Quick Content Navigation

- What Is Business Rental Insurance?

- What Does Business Rental Insurance Cover in Illinois?

- What Doesn't Business Rental Insurance Cover in Illinois?

- Do Rental Businesses Need Insurance?

- How Much Does Rental Insurance Cost in Illinois?

- Does General Liability Insurance Cover Rental Business?

- How an Illinois Independent Insurance Agent Can Help You

In today's world, you can pretty much rent anything. From party supplies and tools to sporting equipment, electric scooters, and even wedding dresses, if you're in need of an item and you don't want to buy it, there's a company that will rent it to you. With the wide array of rental businesses, it's important to have coverage for your business and the inventory you're renting out, which requires a special type of business insurance.

Fortunately, an Illinois independent insurance agent lives in a state with more than 1,200,000 small businesses and knows all about rental business insurance. It's not as simple as your typical business policy, but they can help you better understand what you need.

What Is Business Rental Insurance?

Business rental insurance is a type of insurance that includes everything in a standard business insurance policy with some additions to help protect your rental equipment and any risks it presents. In particular, rental businesses face two main risks through their rental equipment.

- If the equipment is lost or damaged while in the possession of the customer or even yourself

- If the equipment causes bodily injury or property damage to the customer

Your Illinois independent insurance agent can assess how risky your business is and determine what additions need to be made to your standard policy to fully cover your rentals.

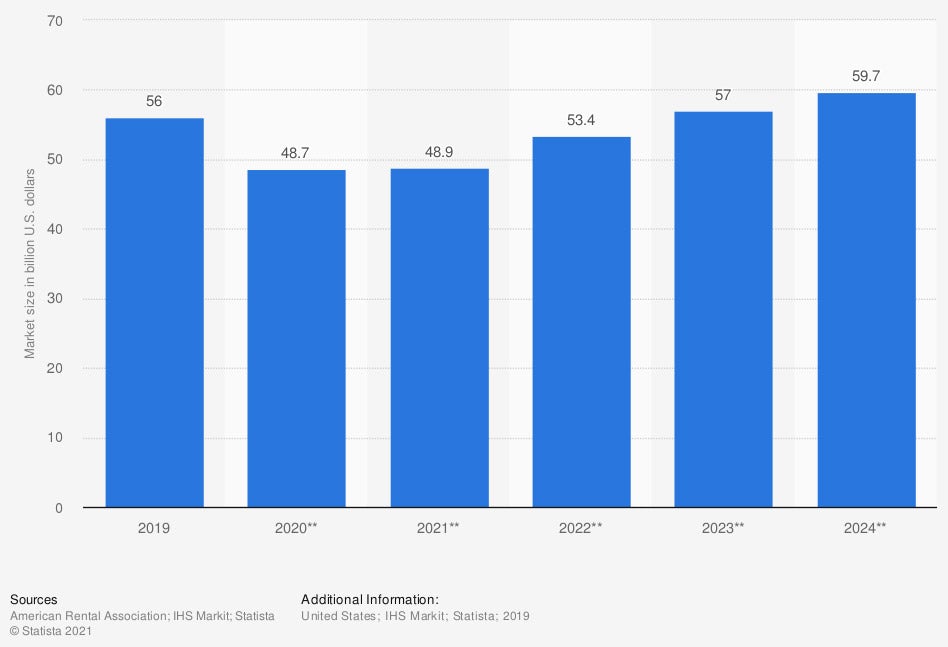

US equipment rental market size from 2019 to 2024 (in billion U.S. dollars)*

In 2020, the equipment rental market in the United States was forecast to be about $48.9 billion in 2021.

What Does Business Rental Insurance Cover in Illinois?

Business rental insurance is designed to protect business owners from any risks or injuries that may affect their business related to the type of equipment they rent out. Your policy will include standard business insurance coverage and additional coverages.

Standard business insurance coverages include:

- General liability: Protects your business from claims made by a third party regarding bodily injury or property damage caused by you or your employees.

