Your horse may serve many different purposes, from racing and other business endeavors to being a beloved family pet. Regardless of why you have a horse, in addition to being an animal, it’s also a valuable piece of property. That’s why it’s so important to be equipped with the right equine insurance to protect yourself in case of a disaster.

Luckily an Illinois independent insurance agent can help you get set up with the proper equine insurance policy for you. They’ll even set you up with this coverage long before you ever need to use it. But before we get too far ahead of ourselves, here’s a closer look at this critical coverage.

What Is Equine Insurance?

Equine insurance is essentially a special type of life insurance policy, designed for horses. These policies are bought to cover several types of horses, including:

- Breeding horses

- Show horses

- Race horses

- Riding horses

- Pet horses

Equine insurance provides a death benefit to the horse’s owner if the animal passes away due to a covered loss. This coverage is important, since horses are very valuable and expensive to care for and replace. An independent insurance agent can help you find the right equine insurance policy for you.

What Does Equine Insurance Cover in Illinois?

Equine insurance, also known as equine mortality insurance, is designed to offer a payout in the event of equine mortality. It provides a death benefit to the owner of the horse in the event of the animal’s death caused by a covered peril, such as:

- Acts of nature (lightning, etc.)

- Fire

- Disease

Some equine insurance policies will pay out the original purchase price of the horse upon its death. Others, however, will cover the current value of the animal, which can increase over time after winning awards or contests, etc.

The Equine Industry in the US

When shopping for coverage for your horses, it’s handy to know where the equine industry stands, overall. Check out some stats for the equine industry in the US below.

The equine industry generates $122 billion annually

- The equine industry employs 1.74 million people

- The equine industry provides $79 billion in total salaries

- There are 7.2 million horses in the US

- Texas, California, and Florida have the most horses among the states

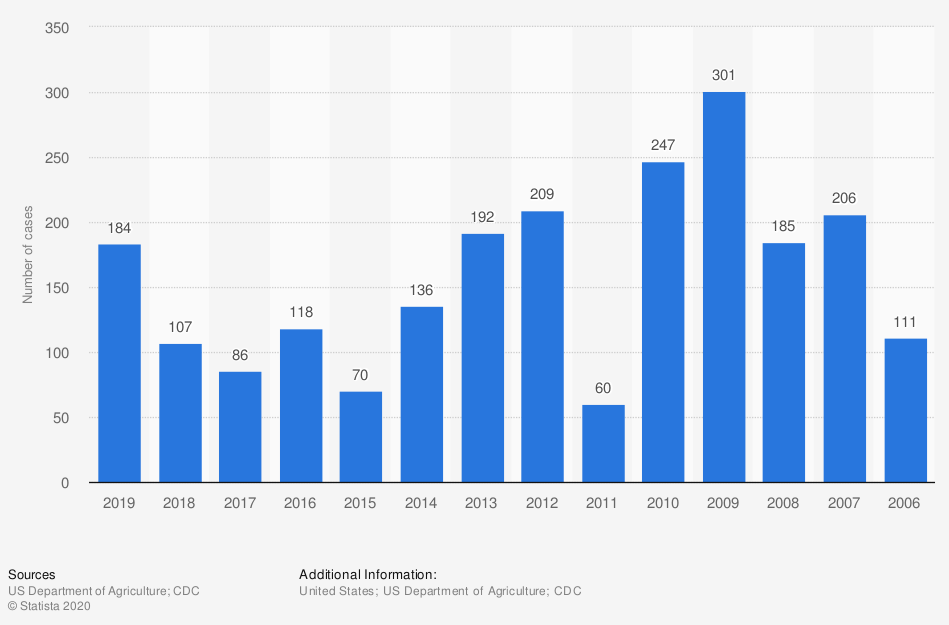

Number of equine cases of Eastern equine encephalitis reported in the US from 2006 to 2019

Eastern equine encephalitis (EEE) is an infection transmitted by mosquitoes. It causes neurological problems in horses and can have devastating effects on horse farms. In 2019, there were 184 reported cases of EEE in the US, up quite a bit from the 111 cases reported in 2006. Since disease outbreaks among horses can be fairly common, having the right coverage is critical.

The equine industry is huge and continues to grow over time. With such a profitable, expanding industry, it’s really important to have the best equine insurance policy you can find to protect yourself in case of the devastating loss of your animals.

What Doesn’t Equine Insurance Cover in Illinois?

According to insurance expert Paul Martin, an equine mortality policy doesn’t cover liability exposures for the animal’s owner. However, a farm and ranch insurance policy can provide this critical liability protection.

Equine mortality insurance policies also tend to exclude horse mortalities caused by neglect or abuse, and some policies may have several additional restrictions. Full coverage and limited coverage policies are often available to choose from.

Equine Insurance vs. Horse Farm Insurance

While equine insurance focuses on protecting owners from the tragic loss of their horses, horse farm insurance provides a broader range of coverage meant to protect commercial farms. Horse farm insurance covers:

- Equine liability: Protects the policyholder against legal fees if a lawsuit is filed by a third party, such as if their horse causes injury to a guest.

- Property damage: Protects structures on the farm against physical damage by covered perils, including certain natural disasters, vandalism, fire, and more.

- Farm equipment damage: Protects a horse farm’s equipment, like horse feeders, against physical damage and destruction or loss by a covered peril.

An independent insurance agent can help you decide if a horse farm insurance policy or equine insurance policy is right for you.

Do I Really Need Equine Insurance in Illinois?

You’re not required to carry equine insurance by law. In certain cases, Martin said, having coverage might not make sense financially, such as if your horse is older, only used for occasional riding, or is not valuable for other reasons. However, if your horse is used for breeding, racing, showing, or other profitable purposes, having coverage is crucial. A horse can cost thousands of dollars to purchase, maintain, and replace.

Regardless of whether coverage is mandatory in Illinois, equine insurance does have several important benefits. An Illinois independent insurance agent can further discuss the importance of this coverage with you, and help you find the right equine insurance policy for your needs.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting horses and their owners against tragic losses due to fire, disease, or other disasters, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in equine insurance and horse farm insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

stats - https://www.quarterhorsenews.com/2018/03/horse-industry-generates-122-billion-economic-impact/

chart - https://www.statista.com/statistics/1024509/cases-of-eee-in-north-america/

https://www.irmi.com/term/insurance-definitions/animal-mortality-insurance