Hair salons come with their own unique set of risks, just like any other type of business out there. It’s important to have the right protection for your customers, staff, property, and more to maintain smooth operations. Fortunately hair salon insurance can help with exactly this.

Even better, an Illinois independent insurance agent can help you find the right kind of hair salon insurance for your business. They’ll also get you set up with the proper coverage long before you need to actually use it. But until then, here’s closer look at this important coverage.

What Is Hair Salon Insurance?

Hair salon insurance is a special type of Illinois business insurance designed with the needs of hair salons in mind. Policies include the basics of business insurance, then get topped off with specific coverages needed by hair salons. An Illinois independent insurance agent can help your business get equipped with enough hair salon insurance to stay safe for years to come.

What Does Hair Salon Insurance Cover in Illinois?

Hair salon insurance provides several important protections for your business. Though your policy may vary, commonly found core coverages in hair salon insurance, aside from general liability, are:

- Workers' compensation: Coverage is important to protect your business from employee injury or illness on the job.

- Product liability: Coverage is important to cover issues with products used sold or distributed..

- Business income: Coverage is important to protect your business’s revenue and employee payroll during extended closures.

- Property damage: Coverage is important to protect your business’s physical building and property damage from many threats, like hurricanes, fire, and more.

An Illinois independent insurance agent can help make sure that your hair salon gets protected with all these core coverages and more, as needed by your unique business.

Do I Need any Specific Liability Coverages?

To fully protect your hair salon against legal threats, several types of liability insurance are necessary. According to insurance expert Jeffery Green, your hair salon should be equipped with at least:

- General liability: Protects your hair salon against third-party lawsuits for claims of bodily injury or personal property damage.

- Product liability: Protects your hair salon against third-party lawsuits for claims of damage done by faulty products.

- Professional liability: Protects your hair salon against third-party lawsuits for claims of harm done by one of your employee’s professional services, such as an injury during a hair treatment.

- Cyber liability: Protects your hair salon against data breaches and other cyber threats, like stolen credit card information.

An Illinois independent insurance agent will help ensure that your hair salon gets equipped with every kind of liability protection it needs.

Hair Salon Stats for Illinois

Ever been curious about your industry as a whole? Check out some stats for the hair salon industry before you start shopping for your business’s coverage.

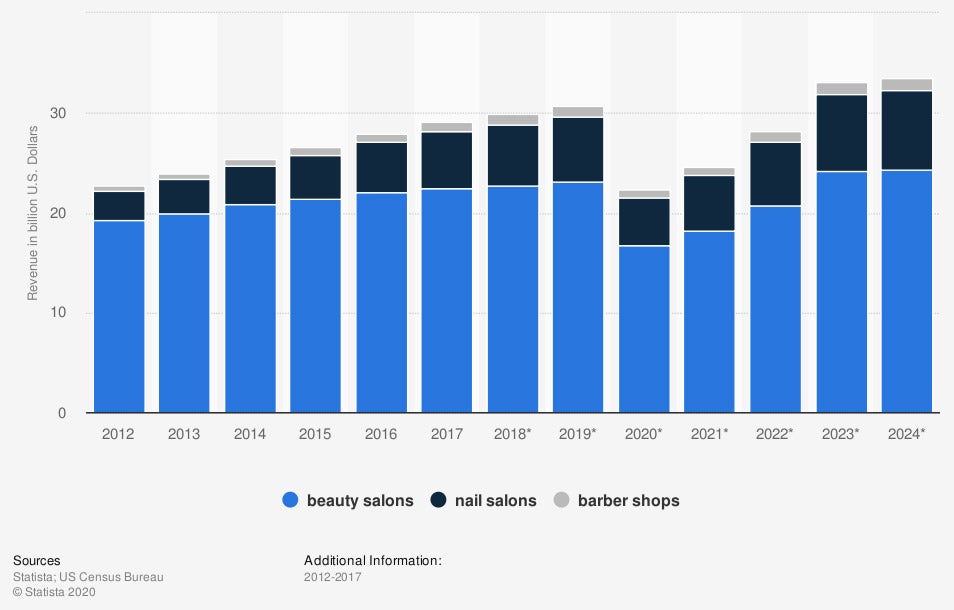

Industry revenue of “hair care and esthetic services” in the US (in billion US dollars)

The hair and barbershop industry’s revenue has been steadily increasing over the past decade, with the only exception being during the time of the COVID-19 pandemic. At the beginning of the observed period, beauty salon industry revenue totaled $19.26 billion, while barbershops’ was $0.54 billion. In upcoming years, the beauty salon industry is projected to bring in $24.37 billion, and barbershops, $1.27 billion.

With the hair care industry becoming more profitable over time, it’s extra-important to make sure yours has the right coverage.

How Much Does Hair Salon Insurance Cost in Illinois?

The average cost of hair salon insurance runs about $240 monthly, or $2,900 annually. But if your salon is smaller and doesn’t generate much business, it may cost even less than this. If your hair salon is much busier, you could pay up to as much as $1,000 per month.

Hair salon insurance’s cost is impacted by:

- Your location

- Your annual revenue

- The size of your hair salon

- The risk level of your hair salon

- How many employees you have

- The amount of business you generate

An Illinois independent insurance agent can help find exact quotes for hair salon insurance in your area.

Will My Location Impact My Hair Salon Insurance Rates?

Yes, most types of insurance are influenced by your location, and hair salon coverage is no exception. If you operate in a larger city that’s more prone to crime, you might pay a noticeably higher amount for your coverage than businesses in smaller, safer towns. An Illinois independent insurance agent can help you find out for sure how much you’ll pay for coverage in your city.

Here’s How an Illinois Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Illinois independent insurance agents shop multiple carriers to find providers who specialize in hair salon insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

graph - https://www.statista.com/forecasts/1014390/hair-care-and-esthetic-services-revenue-in-the-us

© 2024, Consumer Agent Portal, LLC. All rights reserved.