- Property insurance: Pays for any damage that might occur to your business store or property, and this includes your rental items. Property insurance will cover your items whether they're being stored in your facility or are rented out to customers.

- Workers' compensation: Illinois requires businesses to offer workers' compensation for all employees unless they're a sole proprietor, corporate office, or business partner. Workers' compensation pays for medical bills and payroll should an employee get injured or fall ill while on the job.

- Commercial auto insurance: If your business has vehicles that it uses for operation purposes, then a commercial auto policy is necessary to cover your vehicles and employees should an accident occur.

Your rental business may benefit from these additional insurance options:

- Commercial umbrella insurance: For most rental businesses, the standard liability policy will not be enough coverage to include the risks that could result from rental equipment. You'll want to work with your agent to make sure you have enough coverage should a customer slip and fall in your store or severely injure themselves while using your rental equipment. Typically, this added liability coverage can be found in a commercial umbrella policy.

- Inland marine insurance: If your property is movable or transferrable, then an inland marine policy will cover your equipment while it's in transit. This could mean being shipped or transported via roads.

- Equipment breakdown insurance: If you're a business that rents out heavy machinery, like farming equipment to the many farmers in Illinois, you'll want to purchase equipment breakdown insurance. This covers any damage or repairs should your equipment unexpectedly break down.

- Business interruption insurance: Helps pay for bills, lost wages, and other finances should you have to cease operations because of a covered event.

"Rental companies have many risks, because other people are using your property and you have no idea how they're going to treat it," said insurance expert Paul Martin. "It's a risky type of business for carriers to insure, so it's best to get assistance from an agent to make sure you have the best coverage."

What Doesn't Business Rental Insurance Cover in Illinois?

Business rental insurance will have similar exclusions to a standard business insurance policy. Every policy will differ, so it's smart to read through yours so you know what exemptions are included. Common exclusions include:

- Flood: Flood insurance is not included in any standard business policy. It must be purchased separately.

- Earthquakes: Damage from earthquakes is also excluded from a business insurance policy. It can be purchased as an endorsement or stand-alone addition.

- Professional liability: If you're providing professional services in addition to your rentals, you'll want to purchase a professional liability policy. This will cover you should someone sue you for negligence or improperly performed tasks.

- Automobiles: Your typical business rental insurance policy will not cover automobiles unless you have purchased a commercial auto policy.

It's also important to note that business rental insurance will not cover any loss of income unless you've purchased business interruption insurance. If your company rents bikes and your warehouse burns down overnight, without business interruption insurance, you'll still be required to pay your bills and payroll out of pocket.

Do Rental Businesses Need Insurance?

According to Martin, rental businesses need insurance for the same reason that every business needs insurance, "Something could damage your stuff and you could get sued. But for rental businesses these risks are even greater because you're putting someone else in charge of your property."

Rental business insurance claim examples:

- Outdoor sports equipment rental: A customer rents a snowmobile from you but has never ridden one before. You train them on how to drive the snowmobile before they leave, but once they're in the mountains, they lose control of the vehicle and crash it into a tree.

- Farm equipment rental: A customer rents an excavator from you and while working on the farm, accidentally knocks down the neighbor's fence. Technically, since they are using your rental equipment, the claim could fall on your business.

- Computer/technology rental company: A power surge short circuits all of your technology, causing several computers to break down and need repair or replacement.

- Photography equipment rental: Someone rents $5,000 worth of photography equipment from you then steals the equipment and never returns it.

Martin added that even though customers always agree to "terms and conditions" when renting equipment, they don't typically read the documentation. If it's a serious accident, it's difficult to say if the language in the contract would even hold up, so it's best for business owners to fully protect themselves instead of relying on rental terms and agreements.

How Much Does Rental Business Cost in Illinois?

