When you run a business, several exposures will have to be taken into consideration. Your policies should come with coverage for all life throws at you. Illinois business insurance can provide protection for your daycare.

An Illinois independent insurance agent will help you find policies that suit your needs and budget. They review your coverage for free so that you know what you're getting. Connect with a local expert to start saving.

What Is Daycare Insurance?

Daycare insurance in Illinois will come in many forms. When you're dealing with children, there are specific coverages that you'll want to include. Check out some common coverage choices for daycare insurance below:

- General liability

- Business property

- Sexual misconduct

- Commercial umbrella liability

- Workers' compensation

- Employment practices liability

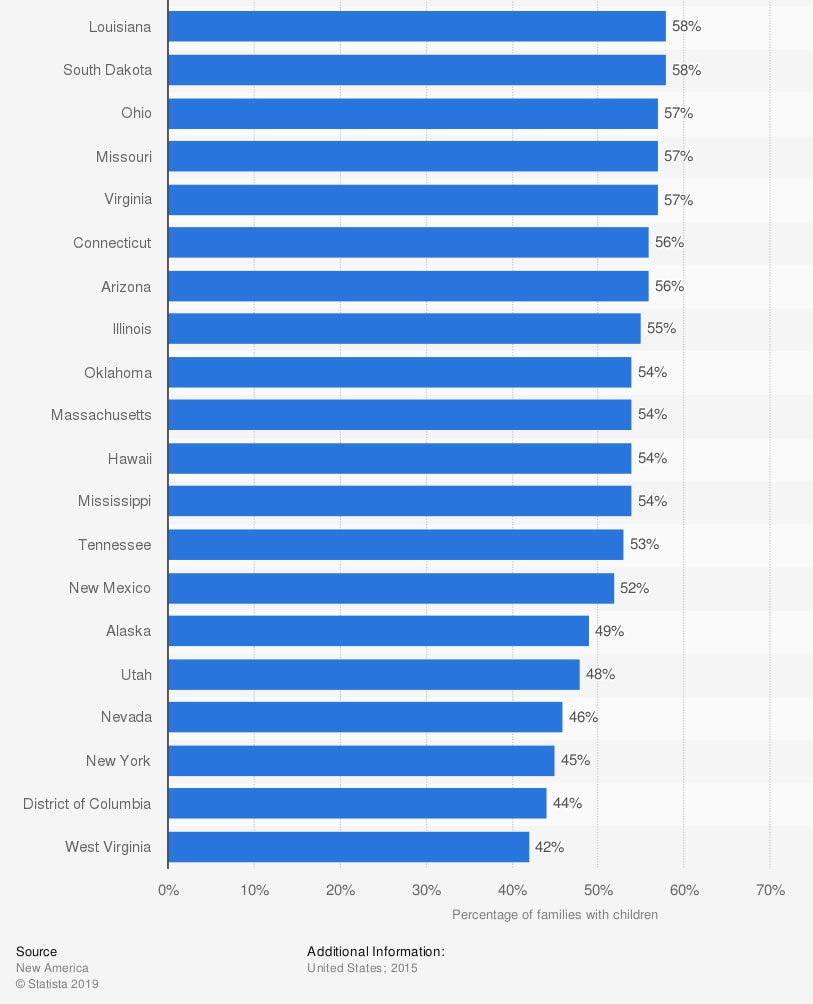

The number of children in daycare in the US.

The number of children in daycare facilities is high in every state. In Illinois, 55% of parents put their children in day care.

What Does Daycare Insurance Cover in Illinois?

In Illinois, there are 1,200,000 small businesses in existence. Daycare protection will need a specific set of policies when dealing with child care. Let's look at common coverage for daycares:

- Coverage for bodily injury or property damage claims

- Coverage for your business property that is damaged due to a covered loss

- Coverage for sexual misconduct

- Coverage for business equipment that breaks down due to a covered loss

- Coverage for employees who are injured or become ill on the job

- Coverage for disgruntled employees that sue due to discrimination or harassment

There are a few primary coverages that come standard on your daycare insurance. The perils below are automatically included on your policies in most cases:

- Fire

- Natural disasters

- Theft

- Vandalism

- Water damage (not from a direct flood loss)

How Much Is Daycare Insurance in Illinois?

