Quick Insurance Content Navigation

- What Is Commercial Umbrella Insurance in Illinois?

- What Does Commercial Umbrella Insurance Cover in Illinois?

- Stand-Alone Commercial Umbrella Insurance in Illinois

- What Doesn't Commercial Umbrella Insurance Cover in Illinois?

- Why Would My Illinois Business Need Commercial Umbrella Insurance?

- Commercial Umbrella Insurance Quotes in Illinois

- How an Illinois Independent Insurance Agent Can Help You

As a responsible business owner, you keep your corporate brainchild’s safety at the forefront of your mind at all times. But while your Illinois business insurance offers some important liability protection, it may not be enough to cover you in the event of a hefty unforeseen lawsuit. Fortunately, commercial umbrella insurance exists for just that reason.

Even better, Illinois independent insurance agents can help you get your business equipped with all the commercial umbrella coverage it needs. They’ll factor in your business’s legal risks ahead of time and hook you up with the right coverage to leave you feeling secure. But before we get too far ahead, here’s a closer look at this important coverage.

What Is Commercial Umbrella Insurance in Illinois?

According to insurance expert Jeffery Green, commercial umbrella insurance in Illinois comes in two main forms: stand-alone and excess. While stand-alone policies have their own terms and limitations, excess umbrella policies follow the terms of your underlying business insurance policy. Excess commercial umbrella policies are sold in increments of $1 million in liability coverage, and extend your business insurance’s legal protection by increasing your limits.

What Does Commercial Umbrella Insurance Cover in Illinois?

Excess commercial umbrella policies in Illinois are designed to increase the legal coverage provided by your business insurance. Your business insurance comes with its own limit on liability protection, and commercial umbrella insurance is purchased to greatly increase this limit. A business insurance policy may have a $1 million limit on liability coverage already, but adding commercial umbrella insurance can up this coverage to $2 million or even more.

Excess commercial umbrella insurance can be added onto the following business policies:

- Commercial liability insurance

- Commercial auto liability insurance

- Employment practices liability insurance

- Professional liability insurance

- Directors and officers liability insurance

- Business identity theft insurance

A commercial umbrella policy protects your business against destructive lawsuits, similar to how a regular umbrella protects an individual against harsh weather. An Illinois independent insurance agent can help you decide if commercial umbrella coverage is a good fit for your business.

Stand-Alone Commercial Umbrella Insurance in Illinois

Green explains that stand-alone commercial umbrella policies in Illinois are classified as having their own terms and conditions. So, unlike excess umbrella policies, stand-alone commercial umbrella insurance does not rely on an underlying policy, such as business insurance, to dictate its limitations. This means that a stand-alone commercial umbrella policy may provide coverage for certain perils not covered by your business insurance or other commercial liability policy.

What Doesn't Commercial Umbrella Insurance Cover in Illinois?

Like any other type of insurance, commercial umbrella coverage comes with its own exclusions. However, the exclusions of your specific commercial umbrella insurance will depend on whether you’ve purchased a stand-alone commercial umbrella policy or an excess commercial umbrella policy.

If you’ve purchased a stand-alone commercial umbrella policy, it’ll come with its own set of terms, limitations, and exclusions. Your Illinois independent insurance agent can help you review your specific policy and identify your coverage exclusions.

Excess commercial umbrella policies will follow the terms and exclusions of your underlying commercial policy, such as your business insurance. However, neither type of commercial umbrella policy will cover the following:

- Non-liability related perils: Aside from lawsuits, businesses face all kinds of threats on a regular basis. However, commercial umbrella insurance is only designed to offer liability protection. This means that your commercial umbrella policy will not reimburse for other disasters that affect your business, such as property damage, theft, storm destruction, and more.

If you’re concerned about not having enough liability coverage for your business, your Illinois independent insurance agent can help you add the right type of commercial umbrella policy for your needs.

Why Would My Illinois Business Need Commercial Umbrella Insurance?

