Insurance Content Navigation

- What Is Cyber Liability Insurance?

- What Does Cyber Liability Insurance Cover for Illinois Businesses?

- What Doesn't Cyber Liability Cover for Illinois Businesses?

- Who Needs Cyber Liability Insurance in Illinois?

- Why Do I Need Cyber Liability Insurance in Illinois?

- What Is the Difference Between Cyber Liability and Data Breach Insurance?

- How an Illinois Independent Insurance Agent Can Help You

Technology makes doing business easier but also increases the risk of being hacked. Cybercrimes are all too frequent in the business world. The last thing you want to do is get caught with compromised customer and employee data without proper protection. That's why cyber liability insurance exists, and no, we're not just talking about your business insurance policy.

Cyber liability insurance is a stand-alone policy that most businesses need. Working with an Illinois independent insurance agent can insure that you get the coverage you need to protect all the sensitive information in your hands. Here's how your business in Illinois can benefit from cyber liability insurance.

What Is Cyber Liability Insurance?

Cyber liability insurance is a type of business insurance that covers financial losses that a company may experience from a data breach or cybercrime.

If your business experiences a data breach, you expose your customers' personal information to the public. In the United States, data breaches cost companies an average of $8.19 million a year, so it's important to make sure your company is protected against potential lawsuits that could arise after a breach. Cyber liability insurance does just that and helps pay for the business's liability for the breach.

What Does Cyber Liability Insurance Cover for Illinois Businesses?

Most policies will include first-party and third-party coverages. First-party coverage refers to any expenses the company directly experiences as a result of the data breach. Third-party refers to the damages or legal repercussions that businesses potentially face through lawsuits that arise from the event. Through each of these, a typical cyber liability insurance policy will cover:

- The cost to replace or restore data

- Loss of income related to the breach

- Additional expenses that the business incurs from having to shut down operations for a period of time

- Extortion fees if a company ends up paying a hacker a ransom to restore the data

- Repairing damaged computer systems

- Basic legal fees and expenses

Most of the above are first-party-related coverages. If a hacker steals customers' personal information, a cyber liability policy will also cover:

- Expenses related to identifying customers of the breach

- Credit monitoring for those whose information was compromised

- Any civil damages

- Costs to hire a computer forensics team to investigate what happened

- Costs associated with any reputational damage

- Privacy liability if your company was storing sensitive customer or employee data

In order for cyber liability insurance to pay these costs, the incident must be a covered peril. Covered perils include any type of network security, including data breaches, malware, ransomware attacks, email compromises, and liability claims.

What Doesn't Cyber Liability Insurance Cover for Illinois Businesses?

Since cyber liability insurance is not part of a standard business policy, it's designed specifically for network security perils and any associated costs that could result. There are several exclusions to be aware of:

- Intentional data breaches or dishonest network usage

- Future lost profits that may result from a data breach

- Theft or vandalism of equipment

- Improving breached technology to be more functional than before the breach

- Network and utility failures

- Lost data as a result of war or terrorism

Your Illinois independent insurance agent can help you understand what might be excluded from your policy and discuss possible add-ons or riders if you need a more comprehensive cybersecurity policy.

Who Needs Cyber Liability Insurance in Illinois?

Illinois is home to more than 1.2 million small businesses. It's safe to say that nearly every business has a reason to need cyber liability insurance. Breaking down who needs cyber liability insurance is simple, according to insurance expert Paul Martin, who says, "If your business stores any personal information about its customers or employees, you need cyber liability insurance."

Ultimately, if you run your business using any type of computer system, then it's worth speaking to your Illinois independent agent about it. If you are an online business, you need cyber liability insurance even more, because you're most likely storing additional sensitive information about customers. Sensitive information includes any type of identifying information about a person, including name, date of birth, email address, Social Security number, physical address, credit card number, or bank account number.

