Insurance Content Navigation

- What Does Flood Insurance Cover in Illinois?

- What Doesn’t Flood Insurance Cover in Illinois?

- Is Flood Insurance Required in Illinois?

- Illinois Flood Stats

- What’s Considered to Be a Flood?

- How Much Does Flood Insurance Cost in Illinois?

- Here's How an Illinois Independent Insurance Agent Can Help

The Midwest is no stranger to disasters like hurricanes and heavy rainfall, which can bring devastating flood damage to homeowners and renters. If you’re lacking the right coverage, you could end up paying out of your own pocket to repair the damage. That’s why having flood insurance is absolutely critical.

Fortunately an Illinois independent insurance agent can help you get equipped with the right flood insurance for you. They’ll also make sure you walk away with all the coverage necessary, long before you’d ever need to file a claim. But first, here’s a deep dive into flood insurance and what it’s all about.

What Does Flood Insurance Cover in Illinois?

Flood insurance is designed to protect your home from damage caused by natural flooding, which is not covered in standard homeowners insurance or renters insurance policies in Illinois.

Flood insurance in Illinois covers these disasters:

- Damage to or destruction of your personal property: Protects your furniture, non-built-in appliances, some food, valuables, and clothing against natural flood waters.

- Damage to or destruction of your home’s structure: Protects the structure of your home, AKA the dwelling, as well as indoor plumbing, built-in appliances, electrical systems, and installed flooring like carpeting against natural flood damage. Coverage for detached structures, like sheds, is often available, too.

Damage by flooding will only be covered if it stems from natural events, such as hurricanes, tsunamis, or heavy rainfall. Your flood insurance policy may factor in depreciation of your home’s value upon paying out a claim, but it depends on your specific coverage. An Illinois independent insurance agent can help you find the flood insurance policy that works best for you.

What Doesn’t Flood Insurance Cover in Illinois?

Insurance expert Paul Martin said that flood insurance exists to protect your home from natural flooding damage, as opposed to flooding events caused by backed up plumbing and the like. Additionally, several other perils are often not covered by flood insurance in Illinois.

Flood insurance in Illinois often excludes:

- Flooding caused by non-natural water events

- Natural flooding events that inundate less than two acres of land

- Mold, mildew, or other moisture damage

- Earthquake or mudslide damage

- Patios, fences, pools, septic systems, and plants

- Additional living expenses*

*Additional living expenses coverage is often provided by your homeowners insurance if you’re forced to live somewhere else, like a hotel, while repairs are made to your home after a flood. Your Illinois independent insurance agent can help shed light on other exclusions of flood insurance and address any concerns you may have.

Is Flood Insurance Required in Illinois?

Flood insurance might be required, depending on where you live. Residents in areas at high risk for flooding, or in certain flood zones, are often required to have coverage by their mortgage lenders. However, your flood zone doesn’t always dictate coverage requirements. You may still be required to carry a flood insurance policy in other, less historically risky areas.

Illinois Flood Stats

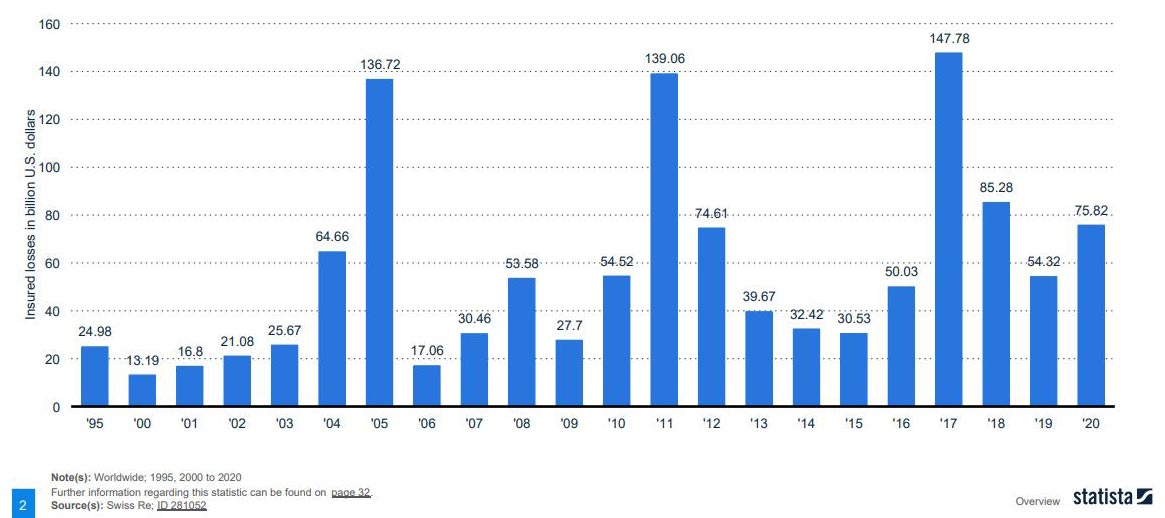

Knowing how common and costly floods are can help further put the importance of flood insurance into perspective. Check out some flood stats for Illinois as well as the US overall below.

Value of insured losses in the US from 2012 to 2020, by natural disaster type (in billion US dollars)

Flooding costs the US billions of dollars in damage almost every year. The two highest insured losses due to flooding over the last decade occurred in 2016 ($7.18 billion) and 2019 ($8.14 billion).

Number of Flood Insurance Claims Per Year

Illinois Residents File 1,765 Flood Insurance Claims Per Year

Kentucky – 1,245

Texas – 9,949

California - 404

Washington – 386

Illinois has the second-highest number of flood insurance claims per year, falling behind only Texas. The reported annual flood insurance claim count in Texas was a whopping 9,949, while Illinois had 1,765. The flood claim count for Illinois residents was over four times as much as California’s, at 404.

Since floods are such a frequent, expensive occurrence in Illinois, it’s crucial for residents to be equipped with the right coverage. Speak with your Illinois independent insurance agent ASAP about getting equipped with the right flood coverage to protect your property.

What’s Considered to Be a Flood?

Martin said that flood insurance companies will only recognize flooding that stems from a natural source, such as a storm. Natural flooding events can happen due to:

- Heavy rainfall

- Hurricanes

- Snow melt

- Monsoons

- Tsunamis

However, other causes of flooding outside of residents’ control may also be covered by flood insurance, including levee dam failure and blocked drainage systems. Also, to qualify for reimbursement through a flood insurance claim, water typically has to cover at least two acres of normally dry land.

How Much Does Flood Insurance Cost in Illinois?

The current annual cost of flood insurance in Illinois is $1,096, which is 49.3% above the national average of $700. Your specific area’s coverage will vary, though.

Your flood insurance policy’s cost may also be impacted by other factors, such as the value and age of your property. An Illinois independent insurance agent can help you find exact quotes for your area.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting homeowners and renters against flood damage losses, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in flood insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

graph - https://www.statista.com/statistics/612615/value-of-insured-losses-usa-by-natural-disaster-type/

https://www.iii.org/fact-statistic/facts-statistics-flood-insurance

https://www.irmi.com/term/insurance-definitions/flood-coverage

© 2024, Consumer Agent Portal, LLC. All rights reserved.