Quick Content Navigation

- What Does Homeowners Insurance Cover in Illinois?

- What Doesn't Homeowners Insurance Cover in Illinois?

- Does Homeowners Insurance Cover Chimney Fires in Illinois?

- What If You're Injured by a Home Fire in Illinois?

- Are My Household Belongings Covered against Chimney Fires?

- Are There Additional Policies That Can Provide More Coverage?

- How an Illinois Independent Insurance Agent Can Help You

What Does Homeowners Insurance Cover in Illinois?

It's key to know what is covered under your Illinois home policy. When you're not sure of your limits of protection, you could be surprised if it's not covered. Check out what's typically included under your home insurance:

- Dwelling limit: Pays for the replacement or repair of your home itself when a covered claim occurs.

- Personal property: Pays for the replacement or repair of your personal belongings.

- Personal liability: Pays for claims of bodily injury, property damage, or slander against a household member.

- Loss of use: Pays for your lost rental income when a claim shuts down your operation for a period of time.

- Medical payments: Pays for the first $1,000 to $10,000 of a medical expense when a third party gets injured on your property.

The primary perils that are covered under most home policies are below:

- Fire

- Wind

- Hail

- Lightning

- Severe storms

- Theft and vandalism

What Doesn't Homeowners Insurance Cover in Illinois?

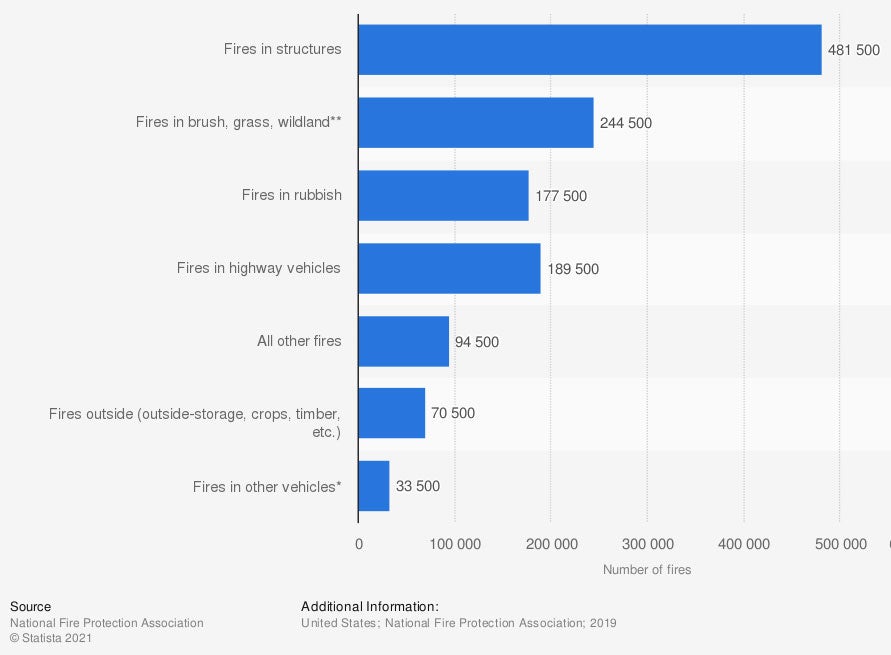

Every policy you obtain will have exclusions. Your Illinois homeowners insurance will have a lot of coverage, but still won't insure everything. That is why it's essential to have adequate limits of protection. Take a look at fire losses below:

Number of fires in the US by Type

Coverage for fires and other disasters that could strike your Illinois home is necessary. Fortunately, most homeowners policies come with this coverage.

Does Homeowners Insurance Cover Chimney Fires in Illinois?

Fires are typically covered under your homeowners policy. If you have a chimney in Illinois that catches on fire, you may have coverage. One gray area that's different for every carrier is what type of fireplace you have and if it is maintained.

There are several kinds of fireplaces. Carriers typically exclude wood burning stoves and handmade fireplaces. If you have a wood burning fireplace instead of an electric or gas one, companies will want to make sure that you are cleaning it regularly so there isn't a greater risk of a fire.

What If You're Injured by a Home Fire in Illinois?

