Quick Content Navigation

- Why You Need Identity Theft Protection in Illinois

- What Does Identity Theft Protection Cover in Illinois?

- What Does Identity Theft Protection Not Cover in Illinois?

- Identity Theft Statistics

- Additional Coverage Options in Illinois

- How Much Does Identity Theft Coverage Cost in Illinois?

- How an Illinois Independent Insurance Agent Can Help You

Why You Need Identity Theft Protection in Illinois

Identity theft is a real concern for every person. In Illinois, your personal insurance policies will have an option for identity theft protection. This is an endorsement that can usually be added to every homeowners policy. The limits you'll have to choose from are dependent upon the carrier offerings.

When it comes to insuring your Illinois business, your insurance can help with protecting your livelihood. Typically identity theft protection for a company could fall under cyber liability and a separate identity theft endorsement. Every carrier is different and will have variations of this coverage.

What Does Identity Theft Protection Cover in Illinois?

Whenever you're purchasing insurance for your personal assets, it's key to know what your limits cover. Identity theft protection on your homeowners policy will usually insure the following.

- Reverse the fraud that has occurred

- Restoration of your credit score

- Get your identity back

If you're a business owner, coverage for identity theft is usually in the form of a type of cyber liability policy. If your business's identity is stolen and being impersonated it can wreak havoc on your operation and customers. Identity theft coverage for a business will typically cover the following.

- Pay to inform the public of the breach

- Restore your company's credit

- Get your identity back

- Pay for legal representation due to a related lawsuit

What Does Identity Theft Protection Not Cover in Illinois?

In Illinois, your identity theft coverage on your home policy will have exclusions. Like any other insurance you own, not everything is covered. Take a look at standard items not covered under your personal identity theft protection.

- Restoration of funds: If you had funds stolen due to identity theft, this endorsement won't replace that.

If you own a business that gets hacked and sensitive information has been stolen, your identity theft or cyber liability coverage should respond. Of course, there are some items it won't cover. Similar to your personal identity theft coverage, it won't replace any monies stolen.

Identity Theft Statistics

Identity theft is a real thing that should be addressed with your carriers for adequate protection. If you're without the right coverage, you could be out thousands of dollars and a whole lot of time. Check out the facts below

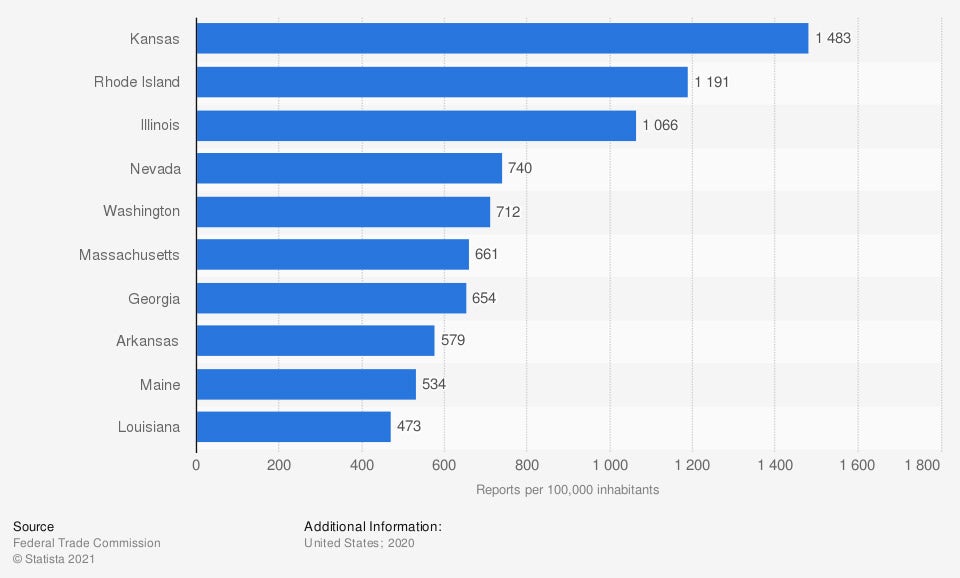

Rate of Identity Theft Reports in the US

Average Home Burglary Rates

- National average: 3.76

- Illinois average: 3.07

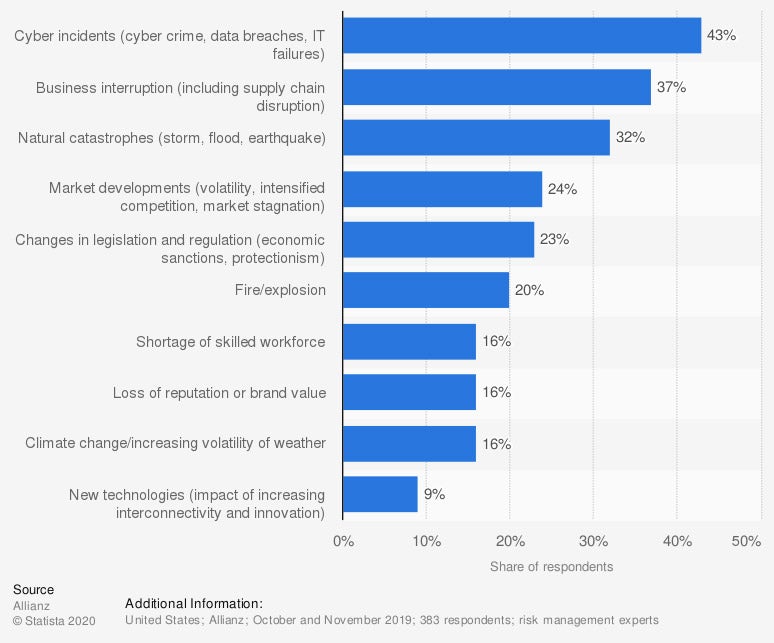

Leading Risks to Businesses in the US

Identity theft is a threat both personally and professionally. If you have a social security number, own a home or a business, you're at risk. The best way to stay protected is by being proactive with your insurance.

Additional Coverage Options in Illinois

If you want even more coverage than what your Illinois homeowners policy can offer for identity theft protection, there are some things you can do. You could obtain a separate identity theft policy at higher limits so that you have enough coverage. One thing about your home policy is it usually will have a basic coverage amount of $15,000 - $25,000 in identity theft limits.

When it comes to your business, you'll want to add a separate cyber liability policy for full protection. Your general liability or business owners policy may include some cybercrime coverage, but it's usually not enough.

How Much Does Identity Theft Coverage Cost in Illinois?

Every personal and commercial policy premium will vary. Carriers look at numerous rating factors when it comes to insuring your home or business. Take a look at some of the items that they account for when calculating costs.

Personal Insurance Rating Factors

- Past losses

- Limits of coverage

- Insurance score

- Precautions taken

Business Insurance Rating Factors

- Past Losses

- Limits of coverage

- Precautions taken

- Experience

- Type of business

How an Illinois Independent Insurance Agent Can Help You

When you're searching for Illinois business insurance or homeowners coverage, you'll want to be sure you are fully protected. There are many policy options when it comes to your personal or commercial insurance. Identity theft protection is essential in this day and age for adequate coverage.

Fortunately, an Illinois independent insurance agent can help you find a policy that's affordable and sufficient. Since they work with several carriers at once, you'll save time and money. Get connected with a local expert on TrustedChoice.com in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/302370/rate-of-identity-theft-reports-in-the-us/

Graphic #2: https://www.statista.com/statistics/422203/leading-business-risks-usa/

http://www.city-data.com/city/Illinois.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.