Insurance Content Navigation

- What to Do after a House Fire with No Insurance in Illinois

- Can I Get Home Insurance after a House Fire?

- When Can I Get Insurance after a House Fire?

- House Fire Costs

- Difference between Owning Home Insurance and Not Owning Insurance in Case of a House Fire

- When Won't Home Insurance Cover after a House Fire?

- Here’s How an Illinois Independent Insurance Agent Can Help

House fires can be devastating in numerous ways. They can be especially devastating, however, without homeowners insurance. But these incidents can and do happen, so it’s imperative to be prepared for disaster whether you’re covered or not.

When you’re ready to get the coverage you and your home deserve, an Illinois independent insurance agent can help you get equipped with the right home insurance. But until then, here’s a guide to how to get home insurance after a house fire in Illinois, and other handy tips.

What to Do after a House Fire with No Insurance in Illinois

Regardless of whether you have home insurance, many things need to be taken care of after a house fire. Follow these simple action steps to get started.

- Make sure all family members are safe: After the fire, your first item of business should be tending to any injuries, including your own, your family’s, and any guests you may have had over. Anyone who’s injured should be treated by a medical professional ASAP.

- Assess the property damage: You’ll want to take an inventory of any damaged or destroyed property and sections of your home, but not until you’re positive it’s safe to reenter. Make sure to have a professional property inspection performed before anyone reenters the home after a fire, no matter how safe it looks from the outside.

- Consider the cause of the fire: If the house fire started as a result of someone else’s negligence, even one of your own guests’ you could be eligible to sue them for the damage. First, however, you’ll need to be equipped with liability insurance.

- Turn to local organizations: After suffering from a disaster like a house fire with no insurance, local organizations like the Red Cross might be able to provide critical help. Local shelters can offer temporary housing for your family until your home gets repaired.

Sadly, if you lack homeowners insurance and have a house fire, you could end up having to pay out of pocket for the destruction. That’s why it’s crucial for all homeowners to be insured long before disaster ever strikes. You never know when a tragedy could occur on your property.

Can I Get Home Insurance after a House Fire?

According to insurance expert Jeffery Green, in general, yes, you can get home insurance after a house fire. But unfortunately your policy would not cover the fire that’s already happened on your property while you were uninsured. Your homeowners insurance will only cover listed perils that occur after the policy’s coverage period starts. But having a policy in place could save you from having to pay out of pocket for another disaster like this down the road.

When Can I Get Insurance after a House Fire?

Green says that you should be able to get coverage after a house fire in most cases, unless your property has a history of fires, or the homeowner has a history of fire claims or fraud. In these cases, it's possible that an insurance company would decline to issue a policy.

New homeowners insurance policies typically kick in immediately once you’ve made your first payment. It can take a few hours to a few days to purchase a new policy. An Illinois independent insurance agent can seriously help speed the process along for you and get you equipped with the coverage you need ASAP.

House Fire Costs

Having home insurance can save you hundreds to thousands of dollars or even more in the event of a house fire. Check out some house fire cost stats below and see for yourself.

