Boat owners are not required to have boat insurance in Illinois, but you should approach protecting your boat as you would your vehicle.

An Illinois independent insurance agent can help you find the proper coverage for your boat, whether it's on the water or being stored on land.

Illinois is home to more than 216,000 recreational boating vessels.

What Is Boat Insurance?

Boat insurance is a type of insurance coverage for watercraft that helps pay for damage that results from a variety of events.

Whether your boat is in an accident with another boater, damaged in a fire, or experiences vandalism, a boat insurance policy helps pay for things like repairs, liability claims, property damage, and other risks.

Boat insurance is typically offered for agreed value or actual cash value.

- Agreed value insurance: Provides coverage based on the value of the boat when the policy is written.

- Actual cash value: Provides coverage based on the actual cash value of the boat at the time of the loss.

With agreed value insurance, depreciation is not factored in. Actual cash value policies will factor in depreciation.

Do You Have to Have Insurance on a Boat in Illinois?

Illinois does not require boat owners to have insurance, but it is valuable coverage to have. A boat is another form of transportation, and the risks of an accident or your boat getting damaged by the weather or other elements out of your control are always present.

In addition, some lenders may require boat insurance, according to insurance expert Jeffrey Green.

Why boat insurance is important in Illinois:

- 81 boating accidents were reported in the last year

- 36 boating injuries occurred

- 21 fatalities were reported

- Most accidents involve boat operators between the ages of 20 and 40

In Illinois, boaters are only required to report a boating accident if it results in a loss of life, injury to a person that requires more than first aid, or if property damage is more than $2,000.

There are a variety of other risks your boat faces, which is why it's important to work with an Illinois independent insurance agent to find the best coverage.

What Does Illinois Boat Insurance Cover?

Boat accidents can occur on the water, but also while transporting your boat or when it's being stored during the off-season.

"Boat insurance covers property for collision, comprehensive, theft, vandalism, liability for property damage and injuries to others, medical payments to others, and uninsured boaters," explained Green.

These coverages will pay for common scenarios such as:

- Collisions with other boaters or objects

- Medical bills for you and passengers

- Physical damage from severe weather

- Theft or vandalism

- Towing

When discussing coverage options with your Illinois independent insurance agent, they can help you determine the amount of coverage you need based on your boating habits.

What Doesn't Illinois Boat Insurance Cover?

Similar to Illinois auto insurance and home insurance, boat insurance comes with exclusions.

According to Green, the most common events that will not be covered by boat insurance include:

- General wear and tear

- Damage from animals

- Mold

- Damage from sea life

- Improper maintenance

Green added that damage resulting from operators not named in your policy may also not be covered.

Can I Insure a Boat I Don't Own?

The boat rental market is expected to exceed $19.7 billion by 2030. Boating has become a popular pastime, but not everyone is in the market to buy. If you're renting a boat you may still want to have protection in the event of an accident.

Similar to renting a car, your boat rental agreement will list what damage you would be responsible for in an accident.

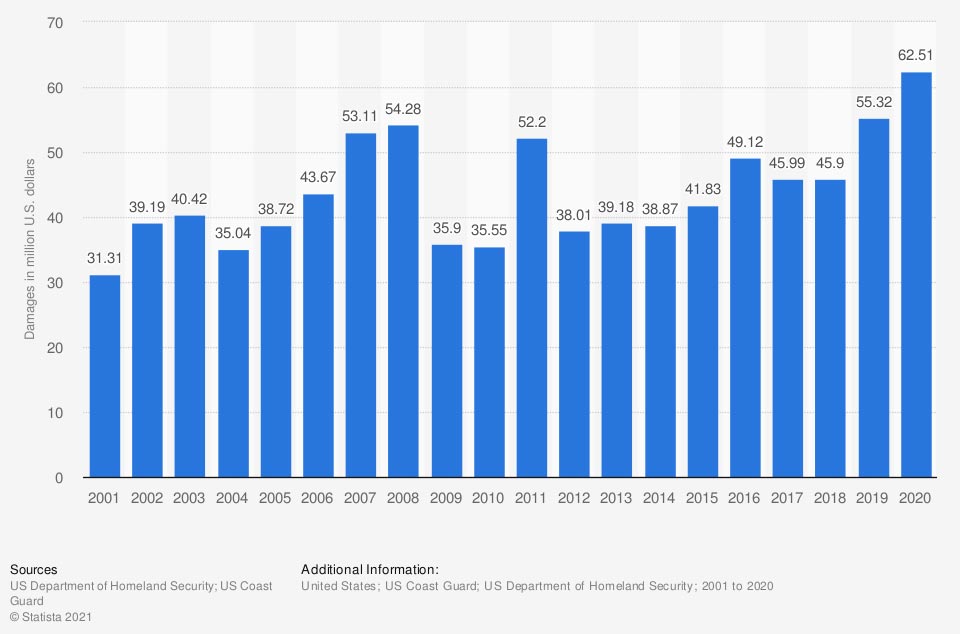

Most companies offer protection to be purchased along with the boat rental, but you can also check with your insurance company to see if your homeowners insurance extends to watercraft. Boating accidents cause millions of dollars in damage every year.

Total damage caused by recreational boating accidents in the US

Does My Illinois Homeowners Insurance Cover a Boat?

Your Illinois homeowners policy may offer an extension for watercraft that would provide protection for your boat. Usually, there is a limit of 100 horsepower vessels for a homeowners policy to cover a boat.

If you plan on operating a boat that has less than 100 horsepower, your Illinois independent insurance agent can look into adjusting your homeowners policy.

While a homeowners policy may provide some protection, most owners benefit from a separate policy. Always check with your agent to compare policies before determining what will provide the best coverage.

How an Illinois Independent Insurance Agent Can Help You

Boats vary in size, usage, and cost. A variety of factors need to be considered when insuring a boat, and an Illinois independent insurance agent understands where to start with getting the best coverage.

An agent will talk with you, free of charge, to learn about your boat and how you plan on using it. They shop multiple carriers and can make recommendations based on your needs. Get started with an independent insurance agent today.

Author | Sara East

Article Reviewed by | Jeffery Green

https://www2.illinois.gov/dnr/safety/Documents/BoatingAccidentReport2020.pdf

https://www.transparencymarketresearch.com/boat-rental-market.html

https://www.statista.com/statistics/1155988/us-recreational-boating-vessels/

https://www2.illinois.gov/dnr/boating/Pages/BoatingOpportunities.aspx

© 2025, Consumer Agent Portal, LLC. All rights reserved.