Quick Content Navigation

- What Does Crop Insurance Cover in Illinois?

- What Doesn't Crop Insurance Cover in Illinois?

- What Is Multi-Peril Crop Insurance?

- How Does Revenue Crop Insurance Work in Illinois?

- What Is Rain and Hail Crop Insurance?

- How Valuable Are Crops in the US?

- How Much Is Crop Insurance in Illinois?

- Here’s How an Illinois Independent Insurance Agent Can Help

As a hardworking farm owner, you have many aspects of your property to oversee. One of the biggest aspects in need of protection on your farm is your crops. Crops need coverage against numerous threats, from human hazards to storms. Fortunately, crop insurance exists to provide your crops with much-needed protection against these perils and more.

Even better, an Illinois independent insurance agent can help you find the right kind of crop insurance for your unique farm. They’ll be able to get you equipped with all the coverage you need to guard against risks that apply to your specific property. But before we jump too far ahead, here’s a closer look at this important coverage.

What Does Crop Insurance Cover in Illinois?

What your Illinois crop insurance policy covers will depend highly on the specific type of coverage you buy. The best way to ensure you get set up with the coverage you need is to work with an Illinois independent insurance agent. Together, both of you will consider the biggest threats, such as natural disaster damage, to your specific crops, and from there you will decide which type of policy is right for your needs.

What Doesn't Crop Insurance Cover in Illinois?

Again, what your specific crop insurance policy excludes will depend on which type of policy you selected. All forms of crop insurance come with some coverage exclusions. Some of the most common exclusions are:

- Excess moisture

- Drought

- Flood damage

- Changes in crop values

To get the most coverage for your crops, you should consider getting a multi-peril crop insurance policy.

What Is Multi-Peril Crop Insurance?

The Federal Crop Insurance Program sells multiple peril crop insurance. This coverage protects against numerous threats to crops, including:

- Drought

- Fire damage

- Flood damage

- Insect damage

- Disease outbreaks

- Hail damage

- High wind damage

- Frost damage

Multi-peril crop coverage needs to be purchased before crops are planted in order to be effective, and must be renewed each subsequent growing season after activation. This coverage is by far the most common policy selected by farmers across the country because of all the protections included. An Illinois independent insurance agent can help you decide if this is the right choice for you.

How Does Revenue Crop Insurance Work in Illinois?

According to insurance expert Jeffery Green, revenue crop insurance protects farmers who sell their crops before harvest. If the crop is lost due to storm damage, etc., the farmer is still responsible for fulfilling the contract. On the flipside, if the price of the crop has risen, basic Illinois farm insurance or crop insurance won’t cover the difference in profits. Revenue crop insurance protects the crop for the greater of the contract price or the harvest price.

What Is Rain and Hail Crop Insurance?

Known as Illinois crop-hail insurance, this coverage protects against various natural disasters, but is much more limited than multi-peril crop insurance. Hail damage and fire damage are most commonly covered by crop-hail policies, but coverage can be expanded to include protection against:

- Lightning

- Frost

- Theft

- Wind

- Vandalism

- Malicious mischief

An Illinois independent insurance agent will be able to help you choose which type of crop insurance makes the most sense for your unique farm.

How Valuable Are Crops in the US?

When considering crop insurance coverage, it’s helpful to see just how valuable crops are in not only Illinois but the US overall. Check out a couple of stats below and see for yourself.

Highest value of crop insurance premiums in the United States

(in thousand US dollars)

In 2017, Illinois had the third-highest value of crop insurance premiums in the country, at a total of $697.2 million. Only North Dakota ($929.7 million) and Texas ($970.5 million) ranked higher.

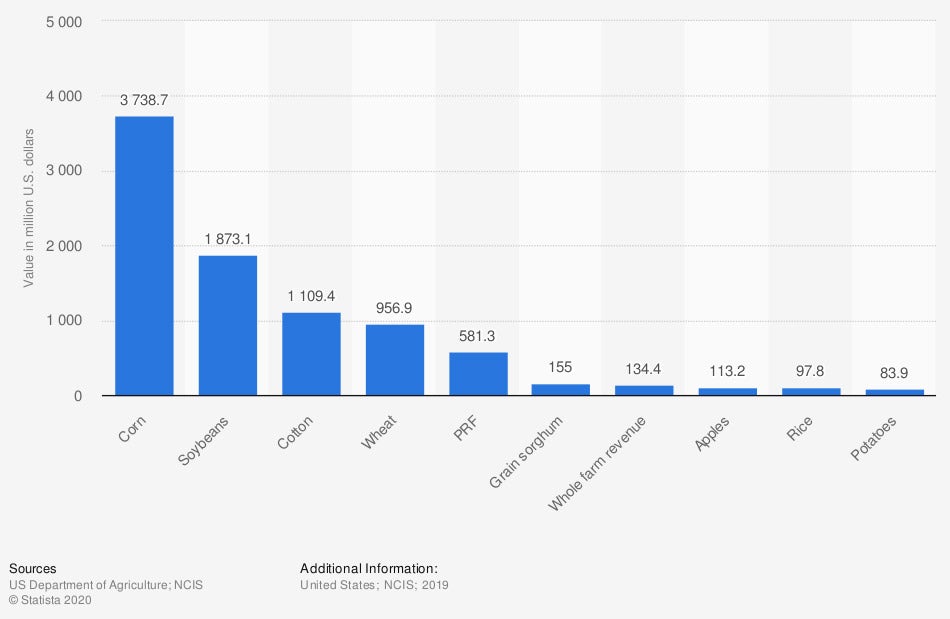

Value of crop insurance premiums in the United States in 2019, by crop

(in million US dollars)

Corn is the most valuable crop in the US, and in turn, is the most heavily insured. In 2019, premiums for crop insurance on corn alone amounted to $3.74 billion. Soybean crops were second-highest, at $1.87 billion, and cotton crops were third-highest, at $1.1 billion.

Keep the value of various crops in mind when you consider the needs of your specific farm, and talk to your Illinois independent insurance agent about finding coverage that best protects your annual revenue and costs.

How Much Is Crop Insurance in Illinois?

Well, the cost of your Illinois crop insurance policy will be determined by many different factors, including:

- The type of crops insured

- The value of the crops insured

- The total amount of acres insured

- Additional coverages purchased

- Your farm’s exact location

If your farm is located in a major city like Chicago, you might pay more for your coverage based on the increased risk of various crimes. Your Illinois independent insurance agent can help you find exact quotes for the different types of crop insurance available in your area.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting farmers and their crops against hazards like fire, hail, vandalism, and all other disasters, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in every type of crop insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Jeffery Green

chart 1 - https://www.statista.com/statistics/649244/total-value-of-crop-insurance-premiums-usa-by-state/

chart 2 - https://www.statista.com/statistics/723049/value-of-crop-insurance-premiums-usa-by-crop/

iii.org

irmi.com

© 2024, Consumer Agent Portal, LLC. All rights reserved.