinois average of uninsured drivers: 13.7%

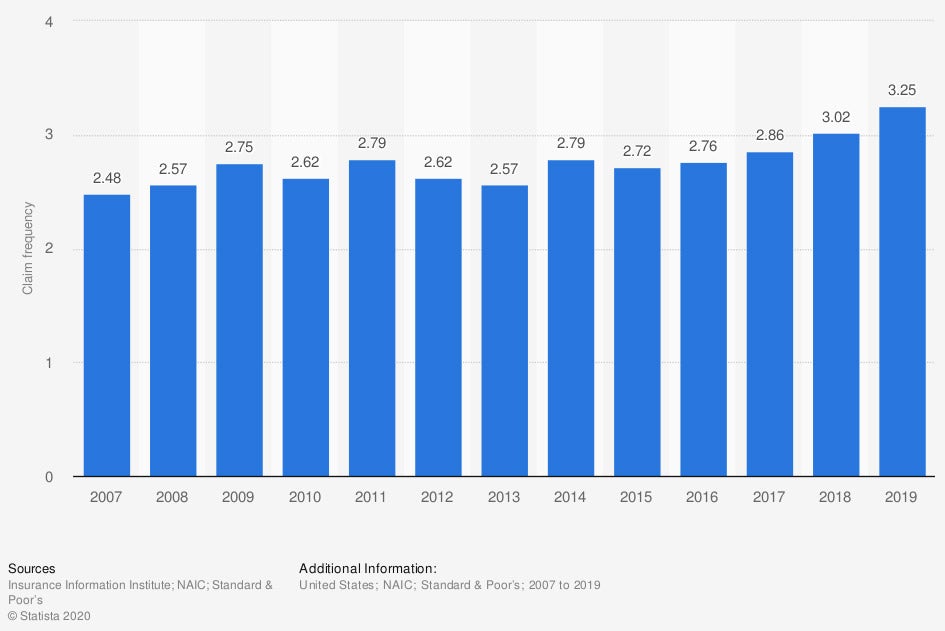

If you want insurance for your vehicles, then comprehensive and collision coverage has to be added to your policy. Take a look at the number of comprehensive insurance claims nationwide.

Comprehensive auto insurance claims in the US (per 100 car years)

Comprehensive claims account for a lot of property damage to vehicles in the US. When you have a loss, you'll want to be sure your insurance is sufficient.

Does Car Insurance Cover Hail Damage in Illinois?

Illinois car insurance will cover your exposure for a bodily injury or property damage loss to another party. When your vehicle has property damage due to hail, flooding, and other severe weather, you'll need to add comprehensive coverage. Comprehensive insurance can be added to your auto policy for additional premium. This coverage will have a deductible of $500 to $1,000, and you'll be responsible for that amount when a claim occurs.

How Much Hail Damage Does Illinois Car Insurance Cover?

Your auto policy's comprehensive limit of insurance will cover your vehicles for damage due to severe weather like hail. A deductible of your choosing applies, and you will be responsible for paying that amount when a loss takes place. Every car on your policy will need to have comprehensive coverage added individually on a per vehicle basis. The coverage amount will go up to the market value of the car itself and will be determined by the insurance adjuster.

Car Insurance Statistics in Illinois

In Illinois, car insurance is mandatory and necessary if you want to avoid a major financial setback. One car accident could wipe you out completely if you don't have the proper insurance. Check out some car insurance statistics below:

Auto insurance annual premiums on average:

- National average: $1,311

- Illinois average: $1,079

Rank for most expensive auto premiums:

- Illinois: 39

Average theft rates (per 1,000 people):

- National rate: 2.289

- Illinois rate: 1.538

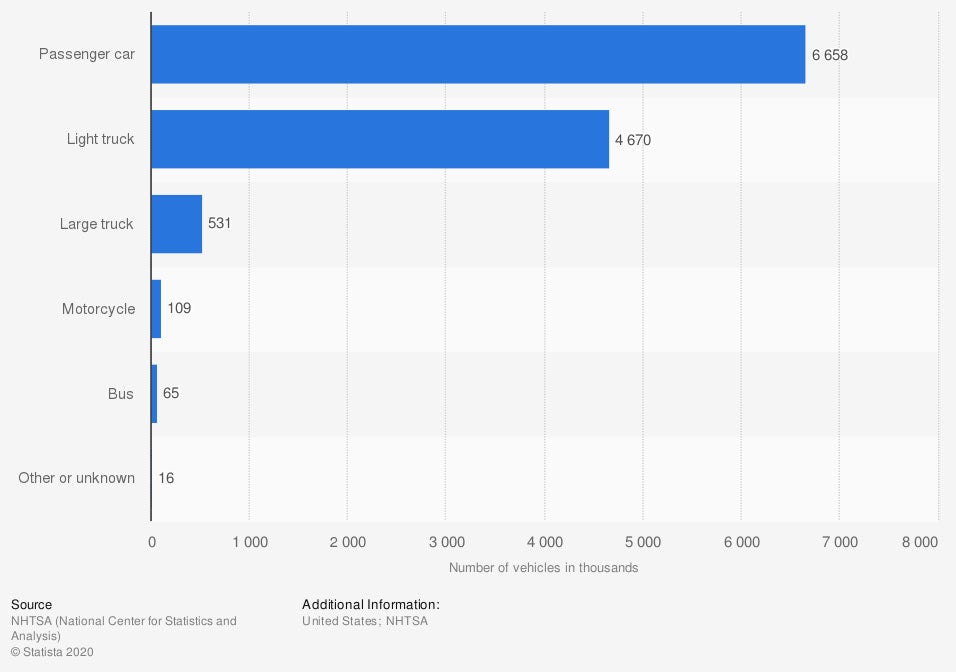

The number of vehicles involved in accidents in the US (in 1,000s)

It's essential to know the facts when purchasing insurance. Your auto coverage can be affected by numerous factors, and some are in your control and others are not. For exact pricing and coverage options, contact a trusted adviser.

How an Illinois Independent Insurance Agent Can Help You

There are several options when it comes to your Illinois auto insurance policy. To ensure that you're not missing key coverage, consider working with a trained professional. Hail damage, among other losses, can impact your finances and more if you're not properly insured.

Fortunately, an Illinois independent insurance agent has access to multiple markets so that you get the best policies and rates in town. They do the shopping for you at no additional cost, saving you time. Connect with a local expert on TrustedChoice for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/830114/comprehensive-car-claim-frequency-physical-damage-usa/

Graphic #2: https://www.statista.com/statistics/192097/number-of-vehicles-involved-in-traffic-crashes-in-the-us/

http://www.city-data.com/city/Illinois.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.