The cost of business insurance depends on a variety of factors. It's difficult to provide an average, as every business is different in size, needs, and the services it provides. What is consistent is the factors used to calculate the cost of insurance. The following will be taken into consideration:

- Type of business

- Age of business

- Previous claim history

- Type and amount of rental equipment

- Value of rental equipment and property

- Number of employees

- Potential risks

Your Illinois independent insurance agent can help you understand what insurance carriers need to know to calculate your premium. It's always best to be up front with your agent about your business and the rental equipment you plan on offering to customers.

Does General Liability Insurance Cover Rental Business?

A standard general liability insurance policy will respond to the operation and use of items that you rent out through your Illinois rental business. However, if what you are renting is determined to be a vehicle designed primarily for use on public roads, it will be excluded. At that point, it's considered an auto and you need a commercial auto insurance policy.

Even though your general liability insurance will cover your rental business, you still need to make sure the coverage is sufficient based on the potentials risks that renting your equipment poses. A company renting out backhoes faces more risks than someone renting out party equipment.

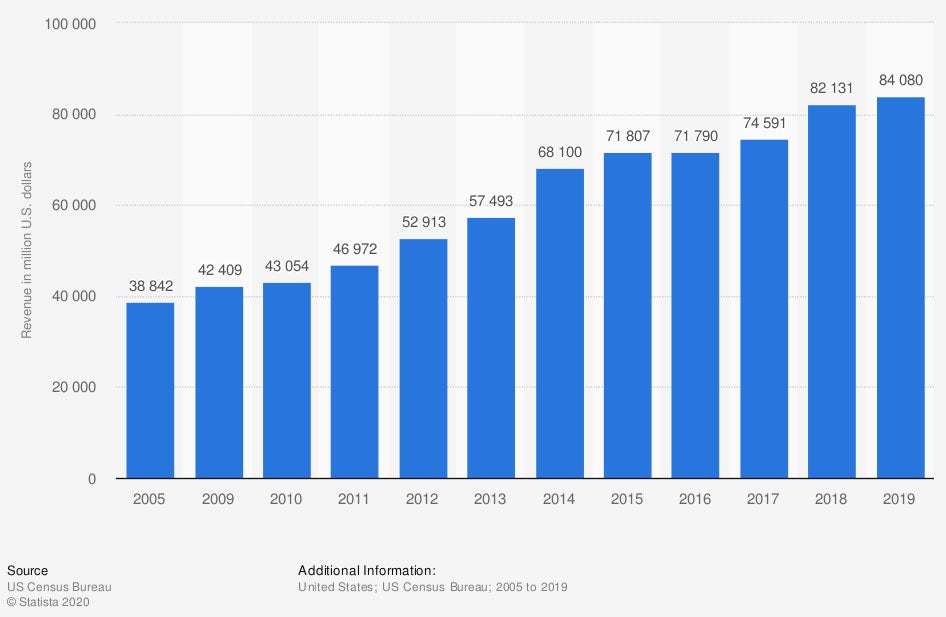

Commercial or industrial equipment rental and leasing revenue in the United States from 2005 to 2019 (in million US dollars)

In 2019, the revenue from commercial or industrial equipment rental and leasing in the United States amounted to $84.08 billion.

How an Illinois Independent Insurance Agent Can Help You

In previous years, more than $16 million in commercial insurance claims has been paid in Illinois. Fortunately, there are 1,184 Trusted Choice agents who can help you find the best rental business insurance.

An Illinois independent insurance agent can shop multiple insurance carriers to help you get a variety of quotes and policy options. They understand business insurance, the exemptions, and the endorsements that can be added. They'll sit down with you to discuss your business and the potential risks and find a policy that fits your needs.

Article Author | Sara East

Article Reviewed by | Paul Martin

iii.org - data sheet

https://www2.illinois.gov/sites/iwcc/about/Pages/insurance.aspx#:~:text=Illinois%20law%20requires%20employers%20to,liability%20companies%20may%20exempt%20themselves.