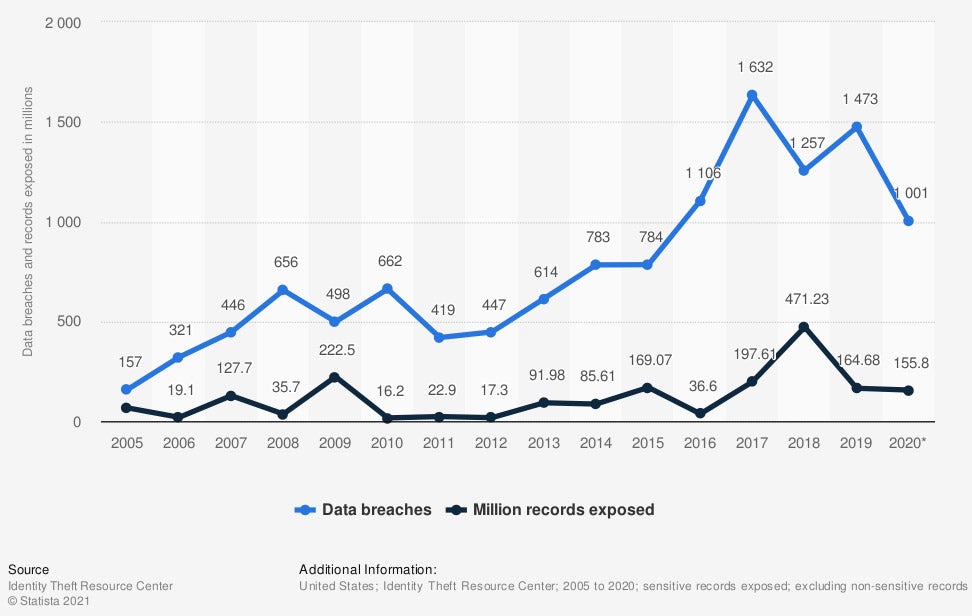

Annual number of data breaches and exposed records in the United States from 2005 to 2020 (in millions)

In 2020, there were 1001 data breaches in the United States

Why Do I Need Cyber Liability Insurance in Illinois?

In 2020 there were 1,108 data breaches that impacted 300 million people. Hackers can break into your network system at any time and leave all of your customers exposed. In particular, high-profile data breaches are becoming more common which puts smaller businesses and their customer's information at risk.

For example, In 2021 Microsoft experienced a data breach that impacted 280 million customers and 30,000 organizations in the US. In 2019, Capital One Financial Corp. experienced a breach that exposed 100 million records. Cyber liability insurance is necessary because even if your business isn't directly breached, the software you use to store your customers' data can be breached. Once you experience a hacker, you're in for a pricey battle if you don't have insurance coverage. According to IBM, a data breach costs a company an average of $150 per record.

What Is the Difference between Cyber Liability and Data Breach Insurance?

Even though the terms cyber liability and data breach insurance are often used interchangeably, there is actually a difference between them. As we've been discussing, cyber liability is a stand-alone policy that is purchased separately from your business policy. It includes first-party and third-party coverage against cyberattacks and is fairly all-encompassing.

Data breach insurance differs in that it only offers first-party coverages. This means that it only pays for financial losses incurred due to a data breach, hack, or theft of sensitive documents or information. According to Martin, if your business has errors & omissions insurance, a common business insurance policy, it's likely that it includes data breach insurance. Your Illinois independent agent can review your current business policy and let you know what type of coverage you currently have.

How an Illinois Independent Insurance Agent Can Help You

Companies are at risk of having their employee and customer personal information compromised every day. As society becomes increasingly digital, the risks are greater. The insurance industry is growing and adjusting its policies as technology changes. An Illinois independent insurance agent stays up to date with the latest offerings for cybersecurity.

They can review your current business insurance and let you know how much data breach insurance is included and recommend additional coverage. If you do need a separate cyber liability insurance policy, they'll shop multiple carriers to find you the most affordable option available.

Article Author | Sara East

Article Reviewed by | Paul Martin

https://www.iii.org/fact-statistic/facts-statistics-identity-theft-and-cybercrime

ibm.com

statista.com

© 2024, Consumer Agent Portal, LLC. All rights reserved.