When you run a business, you’ve got to keep all parts of it protected, which includes your hardworking team. Since workplace incidents can cause serious injury or illness to your crew, you need to ensure that you’ve got the appropriate coverage in place from the very start. That means being equipped with enough workers’ compensation insurance.

Luckily an Illinois independent insurance agent can help you get set up with all the workers’ comp your business needs to operate safely. Even better, they’ll get you covered before you need to file a claim. But before we jump too far ahead, here’s a deep dive into this crucial coverage.

What Is Workers’ Compensation?

Workers’ compensation insurance, also known as workers’ comp, is a coverage added onto Illinois business insurance to protect your crew from disasters on the job. Workplace incidents that result in illness, injury, or even death of members of your team are covered.

Workers’ comp reimburses for lost employee wages, medical costs of treatment, and legal fees if they file a lawsuit against your business. Coverage can even pay out disability or death benefits. An Illinois independent insurance agent can help you find the best workers’ comp for your needs.

What Does Workers’ Compensation Cover in Illinois?

If an employee on your team ends up getting injured, ill, or even dies due to job activities performed, workers’ comp will protect your business. Coverage often also covers employees that are performing work duties away from the business premises.

Workers’ comp often covers the following:

- Employee harm: From using workplace equipment or materials, such as hazardous chemicals, or by other disasters such as workplace violence, terrorist attacks, and natural disasters.

- Medical care: Like doctor or hospital visits, rehabilitation treatment, medications, diagnosis fees, long-term treatment, etc.

- Employee wages: Including hourly or salary wages an employee does not collect due to being out of work because of a workplace injury, illness, or disability.

- Legal protection: Including attorney, court, and settlement fees if an injured employee sues the business after an incident.

- Employee death/disability benefits: Workers’ comp may pay out a lump-sum death or disability benefit for employees who become disabled or are killed on the job.

- Funeral costs: Workers’ comp may even provide reimbursement for final arrangements and ceremonies if a worker is killed on the job.

An Illinois independent insurance agent can further explain what’s covered by your workers’ comp policy.

What Doesn’t Workers’ Compensation Cover in Illinois?

Though your workers’ comp policy provides a ton of critical protection for your business and its team, it can’t cover everything. According to insurance expert Paul Martin, workers’ comp often excludes the following:

- Incidents that occur while an employee travels to or from work

- Incidents that occur due to employee negligence

If an employee was following company guidelines and still got injured, ill, or died, it’s likely the incident will be covered under workers’ comp.

What Are the Most Common Causes of Death in the Workplace?

When shopping for workers’ comp coverage, it’s helpful to know what exactly you might need to use it for. Check out some of the most common workplace incidents below.

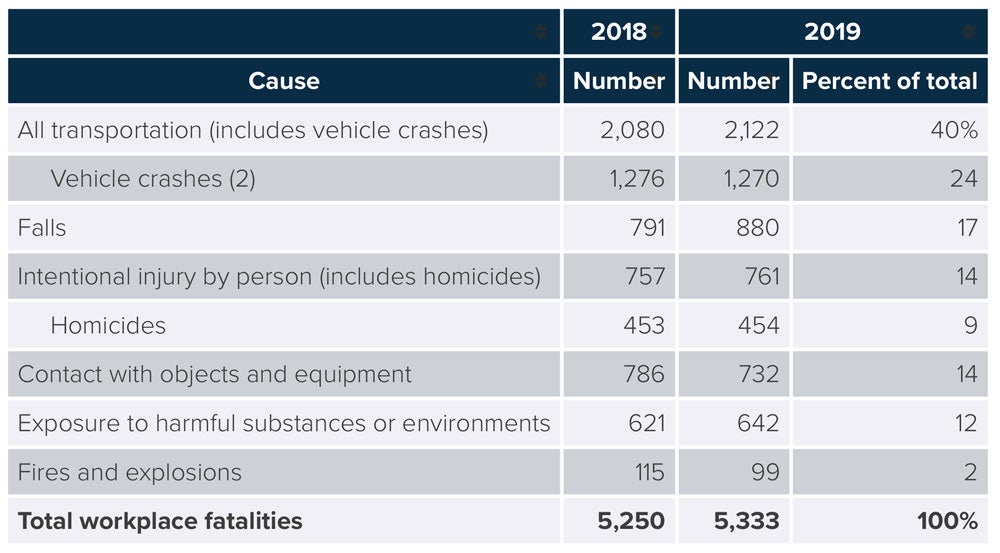

Workplace deaths by selected cause, 2018-2019

Vehicle crashes accounted for 24% of workplace crashes in recent years, with 2,122 reported overall in 2019. Falls were the second leading cause of death at 17%, with 880 overall, and assaults and violence were third, at 14%, with 757 incidents.

An Illinois independent insurance agent can help you find the right workers’ comp coverage to protect your company against these incidents and much more.

Is Workers’ Comp Required for All Businesses in Illinois?

No, not all businesses in Illinois are required to have workers’ comp. Your state’s local laws dictate specific businesses that are exempt from needing workers’ comp coverage. In many cases, however, most businesses that have one employee or more, even if they’re part-time, are are required to have coverage.

Businesses that are exempt from needing coverage are often in the agricultural field. Your Illinois independent insurance agent can find out for sure if your business requires coverage.

Does My Location Influence My Workers’ Compensation Rates?

Yes, like any other type of coverage, your exact location will impact your policy’s rates. Businesses in bigger cities often pay more for coverage than businesses located in smaller towns.

Aside from your location, your workers’ comp coverage rates are also influenced by:

- The type of business

- The business’s specific operations

- The size of the business

- The total number of employees

- Illinois state regulations

Your Illinois independent insurance agent can help find exact workers’ comp quotes for your area, as well as scout out any discounts you may qualify for.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting your business’s team against accidental injury, illness, or death on the job, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in workers’ compensation insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

stats - https://www.iii.org/fact-statistic/facts-statistics-workplace-safety-workers-comp

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/specific-coverages/workers-compensation-insurance

© 2025, Consumer Agent Portal, LLC. All rights reserved.