Illinois gym owners need to think about their building, equipment, employees, and customers when looking for gym insurance.

An Illinois independent insurance agent can provide a risk analysis and offer insight on what business insurance you need to insure the safety of your members and establishment.

Illinois is home to 1,346 health clubs

What Is Gym Insurance?

Gym insurance is a type of Illinois business insurance with additional liability coverage that helps you pay for any incidents that occur to or within your gym.

The basics of nearly every gym insurance package will include commercial property insurance and general liability coverage. However, depending on the type of gym, a variety of other coverages can be beneficial.

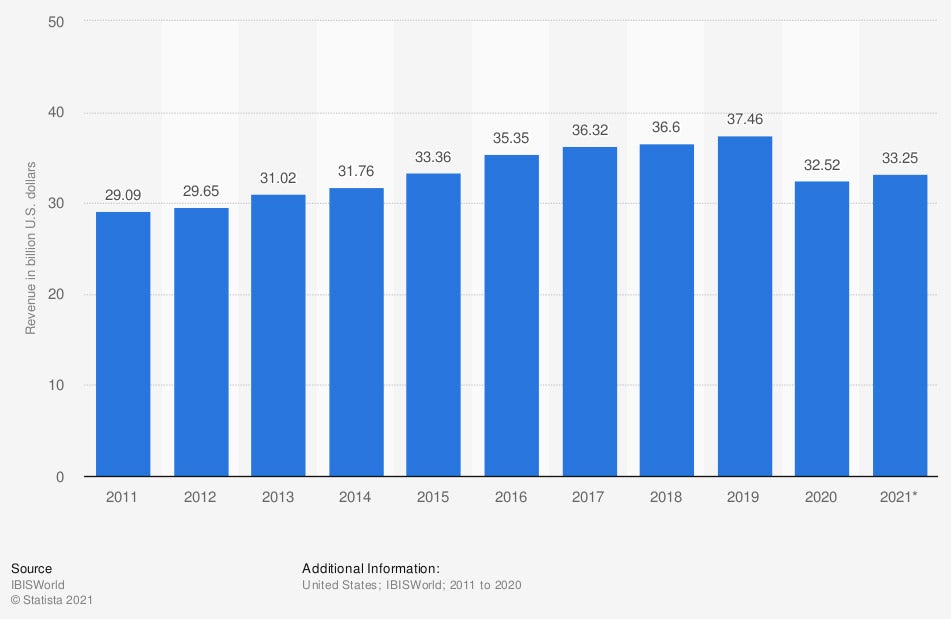

Revenue of the fitness, health and gym club industry in the United States

Thousands of people head to gyms for their workouts every day. Fitness, health, and gym clubs continue to bring in tens of billions of dollars in revenue every year.

What Does Gym Insurance Cover in Illinois?

Whether you run a CrossFit gym or a yoga studio, every gym faces risks from outside elements and potential customer injuries. "There are certain safety precautions gym owners should be taking," explained insurance expert Jeffrey Green.

When discussing necessary coverage with your Illinois independent insurance agent, most gym owners will benefit from the following coverages:

- Commercial property insurance: Covers the building, equipment, and any inventory if it's damaged by fire, wind, hail, or other named risks in the policy.

- General liability insurance: Covers legal fees, medical bills, and any court-issued payouts related to a third-party injury or property damage lawsuit.

- Professional liability insurance: Also known as errors and omissions, this provides liability coverage for your trainers and other professional staff.

- Equipment breakdown insurance: Covers if gym equipment breaks down.

- Product liability insurance: Covers lawsuits from customers if they become ill from products sold for consumption at your gym.

- Workers' compensation: Covers employee payroll, medical needs, and lost wages if an employee is injured or becomes ill on the job.

"Some gyms may be able to work with a business owners policy," said Green. "Most gyms will probably want to go beyond that to a commercial package where they can customize liability coverage because of the possibility for members getting injured on equipment."

What Doesn't Gym Insurance Cover in Illinois?

Business insurance is designed to be highly customizable to fit your needs. However, accidents happen and some events are not covered under business insurance.

Gym insurance will typically not cover

- Floods and earthquakes

- General wear and tear of machinery

- Gym equipment breakdown unless you purchase equipment breakdown coverage

- Lawsuits against trainers and fitness coaches without professional liability coverage

- Business vehicles without commercial auto insurance

- Damage from mold

- Fraud or illegal activities

- Cyberattacks or data breaches without proper coverage

An Illinois independent insurance agent can help you purchase coverage for several of the above exclusions.

