Quick Content Navigation

- What is Business Insurance?

- What Does Business Insurance Cover in Illinois?

- What Does Business Insurance Not Cover in Illinois?

- How Much is Business Insurance in Illinois?

- Does My Business Insurance Have Theft Coverage?

- Will My Business Location Impact My Insurance Rates?

- How an Illinois Independent Insurance Agent Can Help You

What Is Business Insurance?

If you own an Illinois business, the right insurance could mean the difference between you or the insurance company covering a claim. Adequate protection is needed for all the what-ifs. Check out what business insurance is.

- Business insurance: These are a variety of policies that will include, but aren't limited to, liability coverage for bodily injury and property damage. Any business property will be included for replacement and repair under these policies.

What Does Business Insurance Cover in Illinois?

Your Illinois business insurance will be unique to your operation. There are some standard policies that most owners obtain for their operation. Check out the primary coverages for a business in Illinois.

- General liability insurance: Pays for bodily injury or property damage claims where you and your employees are responsible.

- Business interruption: This will pay for regular business expenses when you are temporarily shut down due to a covered loss.

- Commercial property insurance: Pays for building, equipment, and inventory damage from a covered loss.

- Crime insurance: Pays for a claim involving forgery, fraud, or theft to your company.

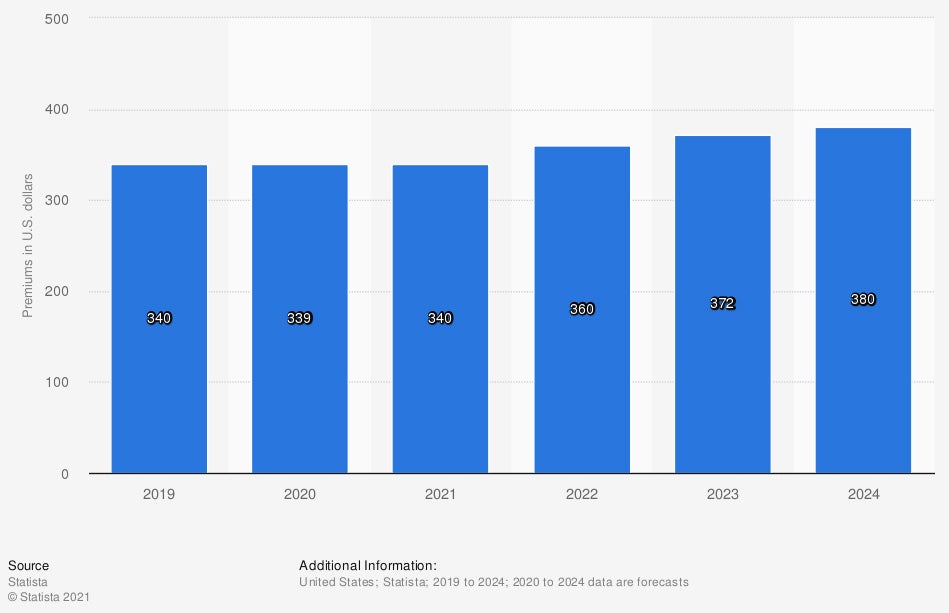

Average Cost of General Liability Insurance

General liability insurance will be the backbone policy for all businesses. This policy will provide protection for several losses and lawsuits that could come your way as a business owner in Illinois.

What Does Business Insurance Not Cover in Illinois?

Business insurance in Illinois will come with many moving parts. Like every policy, there are certain coverages that are not included in your primary policies. Take a look at standard exclusions that could apply.

- Spoilage: This coverage refers to food or items that spoiled due to an equipment loss. It can usually be added for a fee but won't be automatic in most cases.

- Vehicles: Some insureds think automobiles or company vehicles fall under business equipment, but they don't.

- Structures: If you want coverage for any structures or similar, it will fall under your business property coverage.

- Employee vehicles: If your employees use personal cars to drive to job sites, then they will need to have adequate coverage on their policy.

