Illinois pharmacies and prescription drug stores are at risk of providing the wrong medication to a patient or having their inventory ruined in a storm. The only way to protect your pharmacy is through the proper insurance.

The nature of the pharmaceutical industry means that pharmacists have unique insurance needs. An Illinois independent insurance agent can help you find the coverage you need to protect your store, your inventory, and your clients.

What Is Pharmacy Insurance?

Pharmacy insurance is a type of Illinois business insurance that is designed for companies that sell prescription medications, supplements, and medical equipment.

Like any business, pharmacies are at risk of being damaged from weather-related events, theft, or being sued by customers. Pharmacy insurance protects all aspects of the business from these unexpected events.

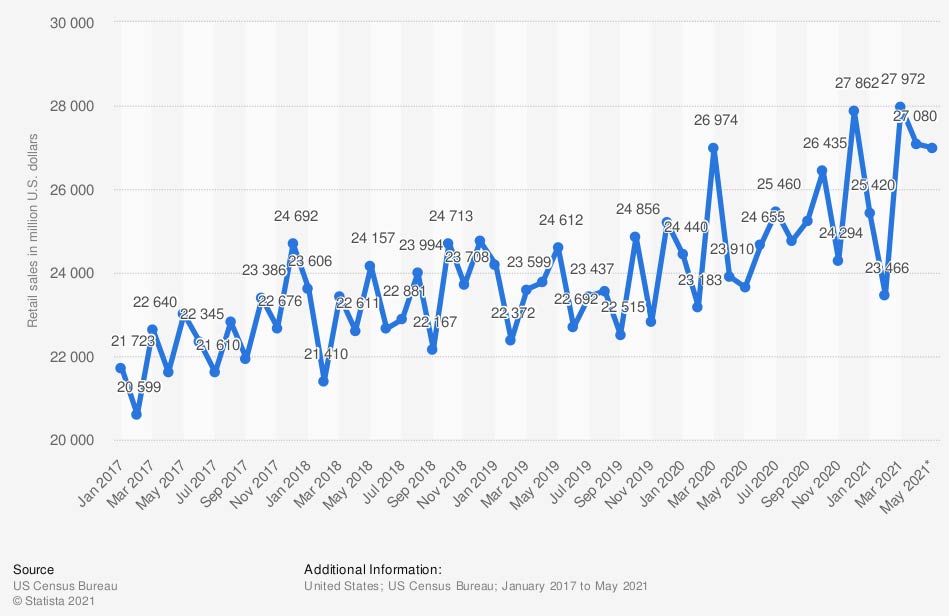

Monthly retail sales of pharmacies and drug stores in the US

Pharmacy and drug stores continue to be a multibllion dollar industry in the US.

What Does Pharmacy Insurance Cover In Illinois?

The basis of most pharmacy insurance will be an Illinois business owners policy. From there, your Illinois independent insurance agent can discuss additional necessary protection.

Most pharmacies can benefit from the following coverages.

- Business owners policy: Combines business property and business liability that covers the structure of your business, equipment, and inventory, and pays for third-party bodily injury and property damage claims.

- Professional liability insurance: Pays for any legal fees and claims associated with negligence, inaccurate advice, or administering the wrong medication.

- Product liability insurance: Pays for legal fees and claims if a customer claims a product they bought caused an illness or injury.

- Equipment breakdown insurance: Will pay for equipment in your pharmacy that unexpectedly breaks down.

- Workers' compensation: Illinois requires that all businesses provide workers compensation that covers work-related injuries and illnesses for employees.

- Data breach coverage: Pays for any financial damage that results from a cyberattack or data breach of your customer's information.

"Pharmacies are like retail stores and typically sell more than medications," said insurance expert Jeffrey Green. "For this reason, you'll want to make sure to have coverage for all of your inventory."

What Doesn't Illinois Pharmacy Insurance Cover?

Pharmacy insurance is a form of business insurance so it contains exclusions just like other types of coverage. Typically, pharmacy insurance will exclude:

- Flood and earthquake damage

- Damage from nuclear war

- Fraudulent activities

- General wear and tear of equipment

- Damage from mold or pollution

An Illinois independent insurance agent can work with you to discuss the exclusions in your policy. They can also assist you in obtaining flood insurance if your pharmacy is at risk of damage from natural waters.

Do Pharmacists Need Specific Liability Coverage in Illinois?

General liability will protect your business from any third-party bodily injury or property damage claims, but it will not help your store or pharmacy if you provide the wrong medication or give poor medical advice.

"One of the biggest concerns for pharmacies is a professional error," explained Green. "That's why it's crucial for pharmacies to have professional liability, or errors and omissions, insurance for their pharmacists. You can also get specialty coverage for your inventory."

Your Illinois independent insurance agent can help you purchase adequate professional liability coverage based on the operations of your pharmacy.

How Much Does Illinois Pharmacy Insurance Cost?

Business insurance is highly customizable, making it difficult to pinpoint an average cost.

Your premium will be based on your individual needs and the types of coverage you choose to purchase. Some common factors that can impact your rates include:

- Pharmacy size and location

- Type and amount of inventory

- Previous claims history

- The number of employees

- Amount of coverage you purchase

A business owners policy is designed to help small to medium businesses save money by combining policies. If you qualify you can save on your costs.

Your Illinois independent insurance agent can also provide insight on how to save money on your coverage.

Will My Location Affect My Pharmacy Insurance Rates?

Yes, location plays a large role in insurance premiums because it can help carriers determine your risks. Both the crime statistics and the susceptibility of your property to natural disasters like fire and hurricanes can increase your rates.

5 cities in Illinois with the highest crime rates

City / Crime rate per 1,000 residents

- East St. Louis 26.22 per 1,000 residents

- Bloomington 19.89 per 1,000 residents

- Chicago 39.76 per 1,000 residents

- Quincy 36.37 per 1,000 residents

- Alton 52.24 per 1,000 residents

If your pharmacy is located in a high-risk crime area, you can increase your coverage limits or consider purchasing an umbrella policy for more coverage.

How an Illinois Independent Insurance Agent Can Help You

Pharmacies need the right protection to keep their property, employees, and inventory safe. One mistake or accident can cost hundreds of thousands of dollars.

An Illinois independent insurance agent will talk with you, free of charge, about the available business insurance coverage for your pharmacy. They'll speak with multiple carriers to pull a variety of quotes and find you comprehensive and affordable coverage.

Author | Sara East

Article Reviewed by | Jeffery Green

https://www.onlyinyourstate.com/illinois/most-dangerous-towns-illinois/

https://www.neighborhoodscout.com/

https://www.pbahealth.com/what-type-of-insurance-coverage-does-your-pharmacy-need/

© 2024, Consumer Agent Portal, LLC. All rights reserved.