Quick Content Navigation

- What Is Barbershop Insurance?

- What Does Barbershop Insurance Cover in Illinois?

- What Doesn't Barbershop Insurance Cover in Illinois?

- How Much Is Barbershop Insurance in Illinois?

- Do I Need Specific Liability Insurance for My Barbershop?

- Barbershop Insurance Near Me

- How an Illinois Independent Insurance Agent Can Help You

Owning a barbershop is not as risky as owning a construction company, but accidents can happen. From a poor haircut to a slip and fall in your shop, Illinois barbershop owners need to be protected from a variety of perils and risks. The best way to protect your business is with a comprehensive barbershop business insurance package.

When looking for barbershop insurance, an Illinois independent insurance agent is the best solution. They can help you find affordable and comprehensive insurance and better understand what you need in your insurance policy.

What Is Barbershop Insurance?

Barbershop insurance is a type of Illinois business insurance that protects a business against common liability, property damage, and employee illness events. Working with sharp tools and having foot traffic in and out of your shop exposes your business to a number of liabilities. Barbershop insurance is designed to help pay for damage that is done to your business by a covered peril.

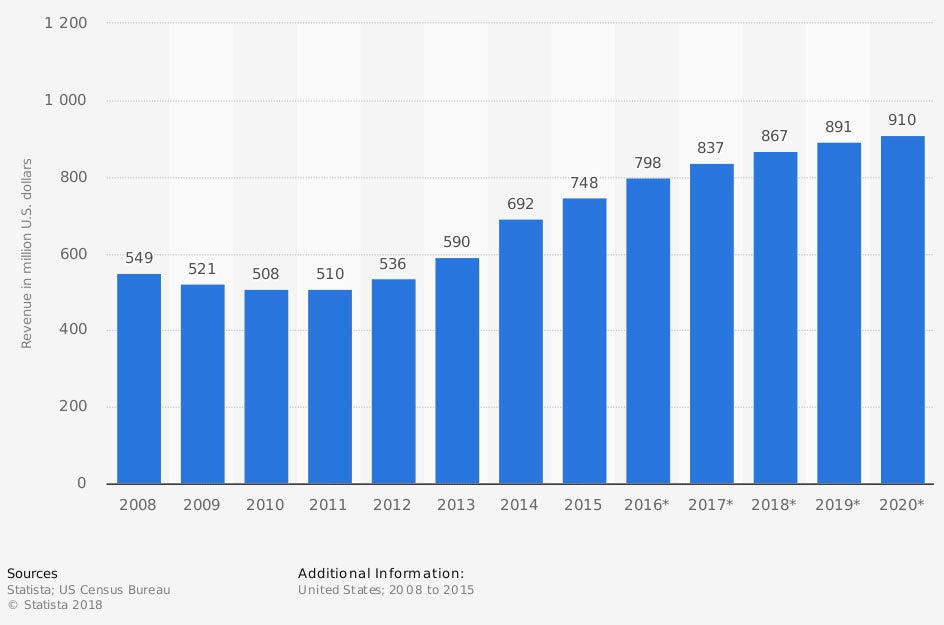

Revenue of barbershops in United States from 2008 to 2020

(in million US dollars)

In 2020, barbershops in the US generated $910 million in revenue, the highest in history.

What Does Barbershop Insurance Cover in Illinois?

Coverage for barbershops is very similar to a standard business insurance policy with an added element of professional liability insurance. This is because a customer could sue a barbershop for an injury other than bodily injury.

Standard barbershop insurance coverage

- General liability: Protects your shop from any claims that are made regarding a third-party bodily injury or property damage. This includes things like slips and falls and accidental cuts to a client.

- Commercial property insurance: Protects your shop's property such as clippers, blow dryers, grooming chairs, hair washing sinks, and the like, including rental items. It will also protect your building, whether it's owned or rented. Property insurance will cover your items whether they're being stored in your facility or are rented out to a customer.

- Workers' compensation: Illinois requires businesses to offer workers' compensation for all employees unless you're a sole proprietor, corporate office, or business partner.

Additional coverages every barbershop should consider

- Professional liability: Provides coverage against any non-injury-related claims. This includes professional errors and claims related to personal distress.

- Product liability insurance: If you sell products out of your barbershop, product liability insurance will pay for any damage that might be done to a client from a product you sell.

- Contents coverage: This can provide added protection for any of the equipment you keep in your shop.

- Business income insurance: Should your shop have to close its doors because of a covered peril, like a fire, business income insurance helps replace some of your lost income during this time.