Every business is different and will have unique premiums for insurance. In Illinois, $16,998,439,000 in commercial insurance claims were paid in 2019 alone. You'll want protection for all the what-ifs. Take a look at the factorscompanies consider when quoting:

- Loss history

- Replacement cost values

- Insurance score

- Experience level

- Location

- Local crime rate

How Much Property Is Covered with Illinois Daycare Insurance?

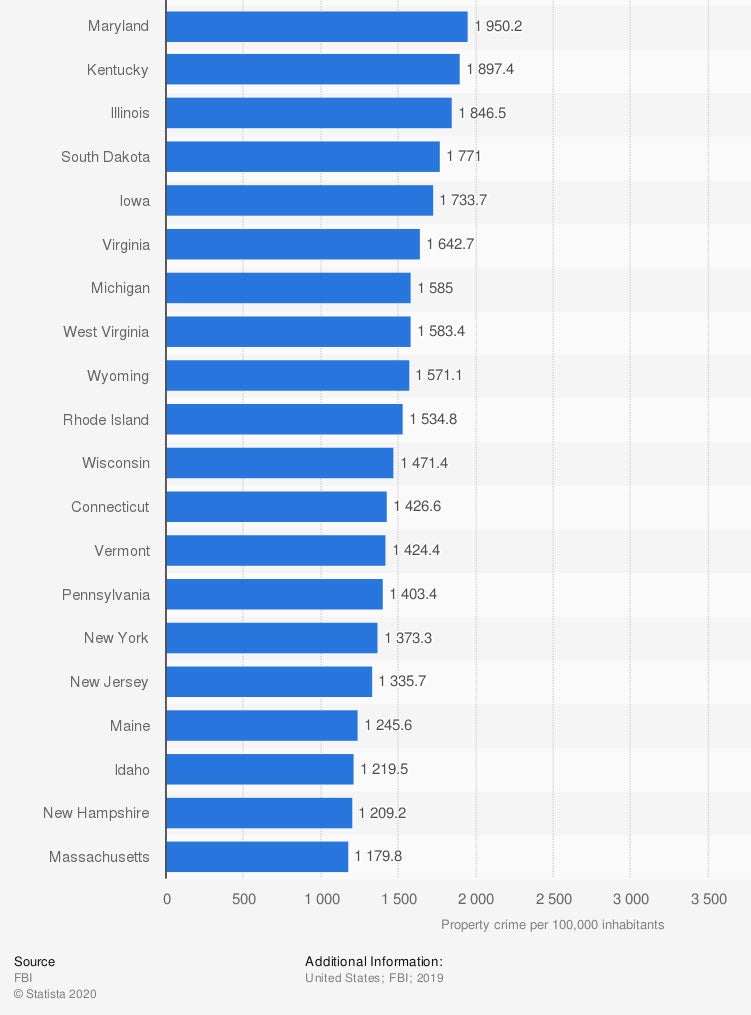

When it comes to your Illinois commercial coverage, you'll want insurance for theft and vandalism. Fortunately, most daycare policies will have protection for property damage. Take a look at the property crime rate by state in 2019:

Property crime rate in the US (per 100,000 residents)

When you're running a business, safety is important. If a theft or vandalism loss occurs, your daycare insurance policy will respond.

Will My Illinois Location Impact My Rates?

There are 12,884,493 residents in the state of Illinois. Where you put your daycare may be good for business, but it might hurt your costs. Carriers look at several factors when rating your policy, and location is one of them.

Another way your pricing will be affected is your risk for flooding. Every location is assigned a flood zone, determining how likely your property is to have a flood loss. A separate flood insurance policy is necessary to have protection.

How an Independent Insurance Agent Can Help in Illinois

When you're shopping for the perfect Illinois daycare insurance, consider using a trusted adviser. You'll have multiple policies that can help protect your business exposures. Review your coverage for accuracy and sufficiency before it's too late.

Fortunately, an Illinois independent insurance agent has access to multiple markets, giving you options on policy and premium. They will do all the shopping for you at no cost. Connect with a local expert on TrustedChoice for custom quotes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/625343/share-of-families-with-children-in-day-care-by-state-us/

Graphic #2: https://www.statista.com/statistics/232575/property-crime-rate-in-the-us-by-state/

http://www.city-data.com/city/Illinois.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.