Insurance Content Navigation

- What Is General Liability Insurance?

- What Does General Liability Insurance Cover in Illinois?

- What Isn’t Covered by General Liability Insurance in Illinois?

- Business Lawsuit Stats in Illinois

- When Does General Liability Insurance Cover Claims in Illinois?

- How Much Does General Liability Insurance Cost in Illinois?

- Here’s How an Illinois Independent Insurance Agent Can Help

Your business needs protection from all kinds of threats, and in today’s litigious society, unfortunately that can often mean lawsuits. Though harm to the public may be purely accidental, your business can still get sued for it, and potentially lose a lot of money without the right coverage. That’s why having general liability insurance is so important.

Fortunately an Illinois independent insurance agent can help you find the right type of general liability insurance to protect your business against many kinds of lawsuits and legal troubles. But before we jump too far ahead, here’s a breakdown of this critical coverage.

What Is General Liability Insurance?

General liability insurance is a special form of coverage designed to protect businesses against lawsuits and their numerous large expenses. Coverage reimburses for fees relating to attorneys, court costs, and settlement fees if you lose the case. It’s imperative for businesses of all kinds to carry this coverage, in order to avoid potential bankruptcy that could stem from a particularly hefty lawsuit. An Illinois independent insurance agent can help you get set up with coverage.

What Does General Liability Insurance Cover in Illinois?

General liability insurance provides important legal protection for businesses in Illinois, as well as across the country. It's an important part of business insurance or a business owners policy. Policies offer reimbursement for the following:

- Claims relating to bodily injury: If a third party, such as a customer, slips and falls on your business premises or otherwise injures themselves and blames you, general liability insurance will reimburse for legal costs.

- Claims relating to property damage: If a third party, such as a customer, claims to have had their personal property damaged as a result of your business, general liability will reimburse for legal costs.

- Claims relating to advertising injury: If your business’s advertisements cause some sort of harm to a third party, such as emotional harm, general liability insurance will cover the legal costs.

- Medical payments: General liability insurance will also cover medical costs stemming from third parties who are injured on your business premises, or claim to have been injured by your business’s operations. Coverage kicks in regardless of actual fault.

Your Illinois independent insurance agent can help you find the general liability insurance that works best for your unique business’s needs.

What Isn’t Covered by General Liability Insurance in Illinois?

Though commercial general liability (CGL) insurance provides a lot of important legal protection for businesses in Illinois, there are certain kinds of disasters it doesn’t cover. According to insurance expert Paul Martin, a few common CGL insurance exclusions are as follows:

- Pollution liability claims

- Worker's comp claims

- Product recall liability claims

- Contract disputes

- Professional liability claims

- Back taxes claims

If you’re concerned that your CGL policy may be lacking crucial coverage your business needs, your Illinois independent insurance agent can help you bridge that gap by finding the right policy.

Business Lawsuit Stats in Illinois

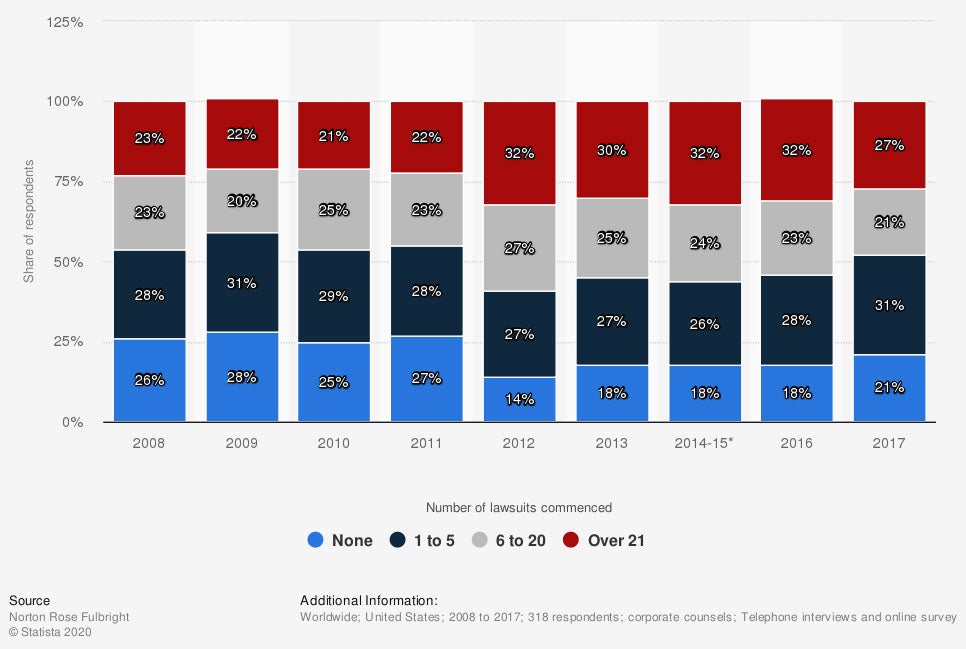

When considering commercial general liability insurance, it’s helpful to know exactly how often businesses get sued, and what for, not just in Illinois, but across the map. Check out some business lawsuit stats below.

How many lawsuits were commenced against your company in the last 12 months?

The frequency with which businesses across the globe are getting sued is increasing. In 2008, 26% of participants reported they had not been sued at all. This number had fallen to 21% of participants by 2017. Conversely, in 2008, 23% of participants reported their businesses having been sued over 21 times that year. In 2017, this number had grown to 27% of participants.

Some of the most common lawsuits filed against businesses are over claims of:

- Slip-and-fall injuries

- Auto accidents

- Discrimination against customers

- Discrimination against employees

- Advertising issues

- Auto accidents

A Illinois independent insurance agent can help your business get set up with the right protection to guard against these common lawsuits, and much more.

When Does General Liability Insurance Cover Claims in Illinois?

It’s not enough to have the right protection for your business, it’s also crucial to know how it works, and when exactly it covers you. Martin recommends working with your Illinois independent insurance agent to review exactly how your coverage works, to avoid costly mistakes and having a false sense of security.

CGL insurance covers business in Illinois in the event of:

- Products and completed operations exposures: Claims due to bodily injury and property damage will be covered if they’re caused by your business’s faulty products or completed operations/jobs.

- Indirect or contingent exposures: Claims arising from the negligence of subcontractors or independent contractors your company hires are also covered by CGL insurance.

- Premises and operations exposures: Claims due to bodily injury and property damage that occur at/on your business’s premises or as a result of your business’s operations are covered by CGL insurance, too.

Your Illinois independent insurance agent will help you review your general liability insurance to ensure that your business’s unique risks are addressed ahead of time.

How Much Does General Liability Insurance Cost in Illinois?

While it can be difficult to estimate the cost of your CGL insurance without knowing additional information, policies generally range from about $500 annually up into many thousands per year. Really, to figure the cost of your specific policy, you’ll have to consider the following factors of your business:

- Annual profits

- Size of business

- Exact location

- Specific operations

- Risk level

- Additional coverages

Certain professions will pay much more for their commercial general liability coverage than others. Construction workers tend to shell out way more for their CGL insurance than food truck operators. Your Illinois independent insurance agent can help you find quotes and exact figures for coverage in your area.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting business owners against lawsuit costs and all other expensive threats, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in general liability insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/892472/legal-services-number-of-lawsuits-per-company-worldwide/

iii.org

https://www.businessnewsdaily.com/15204-common-business-lawsuits.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.