Many barbershop owners opt for a business owners policy (BOP), which combines general liability, property insurance, and business interruption into one affordable package. You can then work with your Illinois independent insurance agent to add on any additional coverages you may need.

What Doesn't Barbershop Insurance Cover in Illinois?

Business insurance is designed to be flexible in order to meet the variety of needs of different businesses. But even with a comprehensive barbershop policy, there are exclusions. The most common include:

- Earthquakes: Earthquake insurance must be purchased separately from a standard business policy.

- Flooding: Flood insurance is typically offered through the National Flood Insurance Program (NFIP), managed by the Federal Emergency Management Agency. and is purchased separately from your barbershop insurance.

- Cyber liability: If you're using a computer system to store customer data, you may want to consider purchasing cyber liability, as your standard policy won't cover any financial loss or reputation damage from a data breach.

- Automobiles: If your barbershop uses vehicles, they won't be covered under a standard business policy. You'll need to purchase a commercial auto insurance package.

- Damage from war or terrorism: If your business receives damage as a result of war or terrorism, it will not be covered.

- Intended damage: Insurance will not cover any damage that is considered to be done intentionally to the business.

How Much Is Barbershop Insurance in Illinois?

Putting a price tag on barbershop insurance is difficult, because there is a variety of factors that go into determining insurance premiums. Carriers will look at a variety of aspects of your business and your risks and use that info to set a price. In addition, there may be discounts available for bundling or opting for a BOP vs. individual policies.

The following factors are taken into consideration when determining insurance premiums:

- Type of business

- Age of business

- Previous claim history

- Type and amount of rental equipment

- Value of rental equipment and property

- Number of employees

- Potential risks

Insurance expert Paul Martin noted that barbershop owners might need additional liability insurance, which would increase premiums. "If your shop is a multi-barber shop, individual barbers are responsible for their own tools," said Martin. "As the owner you can choose to increase your insurance coverage to include individual barbers or not, but doing so will increase your premiums."

Do I Need Specific Liability Insurance for My Barber Shop?

Yes, barbershops can benefit from more than just your general liability insurance policy. A professional liability insurance policy is recommended for barbershop owners because of the risks of a client suing you for non-injury damages. Ultimately, this protects you from any professional errors that you make, which is also why it's often referred to as errors and omissions coverage.

Professional liability claim examples for barbershop owners

- A customer comes in and asks you to cut their hair into a mohawk. As the stylist, you must do what the customer asks, but then the customer ends up getting fired from their job because of their new haircut. They can sue you and your shop for perceived loss and damages.

- A bride who is getting married comes in two days before her wedding to get her hair done and you accidentally dye her hair pink. Her hair is now pink for her wedding. She feels humiliated and she could sue you for personal distress.

Barber Shop Insurance Near Me

When shopping for barbershop insurance, you'll realize there are many options. You'll need to choose from local and national carriers all offering slightly different packages and prices. Sometimes a good place to start is with the carriers who most frequently write business insurance. Below is a list of the most common business insurance writers in the United States.

| Rank | Group/company | Direct premium written (1) | Market share (2) |

| 1 | Travelers Companies Inc. | $18,666,277 | 5.5% |

| 2 | Chubb Ltd. | 18,567,051 | 5.5 |

| 3 | Liberty Mutual | 16,794,384 | 5.0 |

| 4 | Zurich Insurance Group | 12,612,294 | 3.7 |

| 5 | American International Group (AIG) | 12,220,209 | 3.6 |

| 6 | CNA Financial Corp. | 10,602,312 | 3.1 |

| 7 | Berkshire Hathaway Inc. | 10,514,633 | 3.1 |

| 8 | Hartford Financial Services | 9,686,418 | 2.9 |

| 9 | Nationwide Mutual Group | 8,381,732 | 2.5 |

| 10 | Tokio Marine Group | 7,413,819 | 2.2 |

How an Illinois Independent Insurance Agent Can Help You

As a barbershop owner, you know the importance of finding the right business insurance. When it comes to your income and livelihood there is no room for error, which is why an Illinois independent insurance agent is the perfect person to have in your corner. They understand business insurance and what your barbershop needs and what it can skip. They'll shop multiple carriers and present you with a variety of options and coverages to choose from. They'll help you make the best decision for you and your barbershop.

Article Author | Sara East

Article Reviewed by | Paul Martin

https://www.iii.org/publications/commercial-insurance/rankings

iii.org - geo data stats

© 2025, Consumer Agent Portal, LLC. All rights reserved.