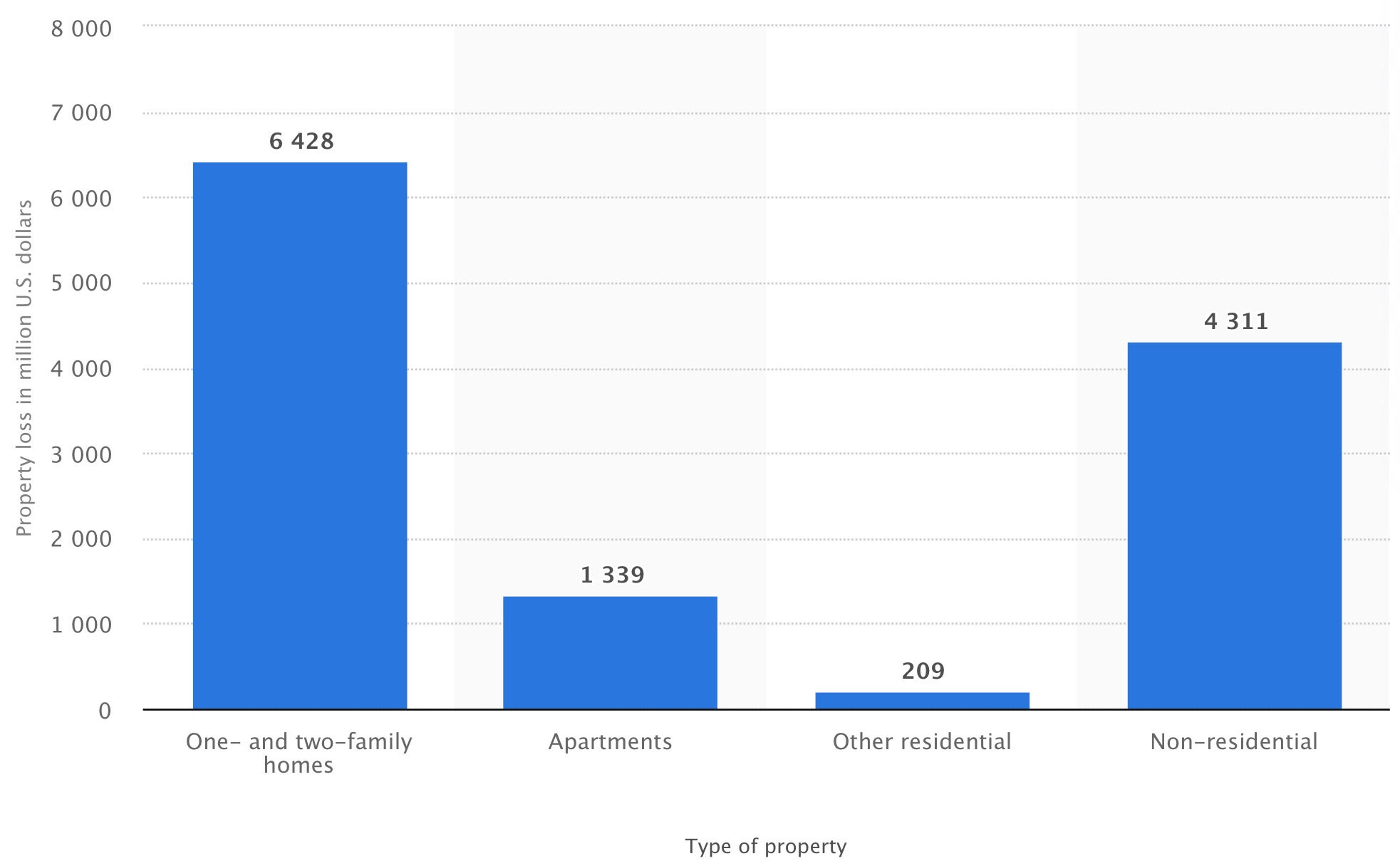

Property loss due to fires in the United States in 2019, by property use (in million US dollars)

In 2019, losses due to fires in one- and two-family homes amounted to $6.4 billion. Fires in apartments amounted to $1.3 billion in losses, and fires in other residential structures totaled $209 million.

There are a reported 481,500 fires in structures annually, costing $12.287 billion in overall damage. House fires are not only destructive and costly, but they can also be deadly. It’s imperative to have the right home insurance in place to be able to at least cushion some of the financial blow in the aftermath of one of these catastrophes.

Difference between Owning Home Insurance and Not Owning Insurance in Case of a House Fire

The difference between having and not having home insurance after a house fire could mean the difference between security and bankruptcy. Home insurance provides crucial protection for damage to the structure of your home and your belongings for many disasters, including house fires. Without this essential coverage, you’d have to pay these large costs all by yourself. If you lacked sufficient funds, you could end up temporarily homeless or even bankrupt.

When Won't Home Insurance Cover a House Fire?

Homeowners insurance won't cover a house fire if the cause of the fire is any of the excluded perils, including war and certain types of explosions. Home insurance also won't cover fires that are intentionally started for malicious reasons by one of the home inhabitants. Fires of a “friendly” nature, or those that stay within their intended area such as a fireplace, are often not covered either. An Illinois independent insurance agent can help explain further.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting Illinois homeowners against house fires and all other threats, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in homeowners insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

chart - https://www.statista.com/statistics/374819/us-fire-statistics-property-loss-due-to-fire-by-property-use/

iii.org

https://contelawyers.ca/what-to-do-after-a-house-fire-no-insurance/

© 2024, Consumer Agent Portal, LLC. All rights reserved.