Insurance Content Navigation

- Does Car Insurance Cover Flooding in Illinois?

- What Does Car Insurance Cover in Illinois?

- What Isn’t Covered by Car Insurance in Illinois?

- Flood Stats for Illinois

- Does Car Insurance in Illinois Cover Other Disasters?

- Is Flood Insurance Mandatory in Illinois?

- Here’s How an Illinois Independent Insurance Agent Can Help

As a responsible driver and proud car owner, you want to keep your vehicle protected from many threats, including Mother Nature herself. But you may be unsure of whether your car insurance policy covers flooding and its resulting damage. The good news is, there is a type of car insurance in Illinois that can protect you in the event of natural flooding.

Even better, an Illinois independent insurance agent can help you get equipped with the right kind of car insurance for you. They’ll shop multiple policies to make sure you get set up with all the coverage you need, long before you ever have to file a claim. But first, here’s a closer look at car insurance and when and how it covers flooding.

Does Car Insurance Cover Flooding in Illinois?

Yes, as long as you purchase the right type of coverage, car insurance does cover flooding in Illinois. The trick is, you need to make sure you’ve purchased comprehensive, aka “other than collision,” coverage for your vehicle in order to be protected. Comprehensive car insurance protects against many threats beyond collision, including flooding and damage from other types of natural disasters. More on this next.

What Does Car Insurance Cover in Illinois?

There are several types of car insurance out there, so what your policy covers will depend on the specifics of what you purchased. That being said, Illinois’s minimum state requirements for coverage include property damage liability, bodily injury liability, and uninsured motorist coverage.

Many car insurance policies in Illinois include the following:

- Collision insurance: Protects your vehicle from damage caused in collisions.

- Comprehensive insurance: Protects your vehicle against many other threats, such as theft.

- Liability insurance: Protects you against lawsuits for bodily injury and property damage claims made by third parties.

- Uninsured motorist coverage: Protects you if you get into an accident with a driver who does not carry any/enough car insurance of their own.

To ensure you get all the coverage you need to protect yourself and your ride while on and off the road, work with an Illinois independent insurance agent. They’ll help you find the right coverage for your needs.

What Isn’t Covered by Car Insurance in Illinois?

Car insurance in Illinois provides many important coverages for drivers, but all policies come with their own exclusions. According to insurance expert Paul Martin, common exclusions under standard car insurance policies are as follows:

- Business use of the vehicle: For any type of commercial or business use of your vehicle, you’ll need to purchase commercial auto insurance to be covered from numerous threats. Personal auto insurance never covers business use of your car.

- Routine maintenance costs: General wear and tear of your car and routine maintenance costs are not covered by car insurance.

- Injuries to you and your passengers: Unless you purchase medical payments coverage, your car insurance policy may not provide coverage for any injuries to you or your passengers in the event of an accident.

An Illinois independent insurance agent can help address any concerns you may have about coverage gaps in your car insurance policy, and help you find additional policies you may need.

Flood Stats for Illinois

You may not be convinced that flood coverage is important to have under your car insurance, or even that a separate flood insurance policy could be necessary in your area. Check out some flooding stats for Illinois below, and you just might reconsider.

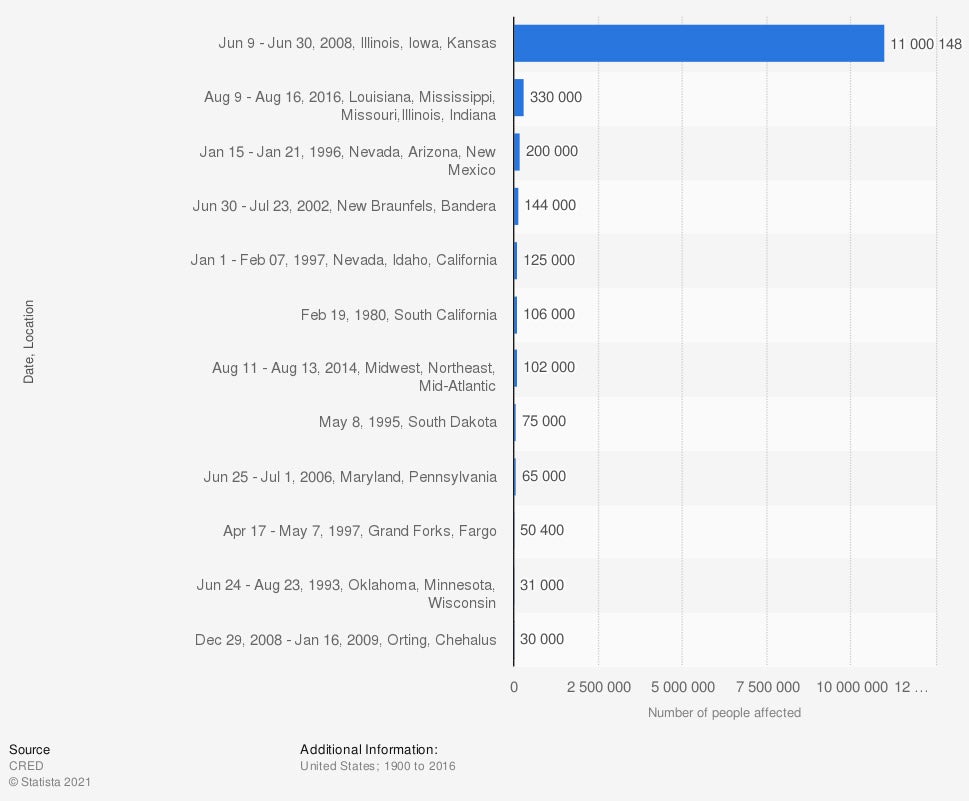

Major floods in the United States from 1900 to 2016, by total number of people affected

During the observed period of more than a century, Illinois was struck by the flooding event that affected the most people by far, in 2008. As a result of that flood, which occurred from June 9, 2008 through June 30, 2008, a reported 11,000,148 total people were affected. The second-most impactful flooding event also impacted Illinois, in August 2016, with a total of 330,000 people affected.

Flood Insurance Stats

Clearly, flooding is a major concern for residents in Illinois. For this reason, it’s important to not only review your car insurance to make sure it covers flooding, but also consider adding a separate flood insurance policy on top of your homeowners insurance. An Illinois independent insurance agent can help you make sure you’re covered in all areas against flooding.

Does Car Insurance in Illinois Cover Other Disasters?

If you purchase comprehensive car insurance in Illinois, then yes, it covers other disasters beyond flooding. Martin provides us with a few additional examples of what comprehensive car insurance covers:

- Windshield damage

- Explosions and missiles

- Falling objects

- Fire, high winds, and hail

- Riot and vandalism

- Collisions with large animals*

*Martin adds that collisions with large animals like deer are not covered under collision car insurance, so you’d need comprehensive coverage to pay for any damages after such an incident. Talk to your Illinois independent insurance agent about the importance of adding comprehensive coverage to your car insurance policy.

Is Flood Insurance Mandatory in Illinois?

Martin says that flood insurance very well could be required, depending on where you live, specifically. Homeowners in high-risk flood zones are usually required to have flood insurance policies by their mortgage lenders. That said, other property owners are still required to have flood coverage no matter where they live. While flood insurance is not a federal requirement nationwide, it’s always better to be prepared in case of a costly, devastating disaster.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting Illinois drivers and homeowners alike against devastating flood damage and all other perils, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in auto and homeowners insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/237575/major-floods-in-the-us-by-number-of-affected-people/

iii.org

irmi.com

© 2024, Consumer Agent Portal, LLC. All rights reserved.