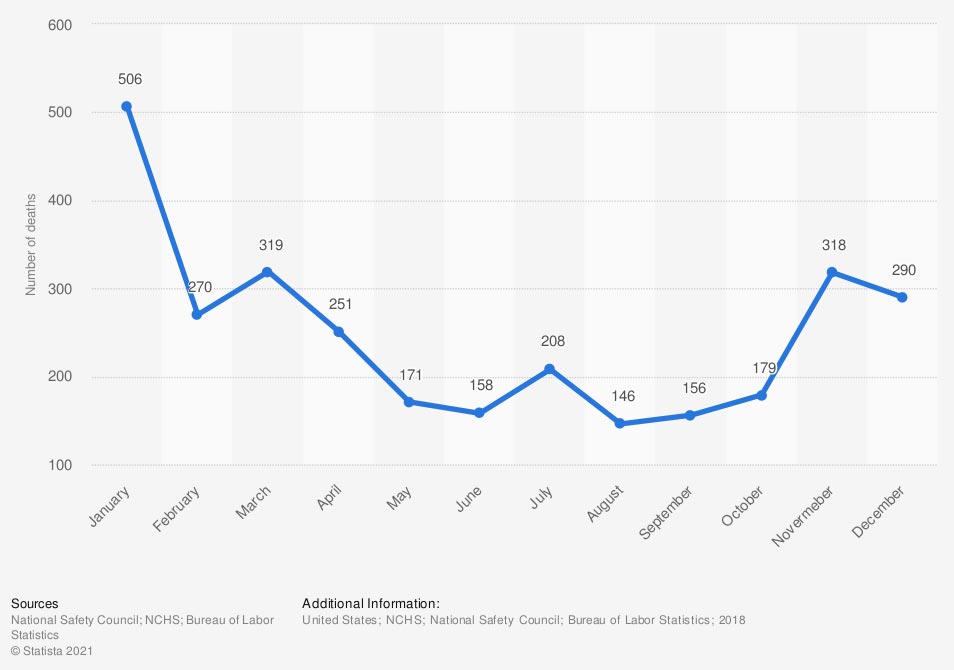

If you have a house fire in Illinois, there are many limits on your homeowners policy that could be accessed. Since fires are a covered peril on most homeowners policies, you would have help paying for medical expenses. Check out the numbers:

Number of fire-related deaths by month in the US

When you own a home, you'll want to make sure you're fully protected. If you're injured in a fire, seek medical treatment immediately and call your agent for further steps.

Are My Household Belongings Covered against Chimney Fires?

Every policy will have a personal property limit that protects your belongings from a loss. If a chimney fire occurs and does damage to items inside your home, then your personal property coverage will apply. This limit is a percentage of the dwelling amount listed on your policy. It can be adjusted so that you have enough insurance.

Another way to have coverage for your belongings is through a personal articles floater. This is often tied to your homeowners policy and provides repair or replacement up to the appraised value of higher-priced items. You have to schedule each piece of property individually on this policy, and a deductible usually isn't applied.

Are There Additional Policies That Can Provide More Coverage?

When it comes to insuring your primary home and all your belongings, you'll want to know what's out there. Your coverage can mean the difference between whether a claim is paid or not. Some losses exhaust your limits and can cause a financial burden for you and your family. Here are some additional coverage options in Illinois:

- Umbrella insurance: This provides an additional layer of liability coverage above and beyond your underlying home policy limits.

- Increased coverage: Making sure your home is properly insured by having sufficient limits on your primary policy is necessary. You can increase your liability and personal property limits to account for a total loss.

How an Illinois Independent Insurance Agent Can Help You

When you're shopping for Illinois homeowners insurance, it's important to know what your policy will and won't cover. Each coverage is unique and provides protection for different parts of a loss. It can be confusing to know what's necessary if you're not a licensed professional.

Fortunately, an Illinois independent insurance agent can help with policy and premium options. They do the comparing for you at no cost so that you can save immediately. Get connected with a local expert on TrustedChoice for custom quotes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/203771/number-of-fires-in-the-us-by-type/

Graphic #2: https://www.statista.com/statistics/863141/fire-flames-smoke-deaths-us-by-month/

http://www.city-data.com/city/Illinois.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.