Deli shop owners have more to worry about than providing customers with quality food. Should someone slip and fall in the store or get ill after dining at your deli, you could face financial ruin.

The easiest way to protect your deli is with the proper business insurance. Deli shops have unique risks to be covered, which is why it's best to work with an Illinois independent insurance agent. Here's how they can help protect your business.

What Is Deli Shop Insurance?

Deli shop insurance is a type of business insurance that protects your shop from any liabilities, property damage, and employee injuries that may occur.

There is not a single type of insurance for deli shops, but rather a combination of policies that provide full coverage against a number of risks.

What Does Deli Shop Insurance Cover In Illinois?

Through multiple policies, deli shop owners will receive a variety of coverages for their deli shops. According to insurance expert Jeffrey Green, deli shop coverage starts with a business owners package (BOP). "This includes property, general liability, and business interruption insurance," explained Green.

- Property coverage: Covers property like ovens, office equipment, and inventory in the event of damage from fire, wind, hail, theft, vandalism and other risks that will be listed in your policy.

- General liability: Pays for any third-party claims that are made against your deli for bodily injuries or property damage.

- Business interruption: Will cover payroll and other finances should your shop have to temporary close its doors due to a covered loss.

"Deli shop owners should also add equipment breakdown coverage and food spoilage coverage," said Green.

- Equipment breakdown insurance: Pays to repair or replace equipment like refrigerators and meat slicers.

- Food spoilage coverage: Pays for any financial losses due to product spoilage or contamination.

How popular are delis in the US?

- Market size: $19 billion

- Number of delis: 23,340

- Number of deli employees: 358,722

What Doesn't Deli Shop Insurance Cover In Illinois?

Every business has different insurance needs. An Illinois independent insurance agent can make sure you're covered for any potential risks you face, but every deli shop owner should understand what may not be covered in their policy.

Standard deli shop insurance will not cover:

- Flooding: You can purchase flood insurance through the National Flood Insurance Program (NFIP).

- Earthquakes: Earthquake insurance can be purchased as an addition to your policy.

- Automobiles: If your deli shop offers delivery, you'll want to purchase a commercial auto policy.

- Nuclear war: Any damage from war or terrorism is not covered.

- Intended damage: Financial or physical loss from intentional damage or fraud will not be covered.

- Employee injuries or illnesses: You must purchase Illinois workers' compensation to cover on-the-job injuries and illnesses.

Most businesses in Illinois are required to provide workers' compensation insurance for employees.

How Much of My Merchandise Is Covered with Deli Shop Insurance?

Any merchandise that you have in your store will be covered for external perils such as fire, vandalism, and theft through the property damage coverage in your policy.

When building your insurance package with your Illinois independent insurance agent, you'll choose policy limits on your property coverage. Your insurance will cover up to your limit in the event of a loss.

"Loss of inventory from equipment failure not caused by a covered peril would not be covered without equipment breakdown insurance," explained Green.

Where Can I Buy Deli Shop Insurance in Illinois?

Nearly every insurance carrier sells business insurance. For Illinois deli shop owners, you want a carrier that offers affordable policies and has a good reputation for handling claims.

The easiest way to find deli shop insurance in Illinois is through an Illinois independent insurance agent. TrustedChoice has more than 1,100 agents located in Illinois that have helped more than 4,700 business owners.

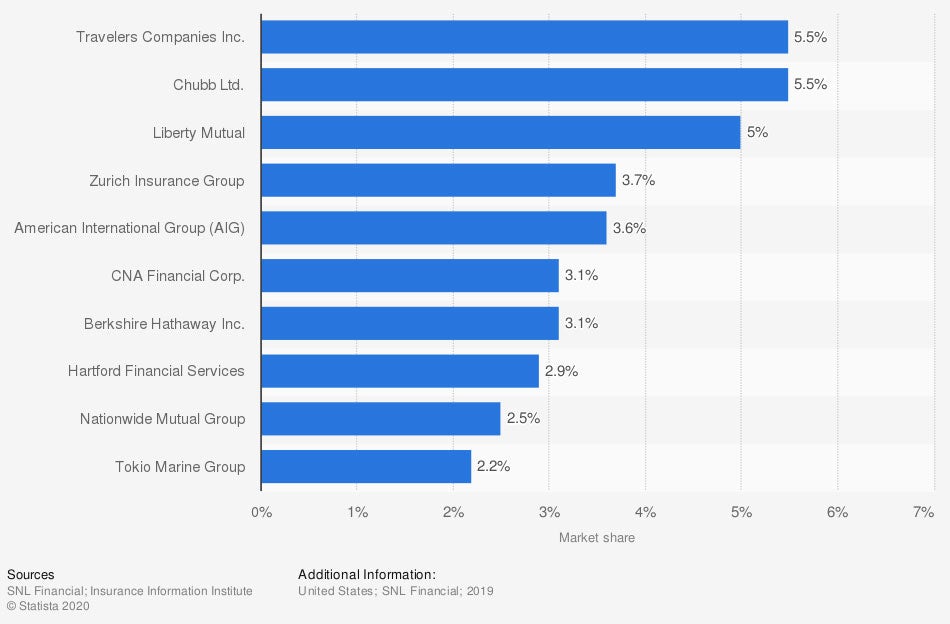

Market share of business insurance companies in the US

Travelers Companies Inc. and Chubb Ltd. write more business insurance policies in the US than other carriers.

How Can an Illinois Independent Insurance Agent Help?

Illinois is home to 1.2 million small businesses. Every business has unique needs that only an Illinois independent insurance agent can understand. They'll speak with you, free of charge, and shop carriers to find you the most affordable and comprehensive deli shop insurance available.

Author | Sara East

Article Reviewed by | Jeffery Green

Deli stats: https://www.ibisworld.com/united-states/market-research-reports/sandwich-sub-store-franchises-industry/

https://advocacy.sba.gov/2019/04/24/2019-small-business-profiles-for-the-states-and-territories/

© 2024, Consumer Agent Portal, LLC. All rights reserved.