How Much Merchandise Is Covered with Gym Insurance?

Many gyms create their own clothing and other merchandise. These products are at the same risk of being destroyed by a fire or storm as the gym itself.

Merchandise is covered under the commercial property insurance policy. When building your gym insurance package, you'll work with an Illinois independent insurance agent to go over the value of all of your property, including the merchandise, and you'll purchase enough coverage to reimburse for it all.

Should your merchandise be damaged or destroyed, you'll receive coverage up to your policy limits for merchandise after your deductible has been paid.

Do I Need Any Specific Liability Coverage in Illinois?

There are several liability coverages that Illinois gym owners should consider. Depending on the type of gym you run and what customers will be doing on your property, the following liability options should be considered.

- General liability

- Professional liability

- Product liability

Between these three coverages, you're protected if a customer is injured on a piece of equipment or working out at your gym, if an instructor is negligent or creates a fitness routine that injures a customer, or if an edible product you sell in your gym makes a customer ill.

Will My Location Impact My Rates in Illinois?

Yes, location plays a large role in insurance premiums, especially when it comes to property insurance.

When carriers are assessing the risks of your gym, they will consider the likelihood that your business will be damaged by severe weather or burglarized because of high crime rates in the area.

If your gym is located in a high-crime area, your premiums will be slightly higher. Similarly, if your business is in an area known for flooding or severe weather, it could impact your rates as well.

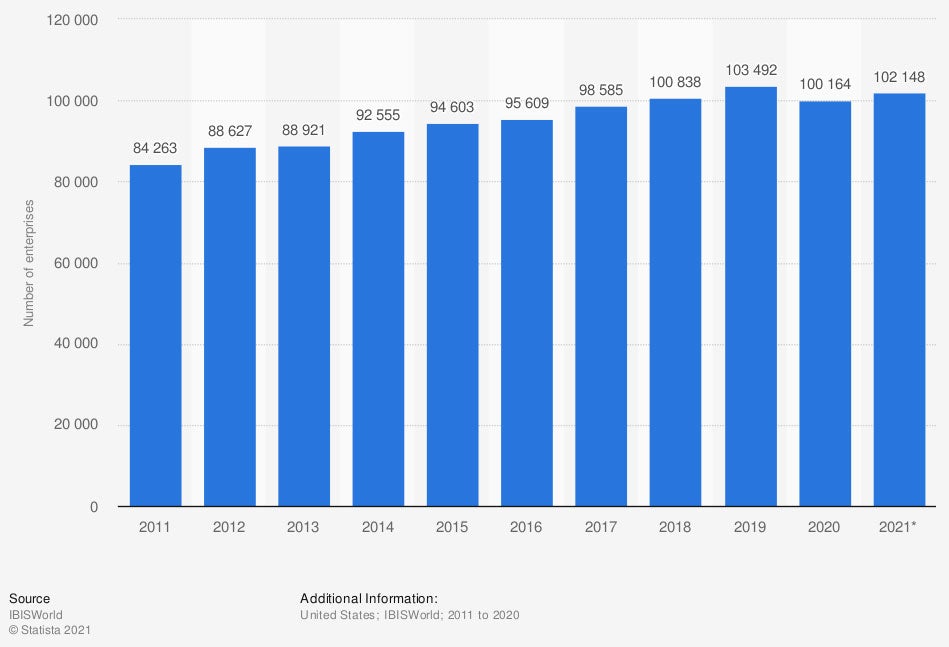

Number of fitness industry businesses in the US

There are currently more than 100,000 fitness facilities across the US

How an Illinois Independent Insurance Agent Can Help You

Gym insurance is essential to keeping your gym operating and your customers and employees safe. Every gym has specific needs, which is why it's easiest to work with someone who knows the industry.

An Illinois independent insurance agent will sit down with you, free of charge, to learn about your gym and your insurance needs. They'll shop multiple carriers for you and can help you find coverage that protects your gym inside and out.

Author | Sara East

Article Reviewed by | Jeffery Green

Statista image: statista.com/statistics/605223/us-fitness-health-club-market-size-2007-2021/

Statista image: https://www.statista.com/statistics/605240/us-fitness-health-club-industry-enterprises/

Health club call out: https://www.ihrsa.org/industry-leadership/state-advocacy/illinois/#

© 2025, Consumer Agent Portal, LLC. All rights reserved.