All medical professionals need protection against devastating accidents that result in injury, illness, and, of course, lawsuits. Since there’s no way to know that an incident won’t ever happen to you on the job, it’s critical to be covered from the very beginning. That means being equipped with adequate malpractice insurance.

Luckily an Illinois independent insurance agent can help you find the right malpractice insurance for you. Even better, they’ll get you set up with this critical protection long before you ever need to file a claim. But for starters, here’s a closer look at this crucial coverage.

What Is Malpractice Insurance?

Malpractice insurance is basically one special form of Illinois professional liability insurance tailored to professionals in the medical field. Doctors, dentists, chiropractors, psychologists, and more rely on malpractice insurance to protect them from critical errors on the job. An Illinois independent insurance agent can help you find the right coverage for your practice.

What Does Malpractice Insurance Cover in Illinois?

Malpractice insurance is set up to protect doctors and other medical field professionals from lawsuits filed against them for claims of injury, illness, or death to their patients while under their care.

Malpractice insurance provides important protection against the following:

- Attorney and court fees during a lawsuit

- Medical damages to patients

- Punitive and compensatory damages

- Arbitration and settlement costs during a lawsuit

An Illinois independent insurance agent can further explain the critical protections offered by malpractice insurance, and how coverage would benefit you.

What’s Not Covered by Malpractice Insurance in Illinois?

Though malpractice insurance offers medical professionals several important defenses, it doesn’t cover absolutely everything. While your policy may vary, malpractice insurance often doesn’t cover:

- Sexual misconduct claims

- Claims of criminal activity

- Dishonest medical record alterations

- Malicious, intentional acts against patients

If you’re concerned about the exclusions under your malpractice insurance, work with an Illinois independent insurance agent to see if you can obtain further coverage.

Best Insurance Companies for Malpractice Insurance

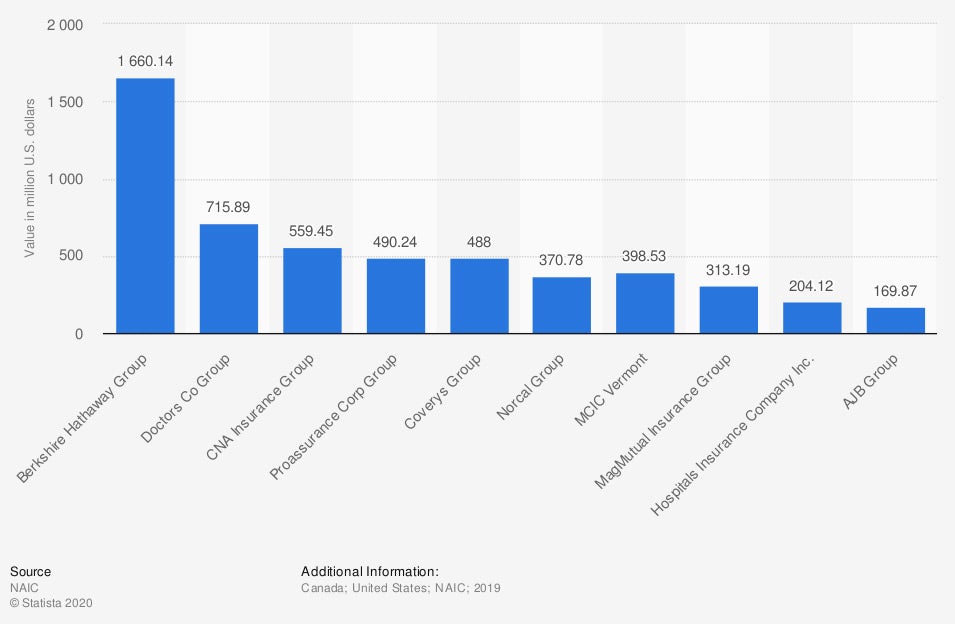

Wondering where to find the best malpractice insurance for your practice? Check out the graph below to see some of the current top malpractice insurance companies in the US.

Leading medical professional liability insurance companies in North America, by market share

Recently, the Berkshire Hathaway Group held the vast majority of the malpractice insurance market in the US, at 17.17%. Next up was Doctors Co Group, at 7.4%, followed by CNA Insurance Group, at 5.79%.

An Illinois independent insurance agent can help you determine if the coverage from one of these leading malpractice insurers is right for you.

Claims-Made vs. Occurrence Malpractice Insurance

According to insurance expert Jeffery Green, there are two major types of malpractice insurance: claims-made and occurrence coverage. Each type of policy is important, but operates differently. Here’s a breakdown of each type.

- Claims-made malpractice insurance: This coverage will only reimburse the policyholder if the following criteria are both met: the service they provided was carried out while the policy was in force, and the claim filed against them was made while the policy was in force.

- Occurrence malpractice insurance: This coverage will reimburse the policyholder as long as the service they provided occurred while the insurance policy was in force, no matter when the malpractice claim was filed against them.

If you have further questions about the main forms of malpractice coverage, an Illinois independent insurance agent would be happy to help clear up any confusion for you.

How Much Is Malpractice Insurance in Illinois?

The cost of your malpractice insurance will vary based on several factors, like:

- Your profession

- History of claims

- Years of experience

- Your exact location

However, the average cost of malpractice insurance in the US is about $7,500 annually. But certain professionals, like surgeons, pay higher amounts, often between $30,000 and $50,000 per year.

Other medical professionals can expect to pay the low end of $4,000 per year, up to $12,000 or more. An Illinois independent insurance agent can provide exact malpractice insurance quotes for you in your town.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting medical professionals against malpractice claims and all other disasters, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in malpractice insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

graph - https://www.statista.com/statistics/796680/leading-medical-professional-liability-insurers-usa-by-market-share/

cost stats - https://howmuch.net/costs/medical-malpractice-insurance, https://physiciansthrive.com/financial-planning/malpractice-insurance-cost/#5

© 2024, Consumer Agent Portal, LLC. All rights reserved.