No matter which part of the medical field you’re in, you’ve got to anticipate numerous disasters from the very start. Unfortunately malpractice incidents can and do happen, and without the right protection, they can have devastating aftereffects, too. That’s why having enough medical malpractice insurance is crucial.

Fortunately an Illinois independent insurance agent can help you get set up with the right type of medical malpractice insurance for your practice. Better yet, they’ll get you equipped with the proper coverage long before you ever need to actually use it. But until then, here’s a breakdown of this critical coverage.

What Is Medical Malpractice Insurance?

Basically, medical malpractice insurance is a special coverage made for medical professionals who work with the human body. Coverage is used by dentists, druggists, physicians, and even psychologists.

Medical malpractice insurance protects medical professionals against lawsuits filed against them for claims of patient injury or death due to their care. An Illinois independent insurance agent can help you find the right as long as the service they provided took place while the policy was in force.

An Illinois independent insurance agent can further break down the main forms of medical malpractice insurance and help you decide which is right for your practice.

What Does Medical Malpractice Insurance Cover in Illinois?

Essentially a specific type of Illinois professional liability insurance, medical malpractice insurance exists to protect medical professionals against potentially costly and tragic errors. Coverage can reimburse for lawsuit fees in the event of a malpractice suit.

Illinois medical malpractice insurance covers the following:

- Arbitration and settlement costs

- Attorney and court fees

- Medical damages

- Punitive and compensatory damages

Your Illinois independent insurance agent can review the coverage provided by your medical malpractice insurance with you, or help you find the appropriate policy.

