Quick Content Navigation

- What Does Car Insurance Cover in Illinois?

- What Doesn't Car Insurance Cover in Illinois?

- Does Car Insurance Cover Hitting a Deer in Illinois?

- Do I Need Full Coverage to Be Insured against Hitting a Deer?

- What If I Am Injured after Hitting a Deer?

- Other Policies That Can Provide Additional Coverage

- How an Illinois Independent Insurance Agent Can Help You

What Does Car Insurance Cover in Illinois?

Illinois car insurance will come standard with the minimum limits of liability required by state law. As a driver in Illinois, you are legally required to carry at least the state's minimum limits or you could face serious consequences. Check out what's needed and what's included in your policy below:

Minimum limits of auto liability in Illinois:

- $25,000 per person/ $50,000 per accident/ $20,000 in property damage

Your auto policy will provide coverage for the following:

- Property: Coverage for damage to vehicles and outside property

- Liability: Coverage for bodily injury or property damage

- Medical: Coverage for your medical expenses due to an at-fault loss

What Doesn't Car Insurance Cover in Illinois?

Illinois law requires you to carry uninsured/underinsured motorist liability as well. While you have to have the minimum limits, that's usually not enough and needs to be manually increased. Your UM/UIM limits will be set at the amounts below:

- Uninsured/underinsured motorist or UM/UIM: A minimum liability of $25,000 per person/$50,000 per accident/ $20,000 in property damage. This coverage will pay for your expenses arising from an accident with an uninsured at-fault driver.

- National average of uninsured drivers: 13.0%

- Illinois average of uninsured drivers: 13.7%

Other coverages that won't be included, but can be added to your policy, are comprehensive, collision, rental car, towing, gap insurance and more. You'll want all the right limits of protection for a loss.

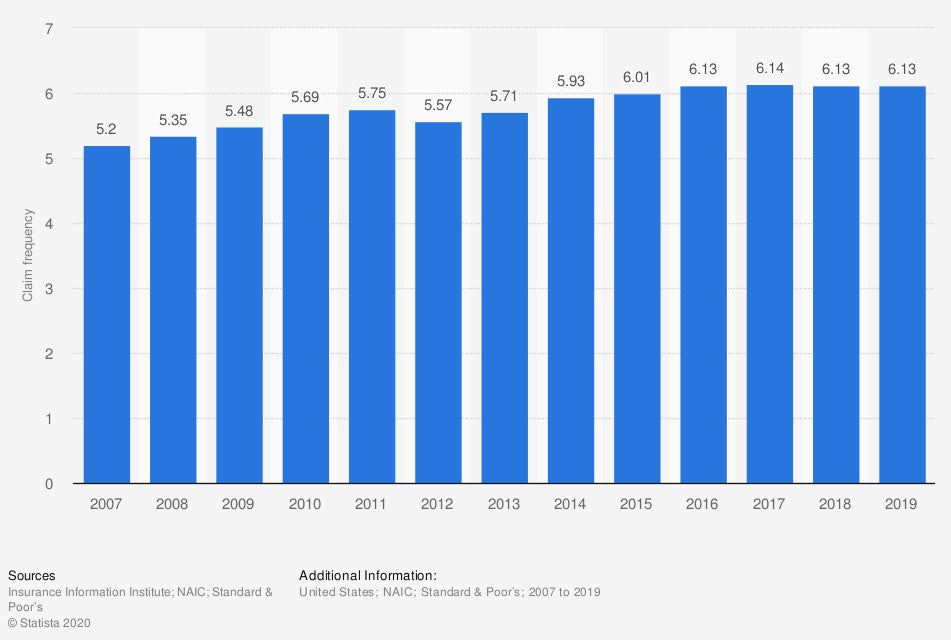

US Auto Collision Claims

Accidents occur all the time and the proper coverage should be reviewed. If you wait until you have a loss, it's already too late and you could have a significant financial setback.

Does Car Insurance Cover Hitting a Deer in Illinois?

That will depend on what type of coverage you have under your Illinois auto insurance. Property damage in general will not be covered under a liability-only policy. If you damage someone else's property, then that falls under your liability limits. When you hit a deer and have damage to your car, then you only have coverage if you added it beforehand. This is known as comprehensive and collision insurance. Take a look at the definitions below:

- Comprehensive coverage: Will pay for property damage to your vehicle caused by a non-collision incident like theft or fire, or being hit by an animal.

- Collision coverage: Pays for property damage to your car in the event of a crash.

Do I Need Full Coverage to Be Insured against Hitting a Deer?

In short, yes. Full coverage to some extent is necessary if you want to have coverage for hitting a deer under your Illinois auto insurance policy. First, you need to know what's considered full coverage. Take a peek at the facts below:

- Full coverage auto insurance: Full coverage on your auto policy is a term used when you have comprehensive and collision insurance in addition to your liability coverage. Comprehensive is used the most when a deer claim comes up, but collision could be accessed as well. The carriers determine if you could have avoided hitting the animal and then assign it as a comprehensive or collision loss. If the animal jumped out and hit you, then it's comprehensive, but if it was in the middle of the road and could have been avoided, it's collision.

What If I Am Injured after Hitting a Deer?

When you are injured in a car accident, you're policy may respond. First, carriers will need to determine if you're at fault or not. If you hitting a deer is considered a collision loss, then you will have coverage for medical expenses up to your medical payments limit. However, if you are not at fault and it is truly a comprehensive claim, then you would usually have insurance for the entire loss.

The number of car accident injuries and fatalities in the US

If you become injured due to hitting a deer or any other road traffic accident, you're not alone. The number of injuries and fatalities resulting from car accidents in the US is high. The right coverage is necessary to be adequately insured.

Other Policies That Can Provide Additional Coverage

If you hit a deer with a motor vehicle, there could be a lot of damage. And that could be not only to your vehicle, but also to yourself and your personal belongings. Other policies that could provide some additional coverage for a loss are the following:

- Personal articles floater: This policy would provide coverage for your valuable personal property that is scheduled.

- Homeowners insurance: If you are traveling with some of your belongings from home, your homeowners personal property limit might apply to a property damage claim.

- Commercial insurance: If you are driving a commercial vehicle, or carrying commercial property, your business insurance could pick up a portion of a loss.

- Health insurance: If you become injured as a result of an accident and you're at fault, your medical payments coverage would only get you so far. The rest could be paid for by your health insurance.

How an Illinois Independent Insurance Agent Can Help You

An Illinois auto insurance policy can help protect your vehicles and liability exposures. Coverage can be confusing when you're not a licensed professional. There are numerous policy options to choose from, and it may be challenging to know what's best.

Fortunately, an Illinois independent insurance agent has access to multiple carriers, giving you the best coverage and rates in town. They do the shopping for you at no additional cost so that you save time and premium dollars. Connect with a local expert on TrustedChoice for tailored protection today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/830102/car-collision-claim-frequency-for-physical-damage-usa/

Graphic #2: https://www.statista.com/study/11003/road-accidents-in-the-us-statista-dossier/

http://www.city-data.com/city/Illinois.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.