Quick Content Navigation

- What Is Shopping Mall Insurance?

- What Does Shopping Mall Insurance Cover in Illinois?

- Shopping Mall Stats for Illinois

- What Doesn't Shopping Mall Insurance Cover in Illinois?

- How Much Theft Is Covered with Shopping Mall Insurance?

- Do I Need Valuable Items Coverage for a Shopping Mall?

- Here's How an Illinois Independent Insurance Agent Can Help You

Shopping malls provide all kinds of goods and services for consumers, but in doing so, they also offer a lot of risks. Owners of shopping malls need to be aware of the safety of workers, customers, and other visitors alike at all times. That’s what makes having the right shopping mall insurance so important.

Luckily an Illinois independent insurance agent can get you set up with adequate shopping mall insurance for the job. They’ll even get you covered long before you ever need to file a claim. But first, here’s a closer look at shopping mall insurance.

What Is Shopping Mall Insurance?

Shopping mall insurance is a specific type of Illinois business insurance designed to protect against the unique hazards and risks of shopping malls. Coverage comes with the basics of a business insurance policy, with additional, more specific types of coverage on top. An Illinois independent insurance agent can help you find the right shopping mall insurance for your needs.

What Does Shopping Mall Insurance Cover in Illinois?

The needs of your shopping mall might vary greatly from another shopping mall. You’ll need to consider the stores, restaurants, and other businesses located in your specific mall. However, shopping mall insurance often covers:

- Commercial general liability: Shopping malls need liability protection for their entire premises, so they’ll often need premises liability coverage, completed operations coverage, and product liability insurance in addition to general liability insurance.

- Commercial property: Coverage protects the shopping mall’s physical structure and often its contents against numerous disasters like theft, vandalism, storm damage, and more.

- Business income: Shopping malls need protection for disasters that could cause the business to close down for an extended period.

- Extra coverages: Additional coverages required by your shopping mall depend highly on what exactly is in your shopping mall. Fast food restaurants with special equipment like fryers may require their own protection.

An Illinois independent insurance agent can further break down the coverages often found in shopping mall insurance packages.

Shopping Mall Stats for Illinois

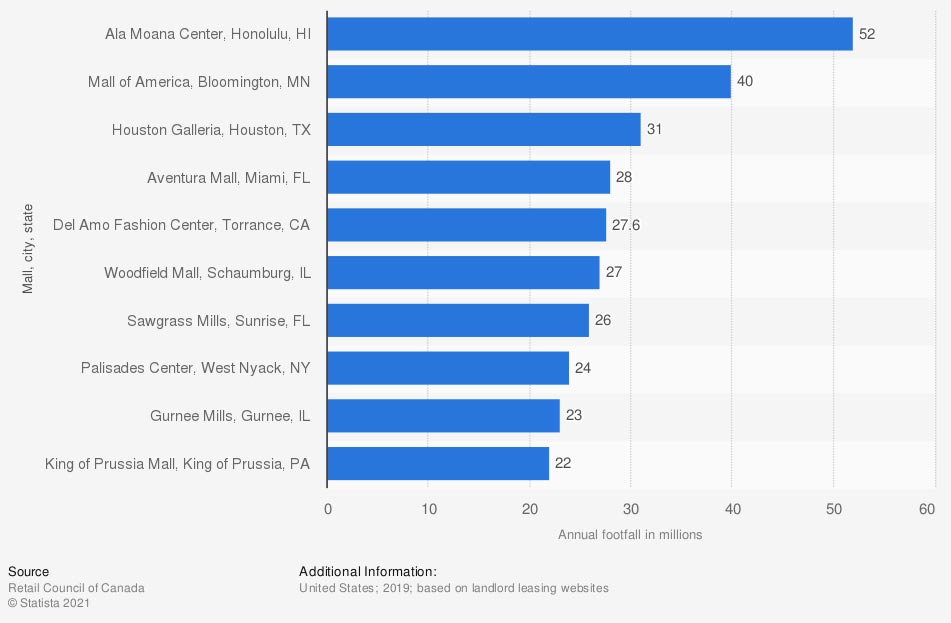

When considering coverage for your shopping mall, it’s helpful to know how your business stacks up against others in the country. Check out this list of the top 10 busiest shopping malls in the US. Two of them are located in Illinois.

Busiest shopping malls in the United States in 2019, based on annual footfall (in millions)

In 2019, the busiest shopping mall in the nation was the Ala Moana Center in Honolulu, Hawaii, with 52 million annual visitors. The Woodfield Mall in Schaumburg, Illinois came in sixth place overall, with 27 million annual visitors, and the Gurnee Mills mall in Illinois came in ninth, with 23 million annual visitors.

The more traffic your shopping mall receives, the more critical it is to be equipped with the right shopping mall insurance. An Illinois independent insurance agent can help get you covered.

What Doesn't Shopping Mall Insurance Cover in Illinois?

Because shopping mall insurance varies so widely, so will you your policy’s specific exclusions. However, in general, shopping mall insurance in Illinois is likely to exclude coverage for:

- Routine maintenance and repairs

- Dishonest acts by staff

- Flood damage

- Nuclear or war damage

- Earthquake damage

In a state like Illinois that’s prone to flooding, it’s important to consider adding commercial flood insurance to your shopping mall coverage. Business insurance does not cover damage caused by natural flooding, but your Illinois independent insurance agent can help you find the right flood insurance policy to add.

How Much Theft Is Covered with Shopping Mall Insurance?

Mall tenants and shoppers alike can sue a shopping mall’s owner if they’re robbed due to inadequate security on the premises. Green said that each mall tenant, such as a store or vendor, would typically have their own theft coverage to protect their property.

The extent of theft protection will vary by policy. Your Illinois independent insurance agent can help ensure that you get set up with all the coverage you need to provide a safe, secure environment for your tenants and shoppers.

Do I Need Valuable Items Coverage for a Shopping Mall?

The owner of the shopping mall might not add valuable items coverage to their shopping mall insurance, but individual tenants might need to purchase it. Store owners, vendors, etc. might need to purchase valuable items coverage if their products are especially pricey. Jewelry store owners, for one, might need quite a bit of valuable items coverage.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting shopping mall owners against liability risks, property damage, theft, and all other disasters, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in shopping mall insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

stats - https://www.statista.com/statistics/1197959/shopping-malls-annual-footfall-united-states/

https://www.irmi.com/articles/expert-commentary/insuring-indoor-environment-risks-in-commercial-property

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/small-business-insurance-basics

© 2024, Consumer Agent Portal, LLC. All rights reserved.