Illinois Medical Malpractice Insurance Stats

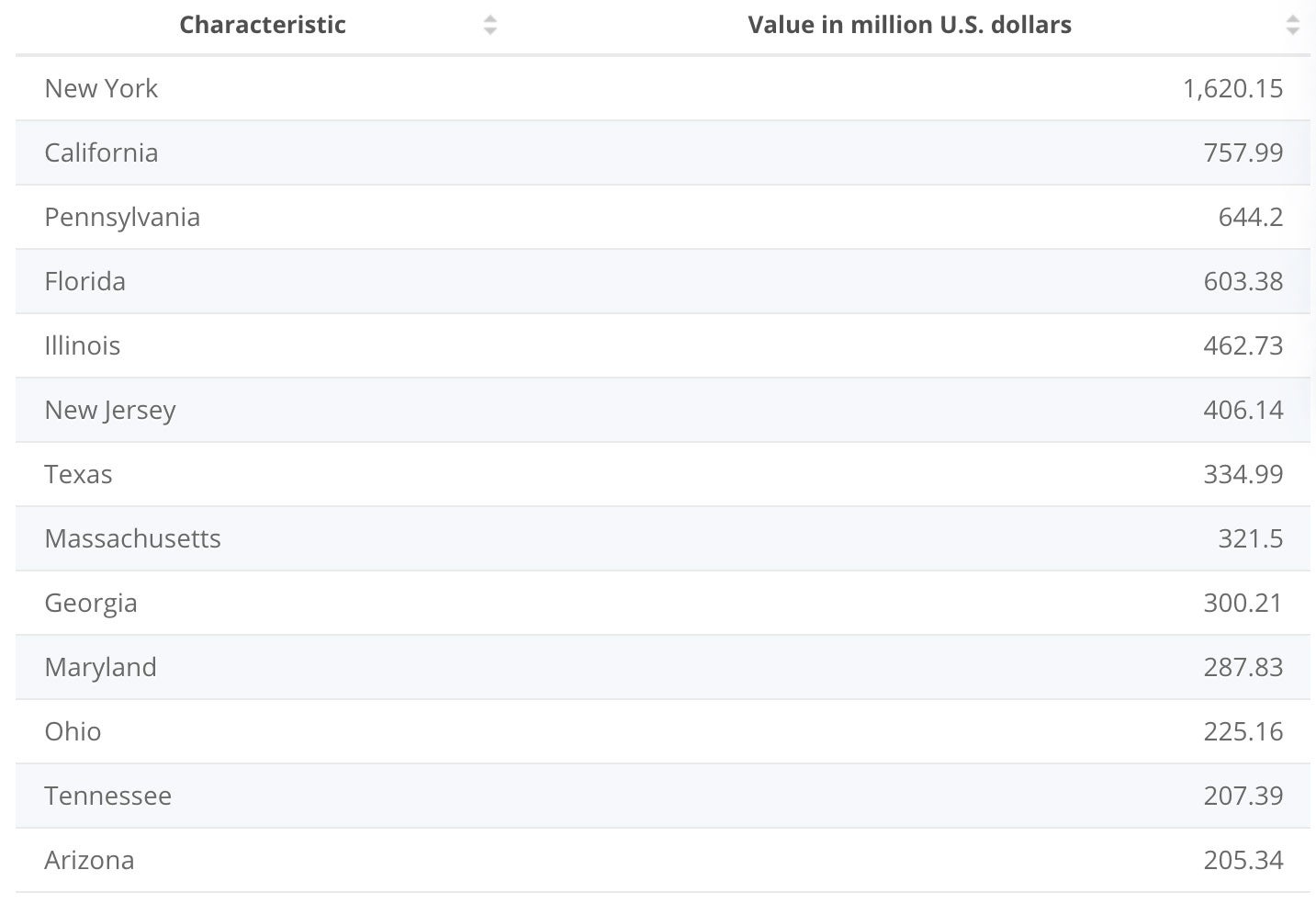

Medical malpractice insurance is critical to have, regardless of where you practice. However, in certain states, far more claims are filed, and medical professionals pay way more for coverage than others. Take a look at how Illinois compares to other states when it comes to the highest premiums earned for coverage.

Direct premiums earned by the medical professional liability insurance market in the United States in 2018, by state (in million US dollars)

The medical malpractice insurance market generated $1.6 billion in direct premiums in the state of New York in 2018. Illinois ranked fifth overall, coming in behind only New York, California, Pennsylvania, and Florida. Illinois’s direct written premiums for medical malpractice insurance totaled $462.73 million in 2018.

Having enough medical malpractice insurance is absolutely imperative to protect yourself as a trusted medical professional, regardless of where you practice.

What Is Illinois Tail Coverage Medical Malpractice Insurance?

According to Green, tail coverage is an option that can be added onto claims-made medical malpractice insurance for a specific term, and still covers services provided while the policy was in force. Retiring medical professionals often purchase five or ten years of tail coverage to protect services they performed during their career.

This way, they’re still protected even after they’re no longer practicing. Tail coverage can be purchased in one-year increments. An Illinois independent insurance agent can help you find the right tail coverage for your needs.

What Doesn’t Medical Malpractice Insurance Cover in Illinois?

While medical malpractice insurance is extremely important and provides a ton of critical protections, it also comes with its own set of exclusions. Common coverage exclusions are:

- Intentional and dishonest acts

- Sexual misconduct liability

- Criminal acts

- Inappropriate alteration of medical records

Your Illinois independent insurance agent can review your specific medical malpractice insurance policy’s exclusions with you.

Does Illinois Umbrella Insurance Cover Medical Malpractice?

Green said no, an Illinois umbrella insurance policy won’t cover medical malpractice liability cases in Illinois. While commercial umbrella insurance does extend a business’s liability coverage limits a generous amount, this coverage cannot be applied to medical malpractice suits.

That’s why it’s so critical to get the right type of coverage if you work in the medical field. Lawsuits in this industry can be some of the most devastating, not to mention expensive, cases around. Work with an Illinois independent insurance agent to learn more about medical malpractice insurance in your area, and get equipped with the right coverage ASAP.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting medical professionals against liability risks and all other disasters, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in medical malpractice insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

chart - https://www.statista.com/statistics/796686/premiums-of-medical-professional-liability-insurance-usa-by-state/

https://www.iii.org/article/understanding-medical-malpractice-insurance

https://smallbusiness.chron.com/doctors-required-malpractice-insurance-60552.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.