Every year, more than $16 million in commercial property insurance claims are paid out in Illinois. The best way to protect your building and business contents is with the proper business insurance.

Since every business is unique, working with an Illinois independent insurance agent can save you time and money.

What Does Commercial Property Insurance Cover in Illinois?

Illinois commercial property insurance will cover the structure, assets, equipment, furniture, and inventory of your business against a variety of risks.

"When purchasing your commercial property insurance coverage you get to choose the covered perils you want to be included in your policy," explained insurance expert Paul Martin. "There is basic, broad, and special coverage."

- Basic and broad coverage: Referred to as named perils by insurance companies. Basic and broad coverage includes a list of things that are covered including fire, lightning, windstorm, hurricanes, hail, and others. Broad coverage has several more options than basic.

- Special coverage: Works opposite of basic and broad coverage. It only lists events it does not cover. Special coverage will cover any event besides those that are listed.

"With special coverage, the burden of proof is switched from the insured to the insurance company," explained Martin. "With basic and broad coverage, the insured must prove the event was one of the things listed on their policy. With special coverage, the insurance company must prove that the event isn't covered."

What Isn't Covered by Illinois Commercial Property Insurance?

Commercial property insurance is only one type of business insurance. This means that any event that is not considered property damage would be excluded.

You'll want to work with your Illinois independent insurance agent to receive coverage for the following additional risks that would not be covered by commercial property insurance.

- Third-party bodily injury and property liability claims

- Employee injuries or illnesses

- Equipment breakdown

- Business vehicles

- Cyberattacks

- Flood damage

Some events are excluded from all business insurance policies, including general wear and tear, fraudulent activities, and damage from nuclear war.

Who Needs Commercial Property Insurance In Illinois?

If your business has a storefront, you most likely will benefit from commercial property insurance. Whether you rent, lease, or own your business property, the contents and inventory inside your building belong to you.

In addition, Illinois is no stranger to severe weather patterns. The state is susceptible to thunderstorms, tornadoes, lightning, floods and flash floods, damaging winds, and large hail. All of them could cause serious damage to your business property.

For businesses that rent or lease buildings, it's likely that the building owner will have some sort of insurance policy. It's important to discuss the coverage their policy includes so you can fill any gaps with your own insurance.

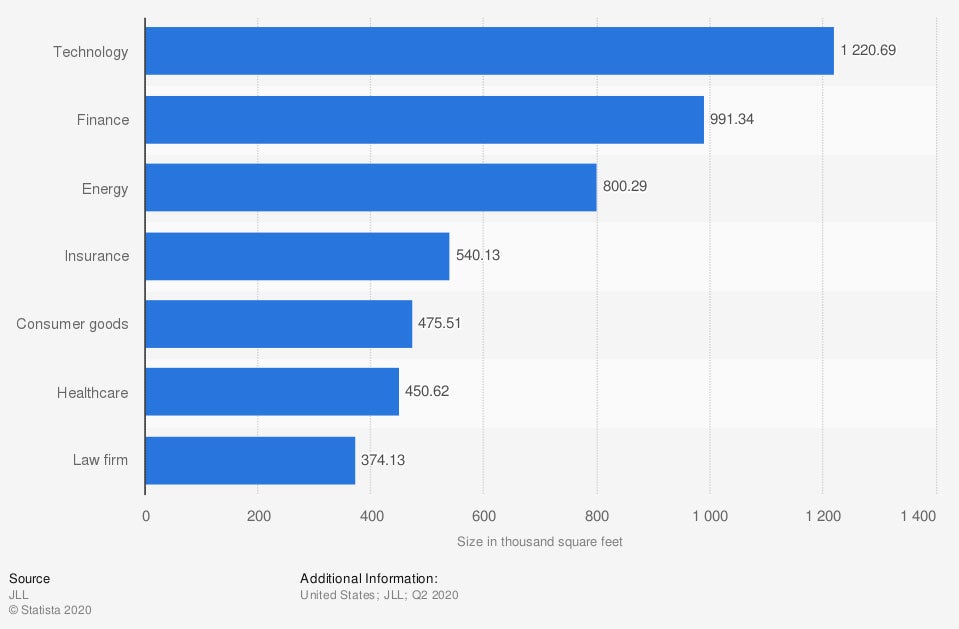

Volume of space leased in the US, by industry

A variety of businesses lease commercial property every year. Technology, finance, and energy companies lease the most commercial properties in the US.

How Is Commercial Property Insurance Calculated In Illinois?

While some believe that commercial property insurance is calculated by square foot, insurance companies actually consider a number of things when writing policies.

Commercial property insurance is calculated by considering the following factors:

- Building location: This includes proximity to a fire department, area crime rate, and weather risks.

- Construction type: Wood is the most expensive construction material to insure. Metal is one of the least expensive.

- Sprinkler systems: Installing sprinklers will lower premiums.

- Building value: Insurance coverage is provided based on the replacement cost of your building.

- Occupancy: The number of employees you have and your inventory will impact your rates.

- Neighbors: Hazardous materials or dangerous neighbors can increase your premiums.

- Theft risk rating: Theft risk ratings determine how likely your business is to be robbed.

Does Commercial General Liability Insurance Cover Property Damage?

Commercial general liability policies are designed to cover third-party property damage. This means any damage that you cause to someone else's property would be covered by liability insurance.

Liability insurance will also cover third-party injuries that occur on your property such as slips and falls or if someone is injured testing out a product. While commercial general liability policies are not typically required of businesses, they're worth considering.

How an Illinois Independent Insurance Agent Can Help You

An Illinois independent insurance agent is available to talk to you, free of charge. They're experts in Illinois business insurance and have built a market of insurance carriers they work with.

Whether you're a large or small business, an agent can discuss your insurance needs and recommend proper coverage. They'll provide you with a variety of options and assist you in getting the best commercial property insurance for your business.

Author | Sara East

Article Reviewed by | Paul Martin

Geo data: Business

https://www.isws.illinois.edu/statecli/Tornado/04_svrprep_info.pdf

Graphic: https://www.statista.com/study/11660/commercial-property-statista-dossier/

© 2024, Consumer Agent Portal, LLC. All rights reserved.