Your business could benefit from Illinois commercial umbrella insurance if it’s at increased risk for legal issues. A good rule of thumb is that any businesses that customers regularly visit are especially vulnerable to lawsuits, since they have any number of third parties on their premises daily. Lawsuits can be filed against your business by third parties for property damage or personal injury, illness, or death.

Beyond the obvious liability threats, check out some of the most common lawsuits filed against businesses in the US in recent years. Knowing common commercial liability threats can further inspire you to speak with an Illinois independent insurance agent about finding the right commercial umbrella coverage.

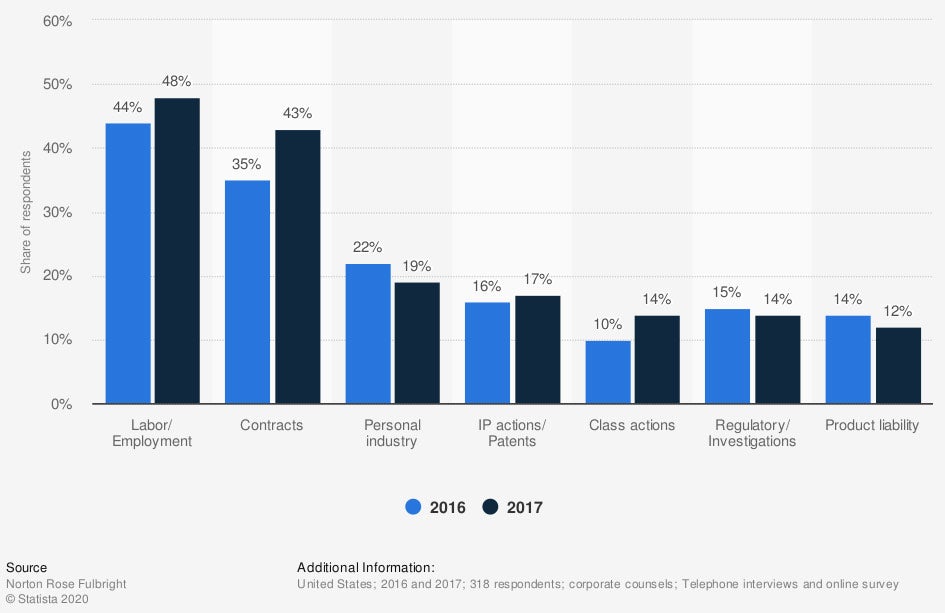

Share of pending litigation against companies in the United States in 2016 and 2017, by type

This study reports the top three types of lawsuits filed against US businesses in 2016 and 2017 over a 12-month period. In 2017, 48% of businesses surveyed reported that labor or employment lawsuits were among their business’s most common liability claim causes. Coming in second place in 2017 were lawsuits relating to contracts. Other top business lawsuits related to personal injury, intellectual property actions/patients, and product liability.

Your Illinois independent insurance agent can inform you of other common legal risks to all businesses in the US, and further explain the importance of commercial umbrella insurance for your company.

Commercial Umbrella Insurance Quotes in Illinois

The best way to get accurate quotes for commercial umbrella insurance in your area is to work together with your Illinois independent insurance agent. That being said, on average, US businesses pay about $900 annually for commercial umbrella insurance policies with a $1 million liability coverage limit. However, many businesses pay less, while many others still pay up to $1,500 annually or even more for coverage.

Commercial umbrella insurance costs are based on several factors, including:

- The size of your business

- Your business’s activities or operations

- Your business’s annual revenue

- Your business’s legal risk

- Your business’s specific location

Again, to get more exact quotes and figures for commercial umbrella insurance costs in Illinois, work with an Illinois independent insurance agent. They’ll help you find coverage at the most affordable rate, and even home in on any available discounts for you.

Here's How an Illinois Independent Insurance Agent Can Help You

When it comes to protecting businesses and their owners against unforeseen, costly legal expenses, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in commercial umbrella insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Jeffery Green

irmi.com

iii.org

https://www.statista.com/statistics/892494/legal-services-types-of-pending-litigation-per-company-united-states/

© 2024, Consumer Agent Portal, LLC. All rights reserved.