Quick Content Navigation

- What Is Crop-Hail Insurance in Illinois?

- What Does Crop-Hail Insurance Cover in Illinois?

- What Doesn't Crop-Hail Insurance Cover in Illinois?

- Hail Stats in Illinois

- Is Crop-Hail Insurance Required in Illinois?

- Does Crop-Hail Insurance Cover Wind Damage?

- Here’s How an Illinois Independent Insurance Agent Can Help

Owners of successful farms know that some of their business’s most vulnerable points are their crops. As a responsible farm owner, you want to ensure that your crops are protected against all risks, including fierce elements of nature. But a regular Illinois farm insurance policy may not be sufficient to guard your crops against certain disasters like hail.

Fortunately, an Illinois independent insurance agent can get your farm equipped with the right crop-hail insurance policy for the job. They’ll take all your farm’s unique aspects into account when selecting your coverage, and make sure you walk away with the right policy for you. But before we jump too far ahead, here’s a closer look at crop-hail insurance.

What Is Crop-Hail Insurance in Illinois?

Crop-hail insurance in Illinois is a special form of coverage for farms. This coverage protects crops against damage caused by hail, which can be extremely costly otherwise. Crop-hail policies often also include coverage for fire damage. These policies are usually bought as supplementary coverage to add to an underlying farm insurance policy. For farms that are especially vulnerable to hail damage, crop-hail coverage can seriously help to protect their crops, profits, and labor.

What Does Crop-Hail Insurance Cover in Illinois?

Crop-hail insurance exists mainly to protect crops from natural disasters. Hail coverage is always included, but many policies also provide coverage for fire damage. According to insurance expert Jeffery Green, crop-hail policies can be expanded to include coverage for the following perils:

- Lightning

- Wind

- Vandalism

- Malicious mischief

- Theft

- Frost

Crop-hail policies are commonly sold by the acre, so farm owners can purchase coverage only for the high-risk areas of their property. Coverage cannot be transferred to another area of the farm at a later date, though, but additional protection can be purchased anytime during the growing season. An Illinois independent insurance agent can help ensure your farm gets set up with the right protections under crop-hail insurance and beyond.

What Doesn't Crop-Hail Insurance Cover in Illinois?

Crop-hail insurance in Illinois does cover disasters, but it also comes with a set of certain exclusions, as well. Exclusions may vary by policy, but according to Green, the following perils are typically not covered by crop-hail insurance:

- Frost

- Drought

- Disease outbreaks

- Floods

- Changes in crop values

An Illinois independent insurance agent can help you review your policy’s coverage exclusions and fill in any gaps.

Hail Stats in Illinois

To further understand the importance of coverage like crop-hail insurance for your farm, it helps to know how common hailstorms actually are. Check out these stats for crop-hail related damage in the US in recent years.

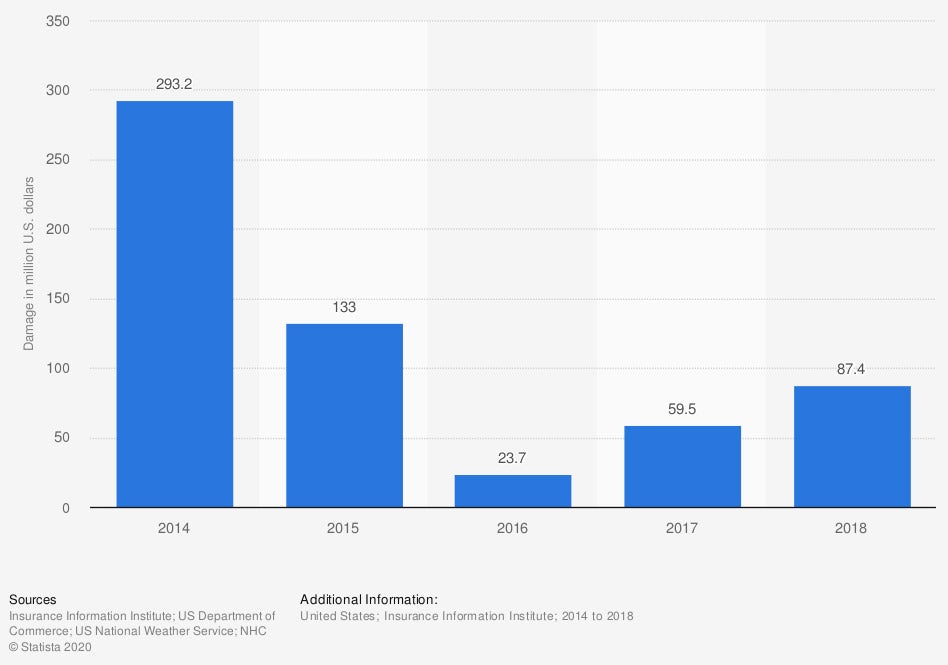

Crop damage from hail in the United States from 2014 to 2018 (in million US dollars)

In the observed period, crop-hail damage had fallen quite a bit from 2014, when $293.2 million in losses were reported. However, as of 2018, crop damage from hail still amounted to $87.4 million.

Crop damage caused by hail costs farmers across the US millions of dollars each year. To avoid a devastating loss for your farm, talk with an Illinois independent insurance agent about crop-hail insurance.

Is Crop-Hail Insurance Required in Illinois?

No, crop-hail insurance is not legally required in Illinois, but it can still be a good idea to get coverage for your farm. Crop-hail insurance acts as sort of an extra security blanket over your farm to protect it from disaster. Without crop-hail coverage, following a particularly harsh hail event, your business could suffer from a huge financial loss. It could be devastating to have to pay for the loss out of pocket. That said, certain states need coverage more than others.

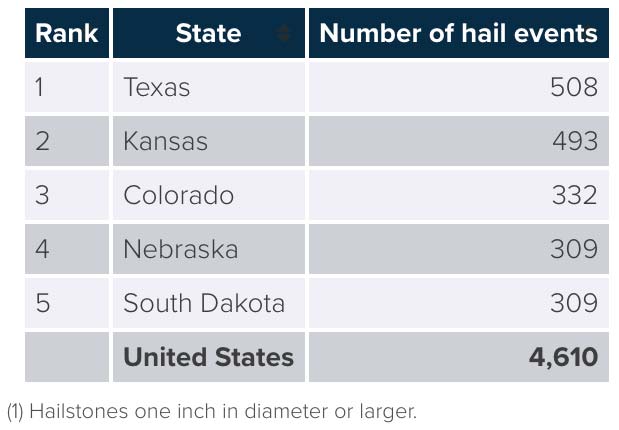

Top Five States By Number of Major Hail Events, 2019

In 2019, the five states with the highest reported number of major hail events were Texas, Kansas, Colorado, Nebraska, and South Dakota. Major hail events are classified as storms producing hailstones at least one inch in diameter. Crop-hail coverage is even more critical for farmers located in these areas.

An Illinois independent insurance agent can further explain the importance of crop-hail coverage in your area, even if it isn’t mandatory.

Does Crop-Hail Insurance Cover Wind Damage?

Green says that crop-hail policies don’t include coverage for wind damage and windstorms by default, but coverage can be expanded to protect against these perils, among others. Farm owners should consider working with their Illinois independent insurance agent to expand coverage provided by a crop-hail policy to protect against additional concerns. When it comes to your crops, it’s better to be safe than sorry, and purchase extra coverage ahead of time.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting farms against losses from crop-hail damage and all other incidents, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in crop-hail insurance and farm insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Jeffery Green

Statista

irmi.com

iii.org

© 2024, Consumer Agent Portal, LLC. All rights reserved.