Quick Content Navigation

- What Is Crop Insurance?

- Is Crop Insurance Tax-Deductible in Illinois?

- How to Apply for a Tax Deduction in Illinois

- How to Qualify for a Tax Deduction in Illinois

- How Much Tax Reduction Can I Qualify for in Illinois?

- Tax Deduction for Multiple Crops in Illinois

- How an Illinois Independent Insurance Agent Can Help You

What Is Crop Insurance?

When you insure your Illinois farm, you should be adding protection for your crops as well. Your crop insurance is usually a separate policy known as multiple peril crop insurance or crop-hail insurance. There can be various forms of coverage as well to protect your crops from different types of damage. These policies will help reimburse you for revenue that is lost due to various kinds of crop losses.

Is Crop Insurance Tax-Deductible in Illinois?

Your Illinois farm insurance premiums can be expensive depending on all that you're insuring. Fortunately, most insurance expenses can be deductible and are used to lower your tax costs. If you happen to have a loss on your crops and receive payment from your carrier, then this can be counted as income.

In some cases, you may be able to defer your insurance income for that year. The premiums themselves can be deducted, typically to help offset any gross income. Speak with a licensed professional about your farm's specifications and steps for filing a claim.

How to Apply for a Tax Deduction in Illinois

When you're trying to get deductions on your taxes, you'll need to keep track of all your annual expenses. If you are deducting items that you cannot prove, then you could get into trouble with the IRS if you're ever audited. To minimize risk, obtain proper documentation of all your crop and farm receipts, mileage, feed, and anything else that can be used as a write-off. By filing your taxes with your accountant, you can go over which deductions apply for your Illinois farm.

How to Qualify for a Tax Deduction in Illinois

All businesses are qualified for a tax deduction on specific items they use to run their operation. The more you use for business purposes, the more of a deduction you can take in most cases. Check out some common farm deductions that may potentially be accounted for in Illinois:

- Motorized vehicles use to run your business

- Mileage driven for business purposes

- Receipts of business items purchased

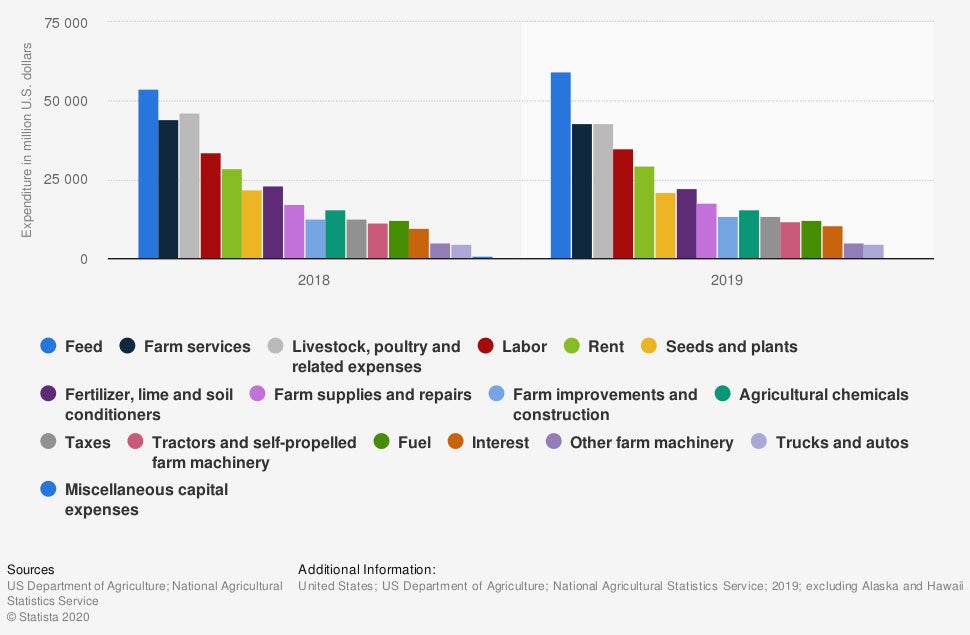

Total farm production expenditure by type in the US

(in million US dollars)

You may share in some of these expenditures when running your farm. Many of these, if not all, can be written off as a business expense.

How Much Tax Reduction Can I Qualify for in Illinois?

The amount of reductions you can expect is completely dependent on your farm's operations. The number of write-offs you have to run your business will determine how much of a reduction gets applied. Consulting with a trusted adviser can help get the exact costs and benefits of tax deductions for your farm.

Tax Deduction for Multiple Crops in Illinois

If you have multiple crops in Illinois, then there's a chance that they are tax-deductible. Like any business, the product you produce and the things it takes for you to produce it can be write-offs. Typically, anything that you use to run and operate your farm for income can be tax-deductible. If your insurance pays out a claim for a crop loss, then you may be able to deduct that as well.

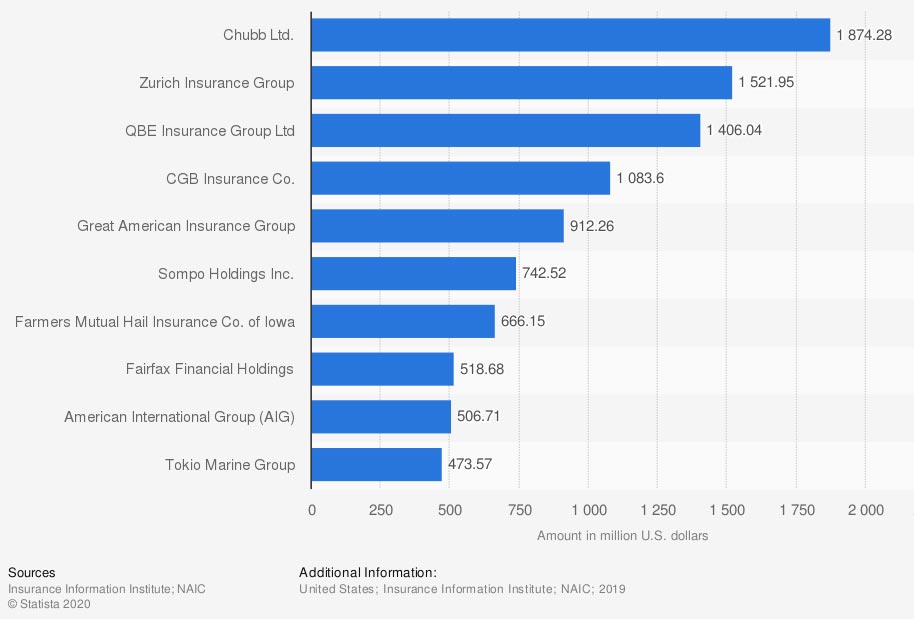

Direct premiums written by the largest MCPI companies in the US

(in million US dollars)

As always, speaking with a trained professional is recommended. You'll want to consult with your independent insurance agent as well as your accountant for more tax-deductible options.

How an Illinois Independent Insurance Agent Can Help You

Your Illinois farm insurance needs to have adequate protection for all life throws at it. If you produce and sell crops, your livelihood may be on the line. Crop insurance income can be tax-deductible and should be reviewed by a licensed professional.

Fortunately, an Illinois independent insurance agent can help with coverage and premium options that won't break the bank. They can refer you to their network of trusted business advisers so that you have all your bases covered. Connect with a local expert on TrustedChoice to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/246508/total-farm-production-expenditure-in-the-us-by-type/

Graphic #2: https://www.statista.com/statistics/689397/largest-mpci-companies-usa-by-direct-premiums/

https://www.irs.gov/publications/p225

© 2024, Consumer Agent Portal, LLC. All rights reserved.