- Cyber liability: This is a separate policy most of the time and will need to be obtained on its own policy form.

- Flooding: Flood insurance is a stand-alone policy that can be purchased from FEMA-approved carriers.

How Much Is Business Insurance in Illinois?

Insurance companies rate every entity on its own set of risk factors. Your Illinois business premiums will be calculated on personal and outside elements. Take a look at the criteria companies use when quoting.

- Loss history

- Replacement cost values

- Insurance score

- Employee count

- Location

- Local crime rate

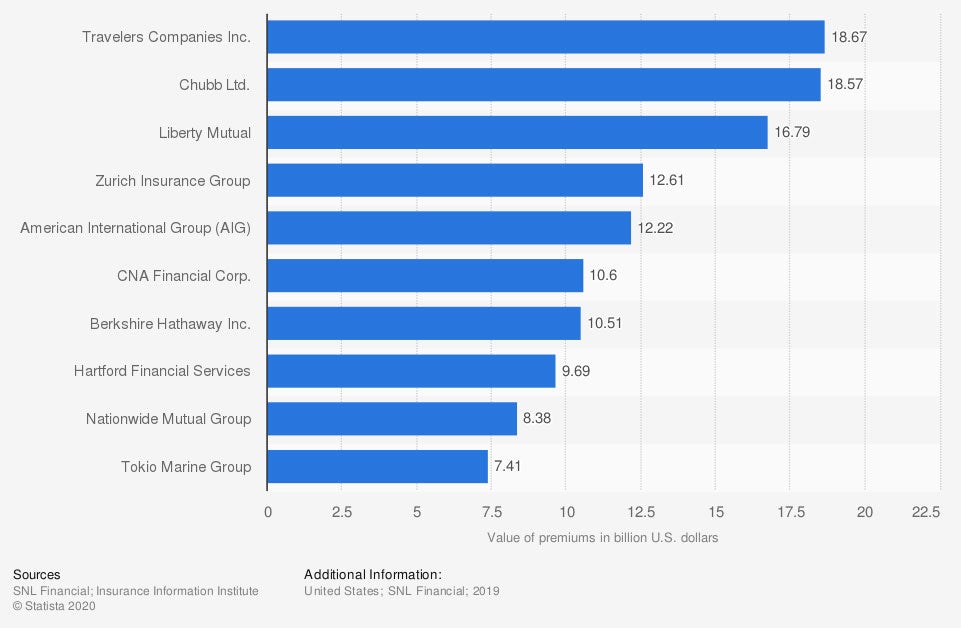

Leading Carriers for Commercial Insurance in the US

There are certain commercial insurance carriers that rise to the top in the marketplace. Some of the most used companies usually have the most comprehensive coverage offerings.

Does My Business Insurance Have Theft Coverage?

When you own a business in Illinois, you'll want coverage for theft and vandalism. Fortunately, your primary commercial insurance policies will have protection against these types of losses. Most property that would be affected will have to be listed under your business property policy or inland marine insurance in order to have coverage.

Will My Business Location Impact My Insurance Rates?

There are roughly 12,884,493 residents who occupy the state of Illinois. More people in an area can be good for business. Where your company is located will have an impact on your insurance costs.

Carriers look at local crime rates, weather patterns, and past losses when calculating your pricing. To get exact premiums for your commercial insurance, consult with an adviser.

How an Illinois Independent Insurance Agent Can Help You

Illinois business insurance can be confusing if you're not a licensed professional. With all the policy options on the market today, it can be challenging to know what's necessary for your operation. To ensure you're getting adequate protection for the road ahead, consider using a trained adviser.

An Illinois independent insurance agent can help you find coverage for an affordable price. Since they do the shopping for no additional cost, you can save time and get back to business faster. Connect with a local expert on TrustedChoice.com to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/study/33205/property-and-casualty-insurance-in-the-united-states-statista-dossier/

Graphic #2: https://www.statista.com/statistics/1119019/value-b2c-liability-insurance-premiums-written-usa/

http://www.city-data.com/city/Illinois.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.